The promise and pitfalls of investing for change

Navigating the line between opportunity and uncertainty in the ESG boom

The market for investments that consider ESG criteria and seek ESG-related impacts is exploding.

Image: Shutterstock

The market for investments that consider ESG criteria and seek ESG-related impacts is exploding.

Image: Shutterstock

When Engine No. 1 succeeded in seating three new directors on ExxonMobil’s board in June 2021, the move was widely hailed as a David versus Goliath moment. And rightly so: The hedge fund, which launched in late 2020 with $250 million in assets, owned a mere 0.02 percent of the energy giant’s shares.

Engine No. 1 had waged a proxy campaign that savaged the company for its lackluster financial performance and lack of a clear path to a low-carbon future, ultimately gaining the support of ExxonMobil’s largest shareholders, including Vanguard and BlackRock. Since the election of its new directors, the company has declared its intention to achieve net-zero greenhouse gas emissions by 2050. By February 2022, its stock price had soared by more than 90% — roughly doubling competitors’ gains at a time when oil prices were booming.

For Engine No. 1’s managing director at the time, Michael O’Leary, MBA ’19, the ExxonMobil coup was proof of concept for the firm’s approach to impact investing, which combines targeted investments with old-fashioned shareholder activism. Its goal is to reap financial rewards while advancing environmental, social, and governance (ESG) aims. “That was a test case,” says O’Leary, now a strategic advisor at the firm. “It was not easy. But we were able to show that if you have the right set of ideas, the right strategy, and the right partners, you can create real change.”

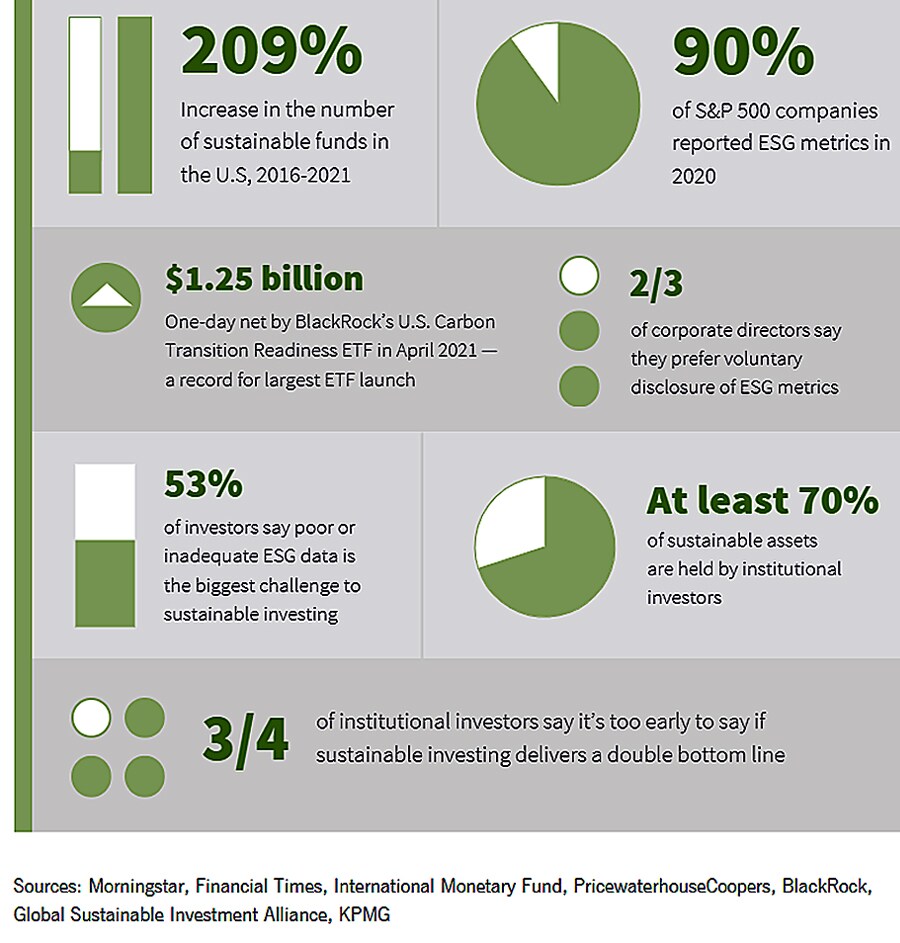

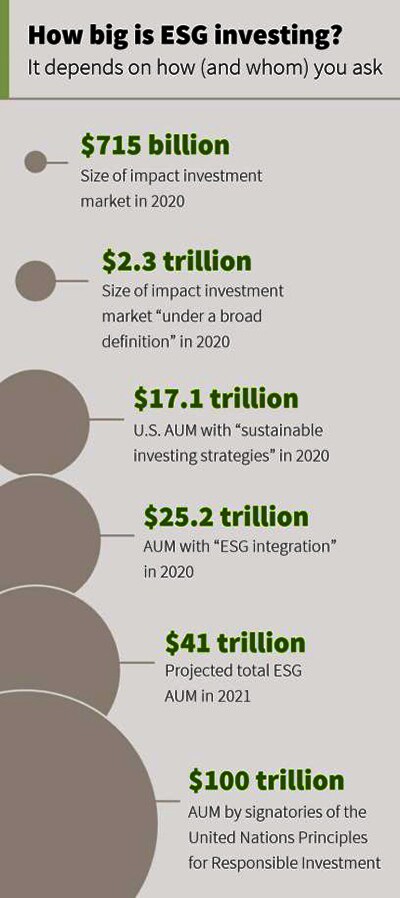

The market for investments that consider ESG criteria and seek ESG-related impacts is exploding. Estimates of its size vary widely. In 2020, the Global Impact Investment Network pegged the total market for impact investment at $715 billion, while the World Bank’s International Finance Corporation reckoned it was worth $2.3 trillion. The Global Sustainable Investment Alliance has tallied more than $25 trillion in assets under management using an “ESG integration approach” — a 143% increase since 2016. Whatever the figures may be, there’s no doubt that vast sums of money are now chasing financial rewards alongside returns such as reducing carbon emissions, strengthening worker protections, and diversifying boardrooms.

ESG “put a name on something that I think has always been there,” says Jim Coulter, MBA ’86, the executive chairman and founding partner of TPG, a private equity firm based in San Francisco. Socially responsible investing is not new; a subset of investors has long sought to prioritize investments that somehow contribute to the well-being of the planet and its inhabitants. Yet in the past few years, there’s been a rapid shift to a “new ethos” the likes of which Coulter has seen only a few times over the course of his nearly four-decade career. “I think of it as the world of and,” he explains. “Businesses are going to be measured for what they do and how they do it. It’s not or. You’re going to be measured for both.”

This piece originally appeared in Stanford Business Insights from Stanford Graduate School of Business. To receive business ideas and insights from Stanford GSB click here: (To sign up: https://www.gsb.stanford.edu/insights/about/emails)

In a recent paper, Larcker exploded several “myths” surrounding ESG investing — starting with the idea that it has a widely accepted definition. What exactly constitutes an ESG activity isn’t cut-and-dried. If a U.S. bank invests billions in initiatives to advance racial equality and economic opportunity, for example, is it really pursuing ESG objectives — or is it simply taking credit for complying with federal regulations that require it to serve low-income communities? After Russia invaded Ukraine in February, a German defense industry group said that weapons makers should be recognized for their “positive contribution to ‘social sustainability’ under the ESG taxonomy.” Larcker questions why governance is part of the formula: Shouldn’t shareholders value good governance at all companies, regardless of their environmental and social priorities?

In a recent paper, Larcker exploded several “myths” surrounding ESG investing — starting with the idea that it has a widely accepted definition. What exactly constitutes an ESG activity isn’t cut-and-dried. If a U.S. bank invests billions in initiatives to advance racial equality and economic opportunity, for example, is it really pursuing ESG objectives — or is it simply taking credit for complying with federal regulations that require it to serve low-income communities? After Russia invaded Ukraine in February, a German defense industry group said that weapons makers should be recognized for their “positive contribution to ‘social sustainability’ under the ESG taxonomy.” Larcker questions why governance is part of the formula: Shouldn’t shareholders value good governance at all companies, regardless of their environmental and social priorities?