Kaleidofin: Fintech platform for the women, by the women

Chennai-headquartered financial technology platform Kaleidofin helps under-banked customers, particularly women, meet their real-life goals by providing tailored financial solutions

Sucharita Mukherjee, co-founder and CEO of Kaleidofin

Image: Nishant Ratnakar for Forbes India

Sucharita Mukherjee, co-founder and CEO of Kaleidofin

Image: Nishant Ratnakar for Forbes India

For Sucharita Mukherjee, it was all very personal.

A former CEO of financial inclusion services provider IFMR Holdings, and more importantly, as a woman, she knew very well the problem she wanted to solve when she set out to become an entrepreneur. “It was clear that we wanted to build for informal India, Bharat, and for women in particular,” Mukherjee tells Forbes India over a video call. “That’s the reason that drives you. There’s no right or wrong. In that, it’s personal.”

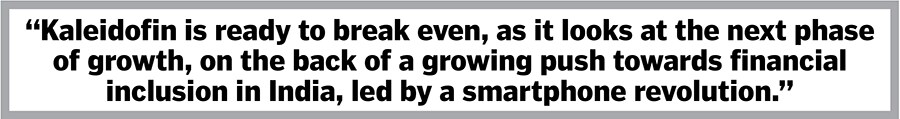

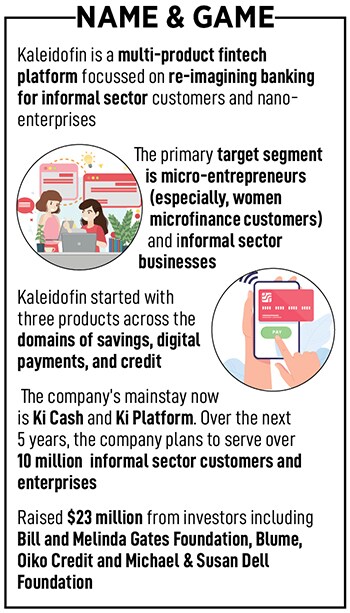

Mukherjee is co-founder and CEO of Kaleidofin, a Chennai-headquartered financial technology platform that helps under-banked customers, particularly women, in meeting their real-life goals by providing tailored financial solutions. “We believe that everyone deserves and requires access to financial solutions that are intuitive and easy to use, flexible and personalised to real goals that can make financial progress and financial freedom possible,” she adds.

Since its founding in 2017, along with co-founder Puneet Gupta, and backed by the likes of Bharat Fund, Blume Ventures, Flourish Ventures, Bill & Melinda Gates Foundation, Michael & Susan Dell Foundation, Oikocredit, and Omidyar Network, Kaleidofin has built up a user base of over 3 million, of which 97 percent are women. A million of them are small-time entrepreneurs.

“Our customers’ lives are extremely volatile,” Mukherjee says. “They probably need savings, credit and insurance all put together. But they don’t have the time or money because time is money for them. We thought how can we deliver financial solutions that make a real-life goal happen?”

At Deutsche Bank, Mukherjee worked in the credit derivatives structuring team before moving to Morgan Stanley. “I began to ask myself, why am I doing this? What impact am I having? What is my purpose? Do I respect the culture of this place? And I honestly could not answer any of those questions for myself and that left me with a little bit of emptiness.”

At Deutsche Bank, Mukherjee worked in the credit derivatives structuring team before moving to Morgan Stanley. “I began to ask myself, why am I doing this? What impact am I having? What is my purpose? Do I respect the culture of this place? And I honestly could not answer any of those questions for myself and that left me with a little bit of emptiness.”  “The first product that we launched was with SEWA Bank,” Mukherjee says. “We took recurring deposit products and combined them with insurance to make a goal-based saving solution.”

“The first product that we launched was with SEWA Bank,” Mukherjee says. “We took recurring deposit products and combined them with insurance to make a goal-based saving solution.”