Chanda Kochhar: A chapter ends at ICICI

A veteran banker, who was instrumental in building ICICI Bank's retail presence, has made a quiet exit after facing several allegations. As uncertainty over her future role ends, the bank will only gain, say experts

ICICI Bank CMD Chanda Kochhar's request for an early retirement from the bank was granted by its board today

ICICI Bank CMD Chanda Kochhar's request for an early retirement from the bank was granted by its board todayImage: Vikas Khot

For Chanda Kochhar, one of India’s most well recognised and known bankers over more than two decades, a chapter with ICICI has ended. Just that it has closed abruptly and definitely not in the way she would have wanted.

In a sudden development on Thursday, the ICICI Bank board of directors approved a request from Kochhar, to seek early retirement from the bank, it said in a statement to the stock exchanges. The board also elevated Sandeep Bakhshi, an ICICI Group veteran and now the chief operating officer at the bank, as the managing director and CEO for a period of five years, with a term ending October 3, 2023.

The ICICI Bank stock closed up 4.07 percent at Rs 315.95 at the BSE, a signal from investors that the bank would now not be weighed down by uncertainty surrounding Kochhar’s current and future role at the bank.

“The impasse is over, the bank can now move forward,” said N. Vaghul, the former chairman of the ICICI Bank, who had mentored Kochhar in her early years with the group. He stayed away on talking about Kochhar and what the future could hold for her. Talking about Bakhshi, Vaghul said: “He carries a huge reputation in the insurance space, both in terms of execution and leadership, I expect the bank to do well.”

Kochhar, 56, has been in exile since June 1, until an internal inquiry into allegations of quid pro quo against her and her family for loans made by the bank to Videocon Industries in 2012 yields a report. The investigation is being headed by former Supreme Court judge BN Srikrishna. The allegations came to light in 2016 after two whistleblower complaints to the market regulators and the Reserve Bank of India.

The allegations refused to die down and the ICICI Bank board, after initially backing Kochhar in March 2018, decided to take a step. A month later, the bank’s non-executive chairman M K Sharma met top mutual fund houses and institutional investors to send the message that 'the institution is bigger than one individual'.

In June, the bank said that Kochhar had gone on leave and a committee would look into the allegations. But the role of the ICICI Bank board and its inability to ask the tough questions to its leader remain under scrutiny.

Kochhar had joined the erstwhile ICICI in 1984 as a management trainee and handled project appraisals and monitoring. She came into the limelight as a senior banker when the ICICI group moved into commercial banking operations in 1993.

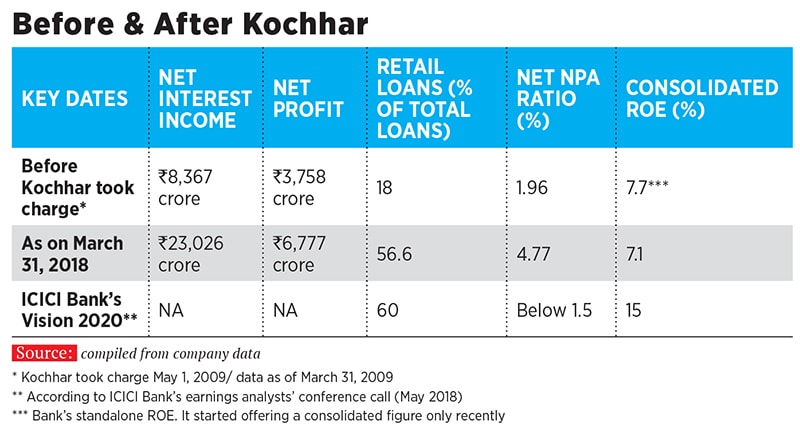

Her key role has been to drive the retail operations of ICICI Bank, particularly over the last 15 years, when it has emerged as one of the major retail financiers, after HDFC Bank. Kochhar has also been seen to be instrumental in leading technology, innovation and distribution channels across India and overseas for the bank since year 2000.

The early retirement effectively means a graceful exit for Kochhar. “The ICICI Bank board enquiry instituted by the board will remain unaffected by this and certain benefits will be subject to the outcome of the enquiry,” the ICICI Bank said in a press statement. Kochhar drew a gross salary and allowance of Rs 5.62 crore in fiscal 2018.

Kochhar, as like her constant business rival Shikha Sharma, had become reclusive in her public appearances in recent months due to the allegations. One of her last public appearances as ICICI CMD was at the India Economic Summit in Mumbai in April 2018.

She did not attend the ICICI Bank’s annual general meeting on September 12, 2018, in Vadodara (Gujarat), where shareholders raised several uncomfortable questions of whether the board was aware of the loans granted to Videocon and why disclosures relating to these were not made to shareholders.