Select home. Add to cart

Renting and buying homes online have portals and investors excited. But no one's making money yet

When 22-year-old Ritij Khurana had to move to Mumbai for a job, he found himself short of money to pay the deposit and brokerage for a rented apartment. “When I heard that a broker’s fee is usually one month’s rent, which according to my budget was around Rs 20,000, I decided to cut out this expense,” says Khurana, manager of marketing and concepts at CampHire.

He turned to Grabhouse.in, a website that put him directly in touch with house owners. A week’s research on the site got him a house within 5 km of his office, and saved him enough money to buy an air-conditioner.

Many like Khurana are logging on to real estate portals to find a house of their choice, to buy or rent. There are more than a dozen such websites (not all work without estate agents), with some offering end-to-end services. That buyers are taking to the concept can be judged by the fact that 70 percent of the total sales of Tata Value Homes (focussed on affordable housing) and 25 percent of the total sales of Tata Housing took place online.

Last September, Tata Value Homes had partnered with Snapdeal—it sold 85 homes worth Rs 40 crore in six days on the online platform—but in October, it launched its own ecommerce platform. Tata Housing continues to sell through Snapdeal, with developers such as Godrej Properties and DLF Ltd also joining the platform.

“The customer talks directly with the developer, so the message does not get lost in translation. A broker may be misquoting the specifications of a project and we take the blame for it. This does not happen when we sell online,” says Brotin Banerjee, managing director and chief executive, Tata Housing.

Bangalore-based Sobha Ltd, one of India’s largest real estate companies, is set to launch its 81-acre township project in Balagere, Bangalore, on a real estate portal. “In the future, we are looking at promoting more projects online than offline. Online is the future and, sooner or later, we all have to follow this route,” says JC Sharma, vice chairman and managing director, Sobha.

Sharma feels that as real estate portals begin to build credibility and trust among users, and offer improved services, they will grab a larger share of overall transactions. “Currently, they are all trying to replicate each other’s services. They simply cannot be plain vanilla listing portals. The services have to go much beyond that. They need to have a competitive advantage. Credibility and transparency will be the trump card,” he says.

What’s on offer

The unorganised nature of the real estate market and the unreliability of brokers have opened a floodgate of opportunity for realty portals. While online real estate listings have existed for nearly a decade, experts say they received a fillip in early 2011 with the launch of large residential projects (with 500 to 1,000 apartments) that needed massive marketing budgets and an efficient medium for sales.

Realty portals started out simply with listings, but now they are gearing up to add more value by offering verified listings, 360-degree virtual tours of properties, and end-to-end solutions (such as verifying the validity of properties, its legal documents and helping with home loans and insurance) for properties that are being rented or sold.

CommonFloor.com, for example, is set to offer ‘live-in tours’, where one can feel as if they are actually present in an area where they like a property. It will formally launch this offering in a few weeks. It also has a Retina app that customers can download on their Android phones and take a 360-degree virtual tour of properties on their Retina headgear.

CommonFloor aims to map every property in the country and will charge the sellers on cost per lead. “We’ll be free for buyers and individual sellers [home owners], but we will charge businesses [developers and brokerage firms]. We have the vendors’ list for various services [legal aid, interior designers, etc], and users can pay them directly,” says Sumit Jain, co-founder and chief executive, CommonFloor. It has 5.2 lakh listings, of which around 2.2 lakh are posted directly by owners, from 200 cities in India. The Bangalore-based company is backed by Accel Partners, Tiger Global and Google Capital.

IndiaProperty.com focuses primarily on new properties and has a verification process that includes checks on the physical attributes of a property (to see if they match the developers’ claims) and its legal documents. It also has certain fee-based services for buyers, such as an ‘assisted search’, area-specific searches, legal services, and help with buying home insurance.

This March, IndiaProperty had a week-long sale that saw 400 bookings, mostly from Chennai, Bangalore, Mumbai and Hyderabad. “The total value of the bookings was about Rs 200 crore and we got close to about 600 site visits that week,” says Ganesh Vasudevan, CEO, IndiaProperty. Backed by investors such as Bertelsmann India Investment, Canaan Partners and Mayfield Fund, the Chennai-based portal offers services in 22 cities, and claims to have 32 lakh unique visitors on its website every month. It has more than 50 lakh registered users with over 7 lakh property listings and over 8,000 builders and agents using the platform to list properties. The company aims to cover almost 100 cities in India over the next 12 months.

NoBroker.com, a home-rental portal that keeps out brokers was started in 2013, and adds about 12,000 listings on its website every month; of these 4,000 to 5,000 are from Mumbai and the rest from Bangalore. To ensure that brokers don’t find space on the platform, it verifies all visitors. Akhil Gupta, co-founder and chief technology officer, has developed an algorithm that scans the internet and online databases to check whether visitors are faking their details or if they have connections to a broker.

“Intermediation cost comes up to 18 percent [sum of 11 months’ rent and brokerage fees]. It is hard to think of any other industry which charges 18 percent just to make the owners and prospective tenants meet. This being the internet age, this industry is going to change; nobody is going to pay 18 percent for brokers,” says Amit Agarwal, co-founder, NoBroker. The company has been backed by SAIF Partners and Fulcrum Venture.

Property-only portals are not the only ones benefiting from the shift of the realty market towards the internet. Pranay Chulet, founder and CEO of Quikr, claims that the number of property listings on Quikr—about 20 lakh—is more than the listings in any of its other segments, and higher than listings on any other real estate site. Buying and renting of apartments has emerged as one of the largest business verticals for Quikr and the company claims to record about 2 lakh real estate transactions, including sales of 50,000 homes, per month. Quikr is set to launch a separate vertical, Quikr Homes, by end-April.

Mumbai-based Quikr, which recently moved its headquarters to Bangalore, raised $150 million (over Rs 900 crore) in a fresh round of funding led by existing investors Tiger Global and AB Kinnevik earlier this April. Hong Kong-based Steadview Capital was the only new investor in the round.

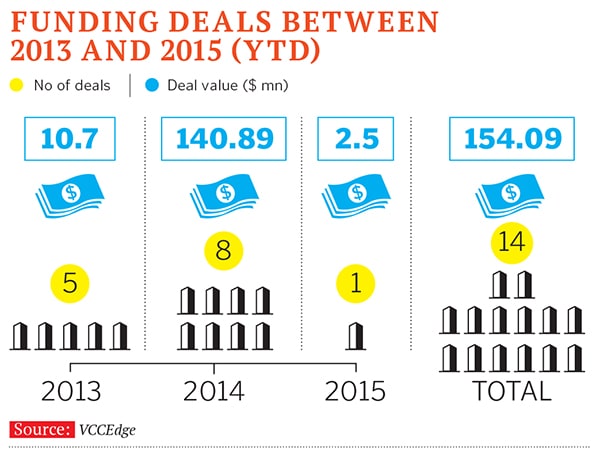

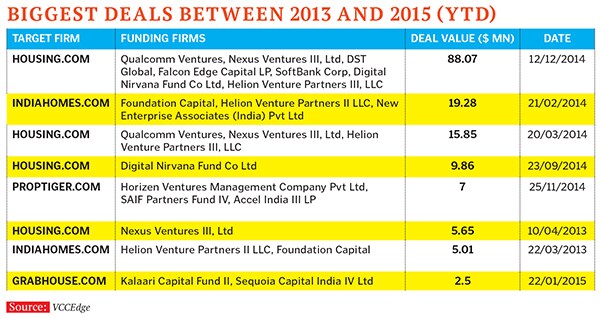

Funding the shift

Property portals are in a high growth phase as consumers get comfortable with the idea of buying and renting property online, and foreign capital is invested in portals like Housing and CommonFloor.

“It’s a very attractive sector, it’s monetisable, there are global comparables available [Trulia in the US and Thea in Australia] and one can take cues from them; it’s a big market, there are pain points across the value chain, there is a trust deficit [with regard to brokers and developers],” says Mukul Singhal, principal, SAIF Partners. “It has all the right recipes to indicate that these businesses will do well.”

Investors say that although there are several players in the residential property space, there is space for the emergence of new models. Singhal, for instance, is looking for new models in the commercial sector. “People feel that one large company will come up in each space and hence the interest in such firms. It can be a large business, the market opportunity is huge, it’s an unorganised market. All these aspects are in favour of this segment. Valuations are far ahead of real business,” says Deepesh Garg, managing director, o3 Capital, an investment bank.

But, although these portals are raising funds, and are increasing the number of listings and offering fee-based models, they are still not profitable, much like their ecommerce brethren. Investors say the lack of profitability is almost a nature of these businesses. TC Meenakshisundaram, founder and managing director of IDG Ventures India Advisors, an investment firm, says, “If people can’t capture a percentage of the market, how they will profit is yet to be seen. Scale is important. What percentage of transaction value do they capture? A broker takes two percent. That will be critical.”

Investors say the segment will see a consolidation as the country cannot sustain eight to 10 real estate portals. Though there is no clear leader yet, two to three firms are expected to dominate this industry. “We expect that a few firms will eventually have large IPOs. Globally, these types of businesses have become very large over a period of time. India, of course, will evolve a lot more in terms of online real estate businesses, but we already see very significant amounts of property research moving online,” says Subrata Mitra, partner, Accel Partners.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)