Why Christie's Auctions Won't Distort the Pop Art Market

Why Christie's historic series of auctions won't distort the pop art market

On November 12, Christie’s will begin auctioning the vast collection of paintings, drawings, photographs, prints, negatives and other material housed in the vaults of the Andy Warhol Foundation. How many pieces? Foundation Chairman Michael Straus says estimates of 20,000 are inaccurate; Amy Cappellazzo, who oversees post-war and contemporary art development at Christie’s, puts the figure in the “many, many thousands”. Foundation tax documents list the trove’s fair market value at $104 million.

Will this deluge flood the Warhol market —or the contemporary market itself, a fifth of whose sales come from the pop art master? Warhol collectors worried about their holdings have bemoaned the auctions, but experts say they have nothing to fear.

Christie’s will be a “good steward”, Cappellazzo insists. The collection will be sold over many years and in new markets worldwide. Some pieces, with estimated values of $100,000 or less, will be auctioned online, some via flash sales. “That platform really opens up possibilities for anybody anywhere to get into the game,” says Warren Winegar, founder of Winegar Fine Art, an advisory service.

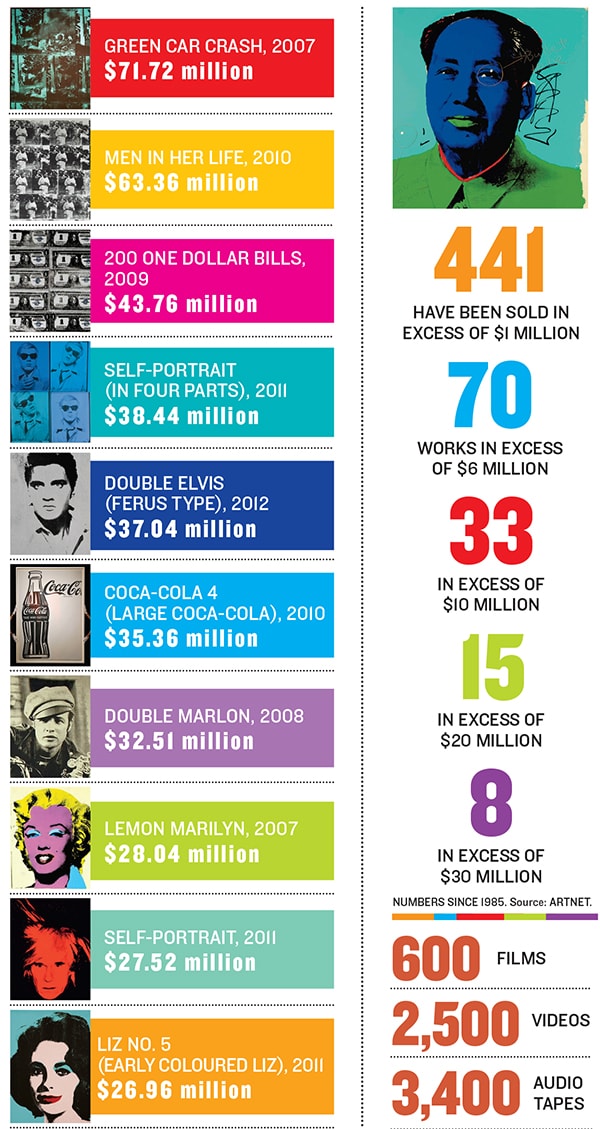

Clayton Press, an advisor at Linn Press Art Advisory Services, concurs. He points to the 22,250 Warhol auction sales catalogued by Artnet since 1985—fewer than 2 percent were for more than $1 million, and many were repeat sales.

Warhol’s enormous output, too, means his works are already sorting themselves by desirability. The first auction’s 350 pieces (some of the foundation’s most prized) are estimated at values between $2,500 and $1.5 million, the range in which the bulk of Warhol traffic already operates. “It’s not like the market is suddenly going to be swamped with high-value works,” Press says. Just a drop in the Brillo box, in other words.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)