Unicorns, gazelles & cheetahs: A billion-dollar startup question

The animals in the startup jungle—whether mythical or real—must be indexed on their financial health and survivability rather than frothy valuations, which paint a misleading picture

ASK Private Wealth Hurun India index comes up with a comprehensive list of valuations, numbers and types of ‘animals’, what is strikingly missing in the startup forest is animal instinct in terms of focusing on unit economics and building a sustainable business

Illustration: Chaitanya Dinesh Surpur

ASK Private Wealth Hurun India index comes up with a comprehensive list of valuations, numbers and types of ‘animals’, what is strikingly missing in the startup forest is animal instinct in terms of focusing on unit economics and building a sustainable business

Illustration: Chaitanya Dinesh Surpur

November 2021. With an issue size of Rs 18,300 crore, it was billed as one of the largest IPOs in India. And on day 1, it turned out to be one of the worst stock market debuts, as the stock dipped over 27 percent. At Bombay Stock Exchange (BSE), the shares listed at Rs 1,950, a discount of 9.3 percent over the issue price. That’s the story of One97 Communications, which entered the IPO market with a valuation of close to $19 billion at the top end of its price band. Over one-and-a-half years later, the stock was trading at Rs 851 on June 27 this year, and the company posted a loss of Rs 1,855.8 crore in FY23. Clearly, there was a gross mismatch in private valuation and public market reality.

A few months earlier, in July 2021, there was another blockbuster listing. Zomato closed day 1 of its listing at Rs 125.85, which was 65.6 percent over the IPO price. Almost two years later, the stock is trading at Rs 76.65 on June 27, and the food delivery startup closed FY23 with a loss of Rs 971 crore. Again, there was a wide contradiction in private valuation and public market reality.

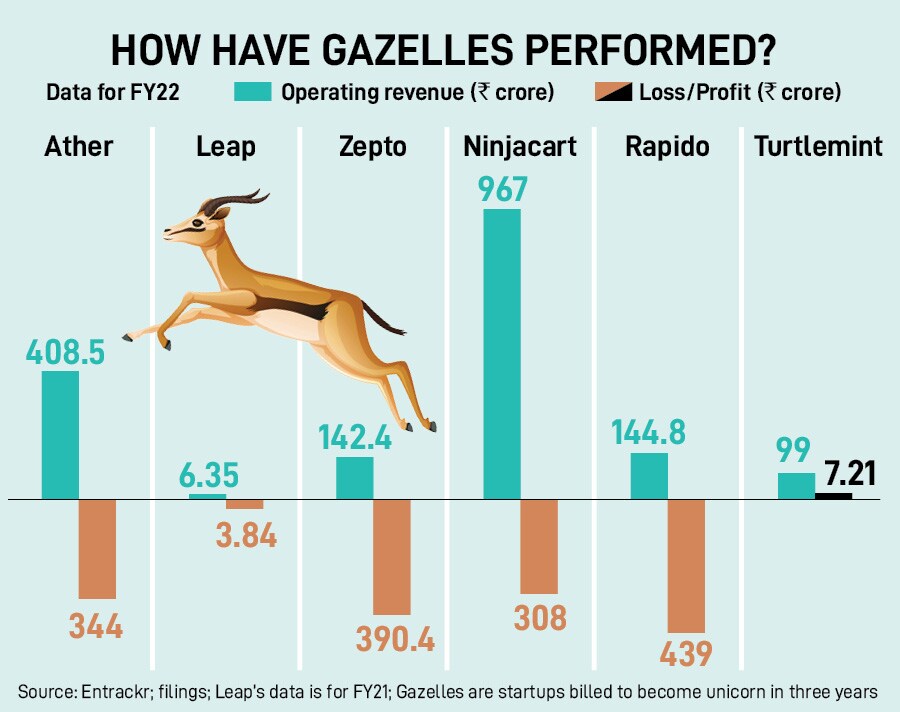

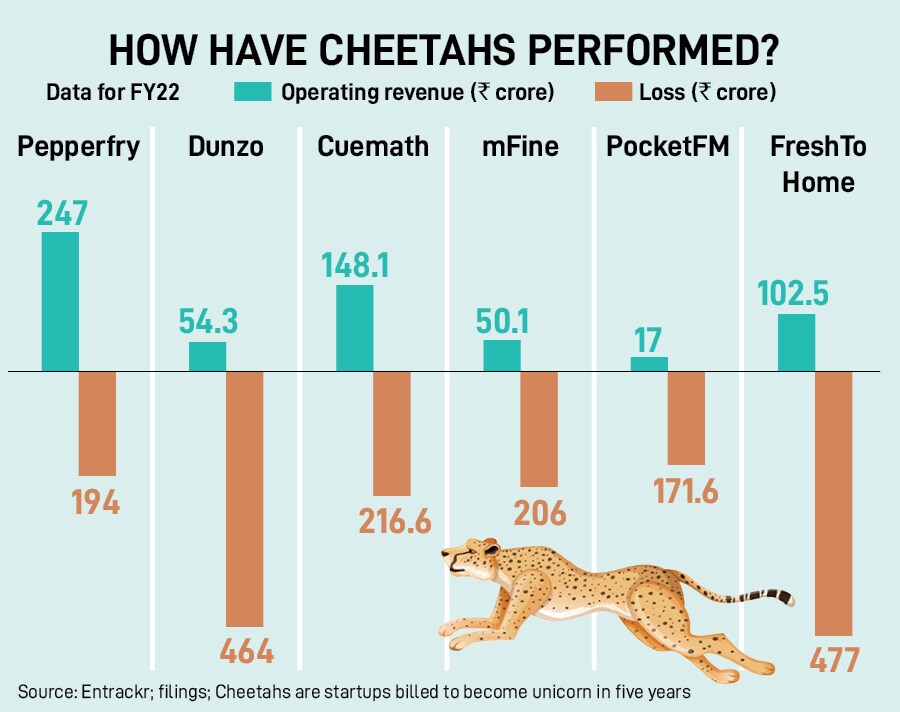

Fast forward to June 2023. It’s funding winter in India; deeply funded, and not-so-deeply funded startups are competing in terms of who can cut expenses the most—mass layoffs being the lowest hanging fruit—to extend their runway, and the startup ecosystem is still buzzing with talks of unicorns, cheetahs and gazelles. Let’s have a look at some of the numbers churned out by ASK Private Wealth Hurun India Future Unicorn Index 2023. “India's future unicorns are worth $57 billion,” underlines the annual report, which introduces two new species of animals in the startup jungle. While ‘cheetahs’ are valued between $200 million and $500 million, and are most likely to enter the unicorn stable in five years, ‘gazelles’ are valued between $500 million and $1 billion, and are tipped to cross $1 billion in valuation within three years.

A closer look at the performance of most of the cheetahs and gazelles again underlines one stark reality: There is a gross mismatch in valuation and performance. Most of the ‘animals’ are overfed in terms of funding, and are in heavy losses. Let’s start with quick commerce platform Zepto. The startup, which has scooped up around $360 million in funding so far and was last valued at close to $835 million, closed FY22 with a loss of Rs 390.4 crore. The revenue, in FY22, stood at Rs 142.4 crore. Then there is Rapido. The bike taxi aggregator has got $310 million in funding, closed FY22 with a loss of Rs 439 crore, and a revenue of Rs 144.8 crore. Another gazelle tipped to become a unicorn is Leap. The India entity of the fintech platform for students had an operating revenue of just Rs 6.35 crore in FY21, and a loss of Rs 3.84 crore. The startup is yet to file financials for FY22.