Is ESG at the risk of becoming a smokescreen?

The world seems headed towards an inflexion point, where a lot of experts are undertaking well-meant ESG initiatives to reverse climate risk, while another set criticizes ESG as being lopsided and often a smokescreen enabled by practices such as greenwashing

Activists of the "Koala Kollektiv" demonstrate in front of the Euro sculpture in downtown Frankfurt against greenwashing of nuclear energy and natural gas by the taxonomy of the EU.

Image: Arne Dedert/picture alliance via Getty Images

Activists of the "Koala Kollektiv" demonstrate in front of the Euro sculpture in downtown Frankfurt against greenwashing of nuclear energy and natural gas by the taxonomy of the EU.

Image: Arne Dedert/picture alliance via Getty Images

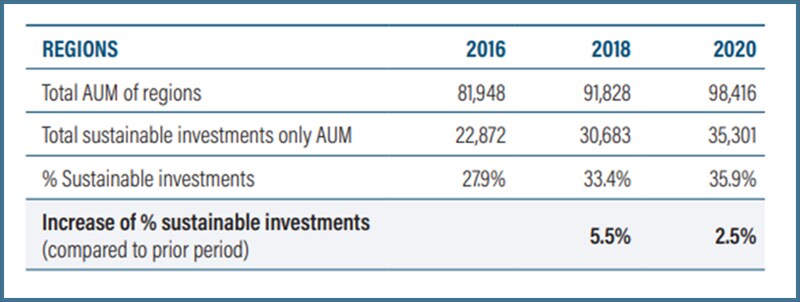

ESG—Environmental, Social, and Governance factors to evaluate the companies and countries on how far they can contribute towards sustainability—has been a buzzword in the policy forums and corporate boardrooms in recent years. All thanks to the initiatives such as the United Nations' Sustainable Development Goals (SDGs), the Paris climate agreement, the Global Sustainable Initiative (GSI), and COP-26. The Global Sustainable Investment Alliance (GSIA) reports that sustainable investments across five markets, including the United States and the European Union, reached $35.3 trillion in assets under management, which is close to 36 percent of all professionally managed assets in these markets (Figure 1).

Figure 1: Global assets under management 2016-2018-2020 (USD billions)

Source: Global Sustainable Investment Review (GSIR) 2021

Source: Global Sustainable Investment Review (GSIR) 2021

However, the world seems headed towards an inflexion point, where a lot of experts are undertaking well-meant ESG initiatives to reverse climate risk, while another set criticizes ESG as being lopsided and often a smokescreen. Is that really the case?

ESG: Well-meaning but flawed?

‘Greenwashing’ is threatening to derail the ESG focus. It is a deceitful marketing technique by which the companies hide the damage they cause to the environment and nature, and use advertising and public messaging to appear environmentally sustainable. For instance, recently, a lawsuit has been filed against one of the largest apparel brands in the world, alleging that the brand was using false sustainable marketing. Such high-profile investigations into greenwashing have prompted questions about the purpose and value of ESG. People are now criticizing ESG as “woke” politics. ESG is becoming a political fight due to the observers pointing to two potential factors. One is that ESG is becoming deeply ingrained in corporate America and financial markets focusing more on environmental issues, than on maximizing returns on government funds. Second, where Republicans are trying to score political points ahead of the elections. For instance, recently, the governor of Florida Ron DeSantis’s office declared ESG language as a threat to the vitality of the American economy, while US Republican lawmakers frame ESG investment efforts as a threat to employment and revenue.

[This article has been reproduced with permission from SP Jain Institute of Management & Research, Mumbai. Views expressed by authors are personal.]