Anisha Dossa Aibara is on a mission to create impact in a Jiffy

For this investment banker turned entrepreneur, it's all about creating long-term impact—and she has a career to back it and a startup that's flourishing

Anisha Dossa Aibara, Co-founder and CEO, Jify

Image: Mexy Xavier; Assited by Hemal Patel

Anisha Dossa Aibara, Co-founder and CEO, Jify

Image: Mexy Xavier; Assited by Hemal Patel

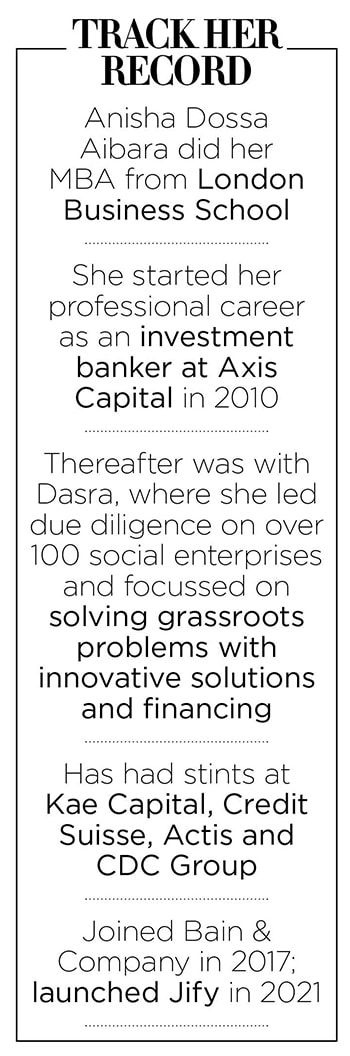

For Anisha Dossa Aibara, Jify didn’t happen in a jiffy. It took a little more than a decade. “I always knew the destination,” reckons the MBA graduate from London Business School, who started her professional stint as an investment banker with Axis Capital in 2010. “The day I joined, I was clear that eventually I have to start my venture,” she adds. Born into a family of entrepreneurs, Aibara was exposed to diverse and conflicting ideologies. Dinner table conversations usually veered around capitalism and social impact. Her mind grasped the best of all the worlds and figured out quite early that there has to be a sweet spot between impact and profitability.

As she grew up, she noticed there were a lot of highs and lows in the entrepreneurial journey, and her family, which had been into businesses for generations, lacked professional training to deal with the extreme vagaries of entrepreneurship. So she wanted to arm herself with essential skills before taking the plunge into the thrilling-but-iffy world of business.

The first step was Axis Capital, which gave the investment banker an insight into the field of M&As and IPOs. “I understood how money makes money,” she says. Call it serendipity, after a few years of rigorous training, Aibara landed in the world of impact investment.

Also read: Progcap's Pallavi Shrivastava is on a mission to change the gender narrative

Also read:

Also read: