Aakash IPO: Is it a well-timed, smart move for Byju's?

Byju's is getting ready to list Aakash, an old-world test prep brand it acquired in 2021 and which has emerged as the silver lining for the $22-billion valued edtech major, which has been battling odds on multiple fronts

Mrinal Mohit, CEO, Byju's

Mrinal Mohit, CEO, Byju's

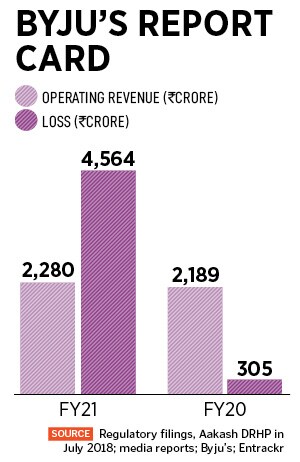

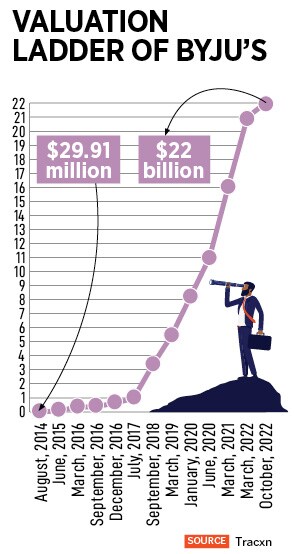

An initial public offering (IPO) is always an option for any privately held company that has raised loads of venture capital. But for Byju’s—it was born offline in 2011, gradually morphed into an edtech company, and rolled out its app in 2015—getting listed seemed a logical progression when it entered the unicorn club, after being valued at $1.02 billion in July 2017. The IPO talk only gathered steam with every subsequent funding round and steep valuation surges: $3.37 billion in September 2018, $5.47 billion in March 2019, $8.24 billion in January 2020, $11 billion in June 2020, and $16.09 billion in March 2021.

Heady funding and staggering valuations whetted the appetite for a global play. Starting with Vidyartha and TutorVista in 2017, Byju’s orchestrated an aggressive acquisition strategy and snapped up companies such as American player Osmo for $120 million in January 2019 and WhiteHat Jr for $300 million in July 2020. The following year, in March 2021, Byju’s valuation pole vaulted to $16.09 billion, and in April, it made its biggest and boldest bet by acquiring test prep major Aakash, reportedly for $1 billion. Byju Raveendran, founder and CEO of the eponymous edtech firm, reiterated his IPO plans. “We are seriously thinking of an 18 to 24 months’ timeline to look at a public offering,” he reportedly said in April 2021.

Flush with funds—2021 was the year when the global startup ecosystem was flooded with capital—Byju’s continued its buying spree and bought Great Learning and Epic for $600 million and $500 million, respectively, in July. Now it was the turn of the bankers to woo and nudge the edtech biggie to hit the IPO street. By August 2021, they pegged the valuation at $50 billion. A few months later in December, Byju's was reportedly in talks to go public via a special purpose acquisition company (SPAC) deal at a $48-billion valuation.

Analysts, industry watchers and funders explain why an Aakash IPO makes more sense. First, the resurgence of offline education after the waning of the pandemic has taken the sheen off online teaching, which was the only mode of instruction during the peak of the Covid-19 wave. “Everybody thought that online would kill offline,” says Anil Joshi, founder of Unicorn India Ventures, a venture fund backing early-stage startups. Consequently, brick-and-mortar coaching and teaching was written off. Interestingly, offline rebounded once schools and colleges reopened across the country, and a wave of edtech players started to struggle to find their feet in the old normal of an offline world. Though the K12 wave started to ebb at an alarming pace, the test prep segment—medical and engineering in particular—continued to boom in the online and offline worlds.

Analysts, industry watchers and funders explain why an Aakash IPO makes more sense. First, the resurgence of offline education after the waning of the pandemic has taken the sheen off online teaching, which was the only mode of instruction during the peak of the Covid-19 wave. “Everybody thought that online would kill offline,” says Anil Joshi, founder of Unicorn India Ventures, a venture fund backing early-stage startups. Consequently, brick-and-mortar coaching and teaching was written off. Interestingly, offline rebounded once schools and colleges reopened across the country, and a wave of edtech players started to struggle to find their feet in the old normal of an offline world. Though the K12 wave started to ebb at an alarming pace, the test prep segment—medical and engineering in particular—continued to boom in the online and offline worlds.

Also read:

Also read:

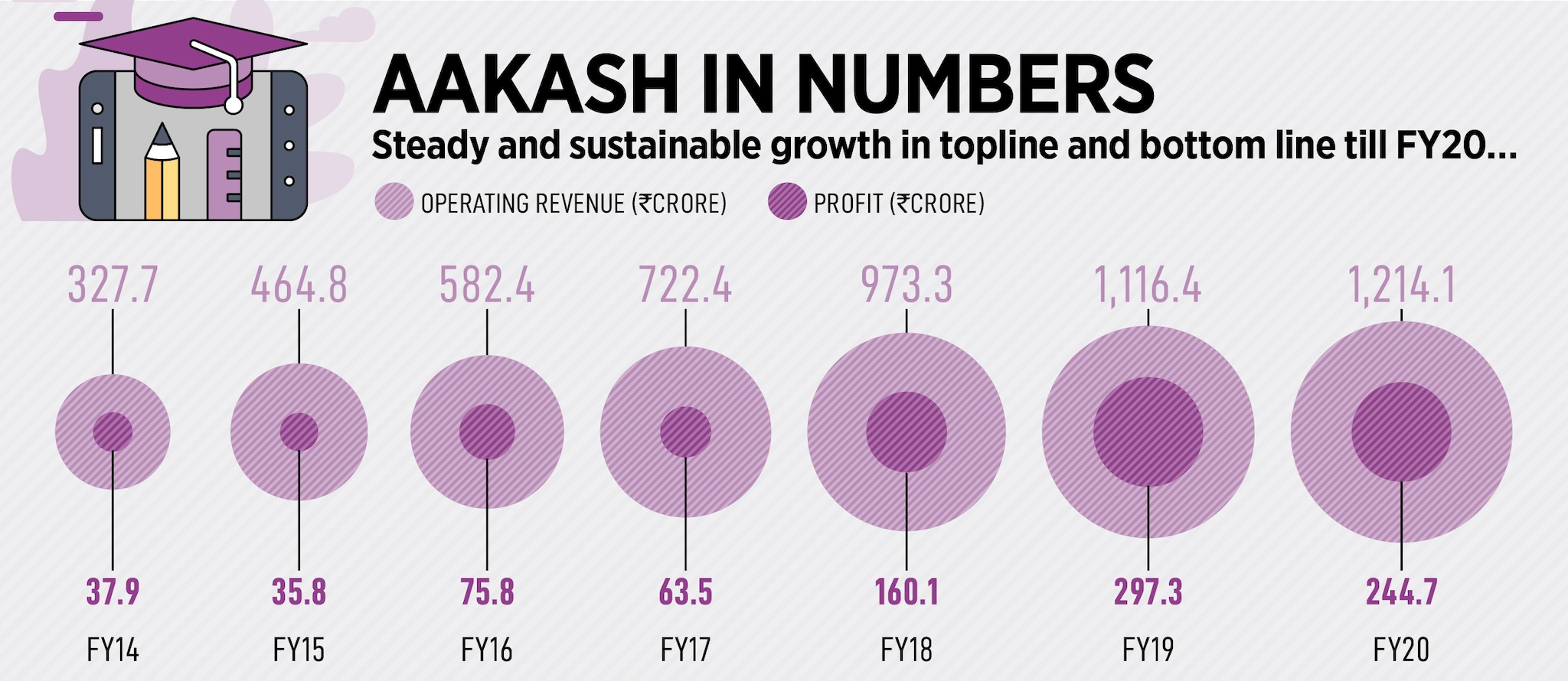

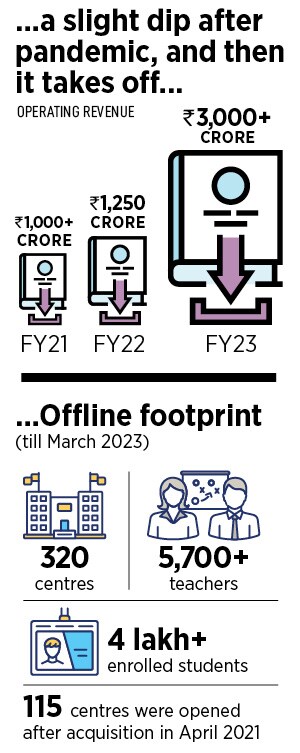

Industry players reckon that Aakash still has massive headroom for growth. Since its acquisition in April 2021, Aakash has more than tripled its revenue to over Rs 3,000 crore. The profit, too, has tripled, claims the above-mentioned source. Byju’s has opened 115 centres since April 2021 and has taken the count to 320.

Industry players reckon that Aakash still has massive headroom for growth. Since its acquisition in April 2021, Aakash has more than tripled its revenue to over Rs 3,000 crore. The profit, too, has tripled, claims the above-mentioned source. Byju’s has opened 115 centres since April 2021 and has taken the count to 320.