After 20 years of bootstrapping, is Bhavin Turakhia switching from value to valuation game?

For over two decades, serial entrepreneur Bhavin Turakhia stayed bootstrapped. With Zeta now a billion-dollar company, can he script bigger success with loads of external money and his obsession with focus?

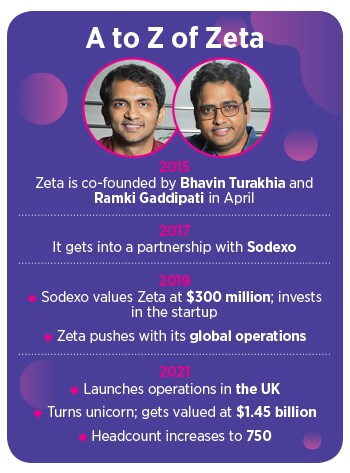

(L-R) Ramki Gaddipati, Co-Founder and CTO, Zeta and Bhavin Turakhia, Co-Founder and CEO, Zeta

(L-R) Ramki Gaddipati, Co-Founder and CTO, Zeta and Bhavin Turakhia, Co-Founder and CEO, Zeta

July 2019. A bootstrapped warrior finally raised money. Bhavin Turakhia’s Zeta was being valued at $300 million by French employee benefits giant Sodexo, which pumped in an undisclosed amount in the banking tech startup. The funding was interesting for two reasons. First, Zeta managed to get the backing of an MNC biggie, which liked the global aspirations of the startup co-founded by Turakhia and Ramki Gaddipati in 2015.

What made the funding most fascinating, though, was the background of serial entrepreneur Turakhia. He founded a bunch of companies with his brother Divyank, kept all the ventures self-funded, sold the first company Directi for $160 million in 2014, and his brother Divyank sold adtech venture Media.Net to a consortium of Chinese buyers for $900 million. In fact, the brothers were on the 2019 Forbes India Rich List with a net worth of $1.54 billion. For most founders, raising external money for the first time might have called for uncorking of a champagne bottle, but not for Turakhia, who got down to penning his thoughts.

The jottings were neither about funding nor valuation. They were about how staying bootstrapped helped him avoid mistakes that could kill funded startups. “I’ve always been concerned about how the media glamourises lofty valuations and achieving unicorn status much more than value creation,” he wrote in his blog in July 2019. “We will soon run out of letters in the alphabets,” he exclaimed, alluding to entrepreneurs focusing on running through Series A to Series F. The focus is always on the next round of valuation. “I'm not against funding,” he explained. Focusing on valuation, though, is not the same as focusing on value creation.

Cut to May 2021. Zeta makes a grand entry into the unicorn club by raising $250 million from SoftBank Vision Fund 2, and gets a valuation of $1.45 billion, a jump of nearly five times since its last round in 2019. For Turakhia, valuation still doesn’t matter. “I still don’t have anything against funding,” he emphasises. He is, however, quick to underline why the context has changed this time. “My every subsequent bet has to be bigger in size,” he explains. In Directi he co-invested Rs 25,000 and it grew to a $160-million company. In Radix, the domain registry firm started in 2012, the Turakhia brothers pumped in $25 million; in enterprise collaboration platform Flock, another $30 million was invested and in Zeta too, the co-founders invested $40 million till 2019. All the ventures, he explains, didn’t need external funds.

Then why now with Zeta? What has changed? Turakhia reckons it’s the global opportunity, and aspiration to take a bigger, bolder bet. Banks across the globe, he maintains, spend roughly $200 billion in IP spend. “Our goal is to try and get Zeta to address a significant chunk of that,” he says. Zeta has over 750 employees across its offices in the US, UK, Middle East and Asia “We have extremely ambitious plans to scale up,” he adds.