India's banks can improve online user experience on multiple fronts, study finds

Consultancy Forrester's assessment doesn't rate even one Indian bank as 'Leader' in its proprietary 'Forrester Banking Wave' framework. Three, however, are categorised as 'Strong Performers'

Image: Shutterstock

Image: Shutterstock

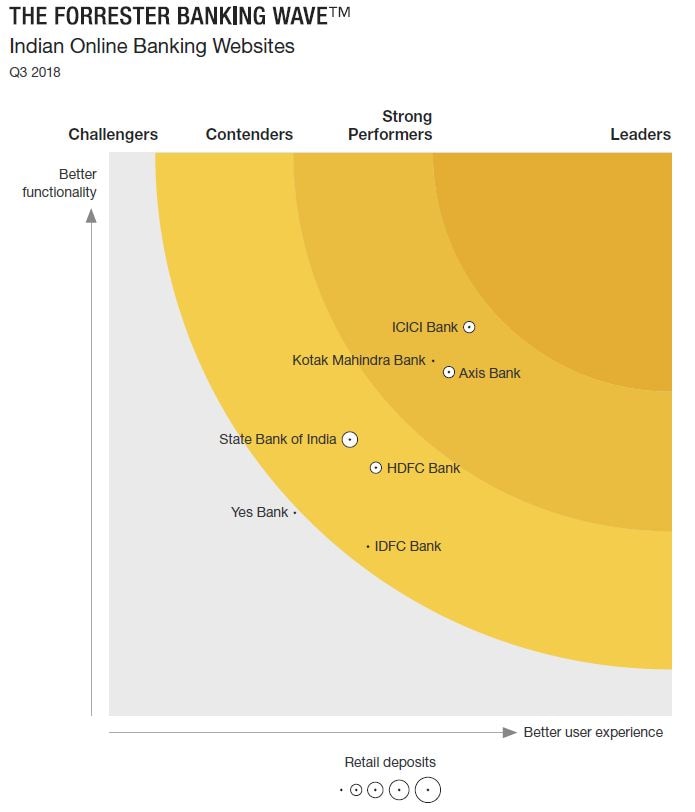

A study of online banking in India shows Indian consumers who are using online banking still use the desktop browser more than their smartphones, tech consultancy Forrester said in a recent report. Further, in its proprietary ‘Forrester Wave’ classification, the market research firm said there were none in the ‘Leaders’ category, when it came to offering better functionality and user experience in the online channel, among seven of India’s top banks that the consultancy studied.

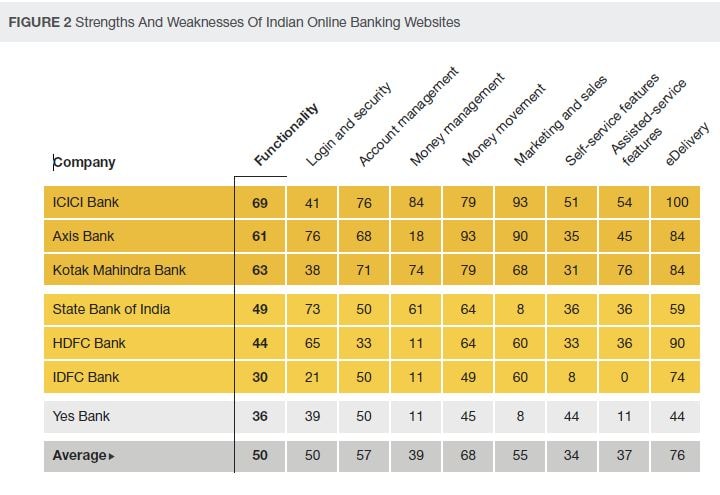

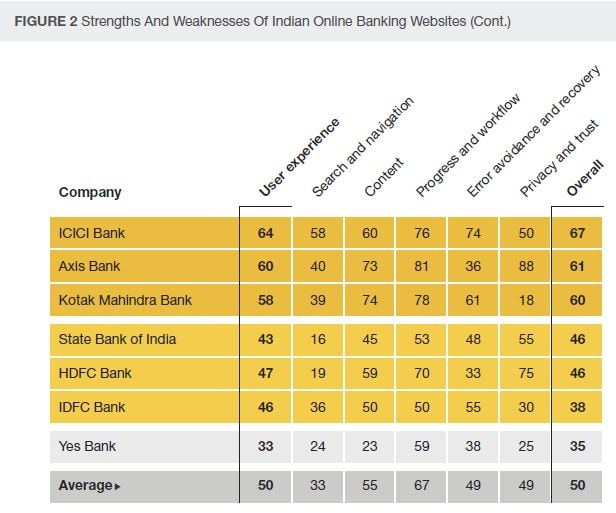

ICICI Bank, Axis Bank and Kotak Mahindra Bank, made it to the ‘Strong Performers’ rating, which is one rung lower than ‘Leaders,’ whereas, State Bank of India, HDFC Bank and IDFC Bank were only ‘Contenders’, another rung lower. Yes Bank rated the lowest, as a ‘Challenger’.

“While mobile is growing rapidly as a preferred engagement channel, Indian banking customers continue to use banking websites more widely than mobile banking,” Forrester said in its report. “These customers expect the latest digital banking services; the majority prefer to keep their money with firms that let them use a website or app to manage it.”

Among the ‘strong performers’ ICICI bank provided a feature-rich website, while Axis Bank delivered good functionality and user experience. Kotak Mahindra Bank was noted for providing superior functionality. When it comes to money management, HDFC Bank joins the three strong performers in handling this function well — considered the “most basic and important function in any banking website,” according to the report.

Good user experience on digital channels is crucial to the overall customer experience for any bank today. And banks that neglect the digital channels are hurting their prospects with their best customers. Poor digital experience could very well prompt affluent customers to look at alternatives, whereas a website or mobile app that provides great user experience could very well enhance the bank’s revenue from the tech-savvy customer.