Temasek cautious in investing in weakening global economic outlook

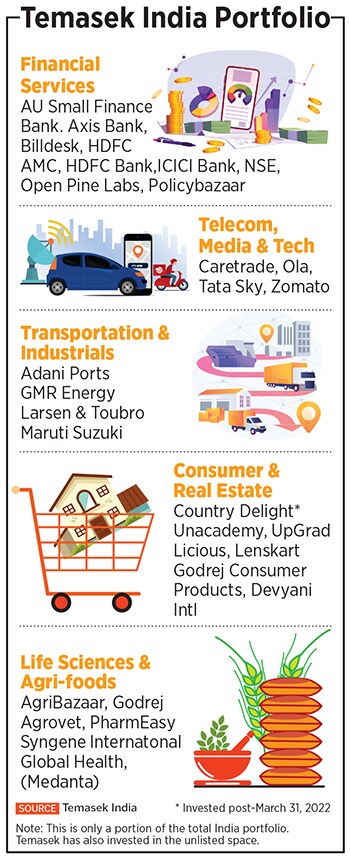

The investment company's India portfolio has grown smartly over past five years with investing in new-age companies

: Left to Right: Mohit Bhandari, Managing Director, Temasek; Ravi Lambah, India Head, Temasek and Vishesh Shrivastav, Managing Director– Temasek

: Left to Right: Mohit Bhandari, Managing Director, Temasek; Ravi Lambah, India Head, Temasek and Vishesh Shrivastav, Managing Director– Temasek

Global investment company Temasek, owned by the government of Singapore, is turning cautious in investing across geographies, including India, due to the increasingly deteriorating economic conditions where central banks are tightening monetary policy to battle rising inflation. “We will act when it makes sense,” Ravi Lambah, Temasek India head, told Forbes India, while discussing growth for their portfolio in FY22.

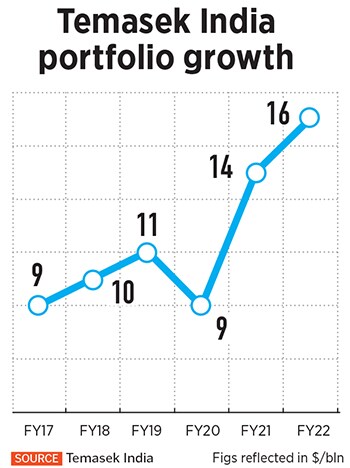

Temasek has reported a much lower return of 5.8 percent in FY22, compared to 24.5 percent for the corresponding period in the previous twelve months. The company has an exposure in India of over 5 percent out of the total portfolio value of $297 billion.

“We definitely see a slowdown and recession looming. Hence we are cautious. The pain in the emerging markets is due to what will play out in the West,” Lambah said.

This week Nomura has cut its growth forecast for India to 4.7 percent in 2023, against an earlier estimate of 5.4 percent.