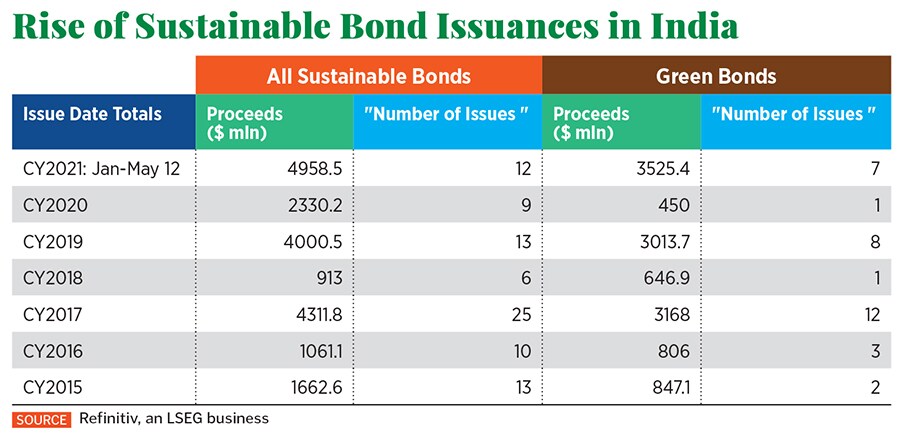

Green bonds, sustainable bonds demand picks up in India in the pandemic era

At least a dozen Indian companies raised money through green or sustainability-linked bonds since the beginning of 2021, doubling the amount raised in all of 2020

Illustration: Chaitanya Dinesh Surpur

Illustration: Chaitanya Dinesh Surpur

When you think of Ghaziabad, you might think of old bylanes, industrial activity and one of the most populous cities of Uttar Pradesh. What you might not think of is green bonds. But this April, the Ghaziabad Municipal Corporation (GMC) became India’s first municipal corporation to raise ₹150 crore by issuing a green bond in the domestic market. GMC will construct a tertiary sewage treatment plant with this capital, which it raised at a coupon of 8.1 percent on a 10-year note, and listed on the Bombay Stock Exchange.

Far from Ghaziabad, at the Mumbai headquarters of billionaire Sajjan Jindal’s JSW Energy, the top management had been working for months to launch its debut green bond issue in the overseas market. It hired Deutsche Bank late last year as the left-lead and structuring agent to raise money against its hydro power assets. After all, the investment bank had previously worked on six fund raising initiatives of JSW Group, and this time the stakes were higher as JSW Energy has been transitioning into a renewable energy company from being a traditional power generator.

On May 11, JSW Energy’s subsidiary JSW Hydro Energy Ltd (JSWHEL) raised $707 million by issuing US dollar-denominated green bonds in the overseas markets, due in 2031. The company managed to raise this capital by offering a coupon of 4.125 percent per annum and it is payable semi-annually. It is listed on the Singapore Exchange.

“For a debt trade like this, you have to get ratings from international rating agencies, and green certification for international ESG advisory entities. This was our first green bond trade, and that too a first hydro issue from Asia, so we had to educate people about hydro power generation assets,” explains Pritesh Vinay, chief financial officer at JSW Energy. The bonds were issued by JSWHEL to repay the existing debt on its two operational hydro projects—the 1,000 MW Karcham Wangtoo on the Sutlej river, and the 300 MW Baspa 2 on the Baspa river, both in Himachal Pradesh.

“From 2013-14, when globally ESG issuances were around nearly $30 billion, it has now accelerated to nearly $500 billion by the end of 2020. Corporates are now far more conscious, and they are thinking about their business objectives through the lens of sustainability and are also tying themselves to specific goals,” says Hardik Dalal, MD and head of loans and bonds at Barclays Bank India.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)