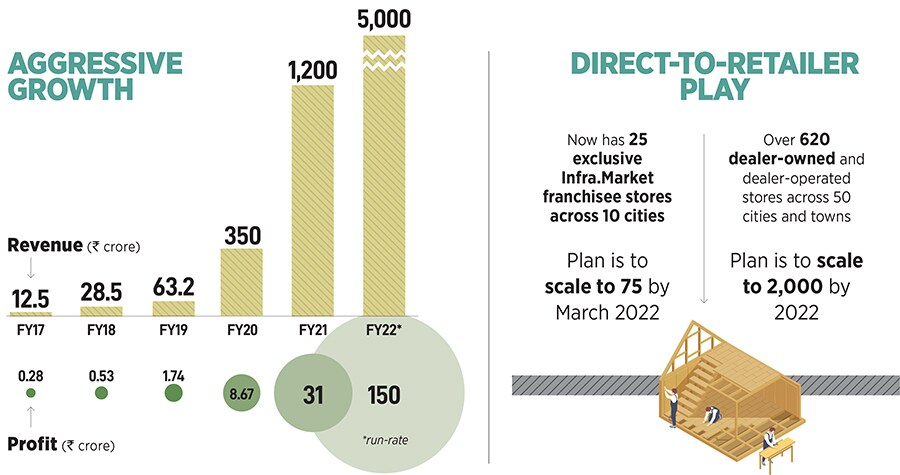

Investors call it the 'Amazon of Construction'. Meet the builders of Infra.Market, the now $2.5 billion behemoth

In its audacious bid to disrupt the fossilised real estate and constructions industry with its innovative business model, Infra.Market—the B2B online infra procurement platform—gets deeper with its retail play. Will the aggressive gambit pay off?

For us, staying profitable is by default... what’s the point in running a business if you don’t make money?: Aaditya Sharda, co-founder, Infra.market

For us, staying profitable is by default... what’s the point in running a business if you don’t make money?: Aaditya Sharda, co-founder, Infra.market

Image: Neha Mithbawkar for Forbes India

February 2019. The early morning, no-frills flight from Mumbai to Bengaluru was jam-packed. It was 5 am on a Friday, and groggy passengers dozed off minutes after the smooth take off. Aaditya Sharda and Souvik Sengupta, though, displayed ample signs of nerves, much like first-time flyers. The moment the seat-belt sign was switched off, the duo hurriedly opened the overhead bin, pulled out a voluminous file, and anxiously started flipping through the pages.

Sharda looked tense. “Are you sure you have properly rehearsed your part?” he asked his friend. Sengupta, too, felt twitchy. “Let’s do it again,” he replied. Both started reading aloud. The sound was loud enough to disturb a few heavy-eyed flyers. Over the next hour and 40 minutes, the duo kept parroting their dialogues, and an irritated flight attendant kept reminding them to lower their pitch. “This was our only chance,” recalls Sharda, who along with his friend started Infra.Market in 2016.

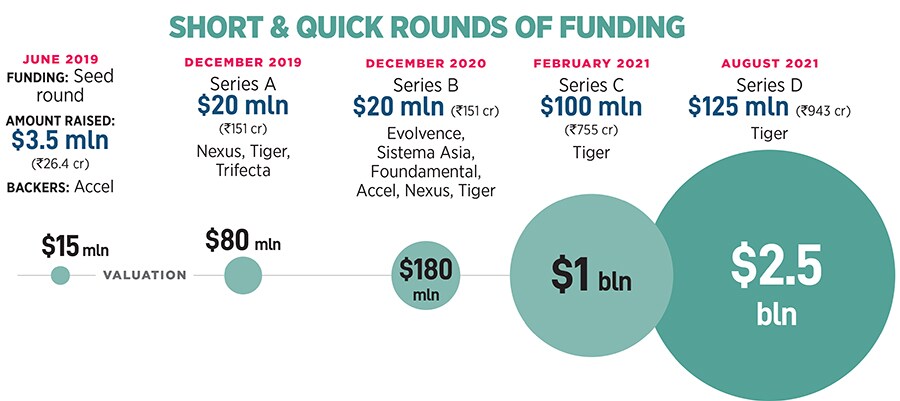

For three years, the Mumbai-based B2B online venture for sourcing construction material had stayed bootstrapped. After a few failed attempts to get venture capital (VC), the co-founders sniffed their first realistic chance of getting funded to expand the business. The desperation to hang on to this opportunity was palpable. “We just had an hour to press our case,” recounts Sharda.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

Sharda and Sengupta had a call with Scott Shleifer, partner at Tiger Global, the American hedge fund giant. The mobile rang at 7 am. “What are you guys up to?” asked a stern voice, alluding to a lot of chatter around the Infra.Market co-founders exploring a Series C round of funding.

Sharda and Sengupta had a call with Scott Shleifer, partner at Tiger Global, the American hedge fund giant. The mobile rang at 7 am. “What are you guys up to?” asked a stern voice, alluding to a lot of chatter around the Infra.Market co-founders exploring a Series C round of funding.

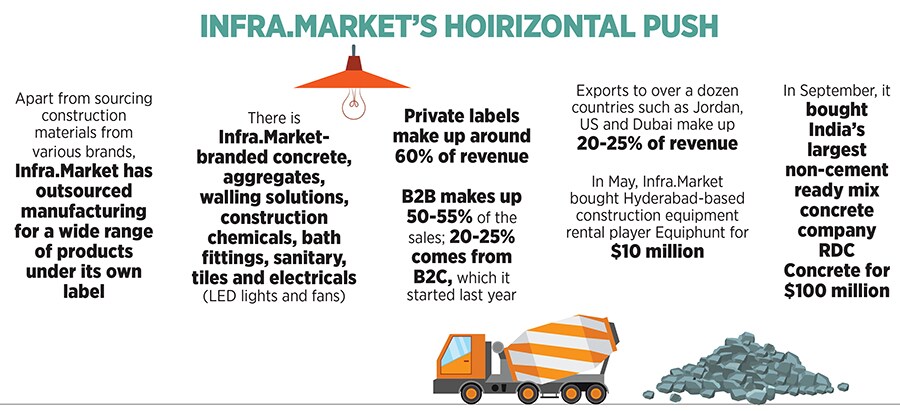

For Infra.Market, private labels make up around 60 percent of revenue. The startup has its own branded concrete, aggregates, walling solutions, construction chemicals, bath fittings, sanitary, tiles and electricals (LED lights and fans). “I don’t think there’s any player in India with private labels at this scale,” says Prakash, adding that a multi-category play is more prevalent in FMCG and not in infra. “In that sense, these guys are breaking into new territory, and setting a new paradigm on how multi-category brands can be built.”

For Infra.Market, private labels make up around 60 percent of revenue. The startup has its own branded concrete, aggregates, walling solutions, construction chemicals, bath fittings, sanitary, tiles and electricals (LED lights and fans). “I don’t think there’s any player in India with private labels at this scale,” says Prakash, adding that a multi-category play is more prevalent in FMCG and not in infra. “In that sense, these guys are breaking into new territory, and setting a new paradigm on how multi-category brands can be built.”