Akasa Air is on an unprecedented flight plan. Can it really redefine flying in India?

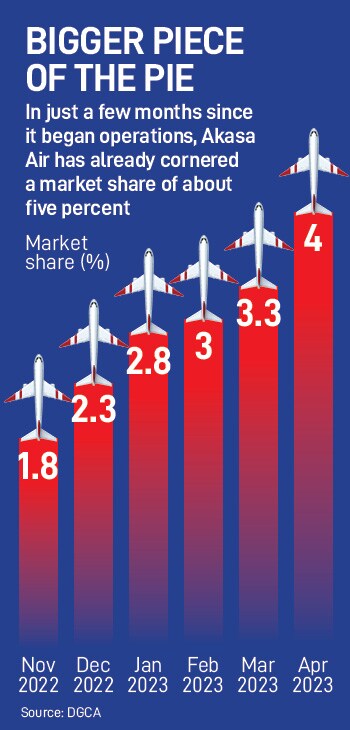

In under 10 months since it started operations, the airline has cornered about five percent market share, while adding a record 19 aircraft to its fleet. All eyes are on where it manages to go from here

Vinay Dube, CEO and co-founder, Akasa Air; Image: Mexy Xavier

Vinay Dube, CEO and co-founder, Akasa Air; Image: Mexy Xavier

For Vinay Dube, it all started with a bit of frustration.

An industry veteran with stints at Delta Air Lines and American Airlines, Dube relocated to India from the US in 2017 to join Jet Airways as its CEO. The Mumbai-headquartered Jet Airways, which in many ways had redefined the way millions of Indians took to the skies, was India’s second-largest airline with a nearly 20 percent share of the domestic market at that time.

Two years into his tenure, Jet Airways folded up, largely due to its mounting debt, prompting Dube to resign a month after the airline operated its last flight in April 2019.

A short stint as the CEO of the now-troubled Go First followed in 2020, after being brought in as an advisor in October of 2019. But, ill-timed as it could get, Dube took charge of the airline in February as the global economy, and more specifically the global aviation sector, went into a tailspin as Covid-19 wreaked havoc. For almost two months, air traffic in the country came to a standstill and by August of that year, Dube had resigned from Go First.

“It was frustrating not being able to work for an airline that I thought had a professional and empowered management team, which was based in Mumbai,” Dube tells Forbes India. “Working out of Delhi was not an option for me and my family.”

The delivery expected in the next few days is only the 20th of the 72 aircraft that it ordered in 2021, close on the heels of the US FAA (Federal Aviation Administration) approving the Boeing 737 Max to return after being grounded for more than a year following separate crashes. “The reason we planned it that way was that when you go from zero to 20 aircraft very, very quickly, we want to make sure there's no other unintended consequence that happens. The deliveries were planned in a particular manner and we're going to stick to that.”

The delivery expected in the next few days is only the 20th of the 72 aircraft that it ordered in 2021, close on the heels of the US FAA (Federal Aviation Administration) approving the Boeing 737 Max to return after being grounded for more than a year following separate crashes. “The reason we planned it that way was that when you go from zero to 20 aircraft very, very quickly, we want to make sure there's no other unintended consequence that happens. The deliveries were planned in a particular manner and we're going to stick to that.”