Tech Mahindra ends lower after tough misses. Five takeaways from Q1

Incoming MD and CEO designate Mohit Joshi, who will take over in December, said he remains optimistic about the company's prospects

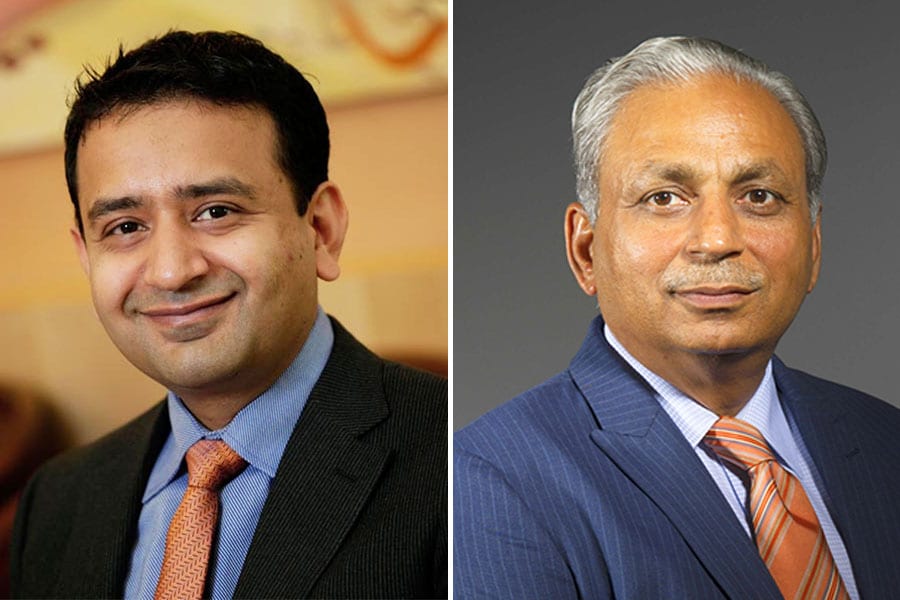

Tech Mahindra CEO and MD CP Gurnani (right), who hands over to Mohit Joshi this year, said the latest Q1 was one of the toughest quarters for the company

Image: CP Gurnani - Amit Verma

Tech Mahindra CEO and MD CP Gurnani (right), who hands over to Mohit Joshi this year, said the latest Q1 was one of the toughest quarters for the company

Image: CP Gurnani - Amit Verma

Tech Mahindra shares ended nearly 4 percent lower on Thursday in Mumbai, after the IT services company posted fiscal first quarter numbers on July 26 that all missed analysts’ estimates. Shares were down as much as 5.4 percent earlier in the day on the Bombay Stock Exchange.

Long-timer MD and CEO CP Gurnani, who is handing over the reins to Mohit Joshi, a former Infosys senior executive, told analysts in a conference on July 26 that the three months ended June 30 constituted “one of the toughest quarters in recent times”.

Tech Mahindra, which has its origins as a joint venture between the Mahindra group and British Telecom, remains dependent on wireless providers and other customers in its communications, media and entertainment segment for more than a third of its revenues. These customers are among those who have cut back sharply on tech services spending in the ongoing global economic slowdown.

Here are five takeaways from Tech Mahindra’s earnings results and comments from Gurnani, who retires in December, and Joshi: