147 Indian companies likely to become unicorns in next 5 years

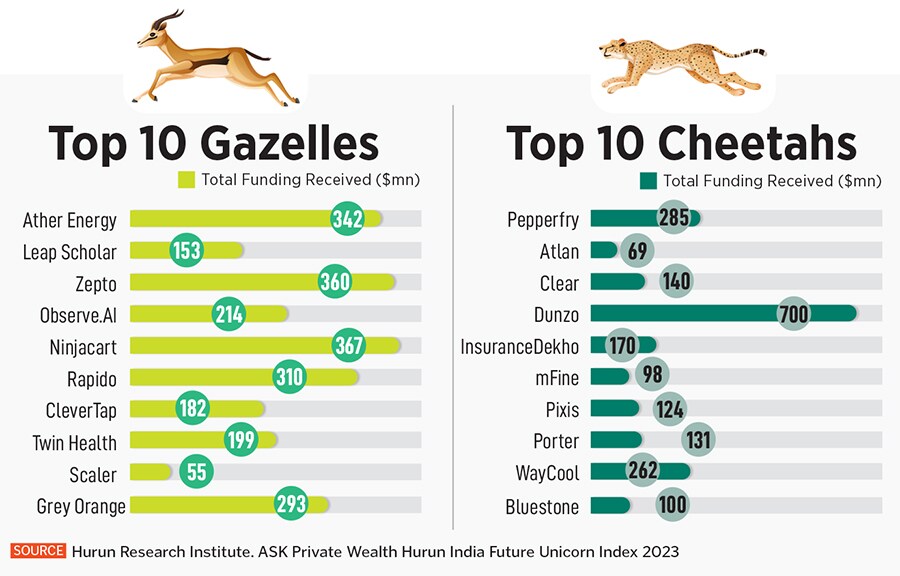

The ASK Private Wealth Hurun India Future Unicorn Index 2023 says there are 83 unicorns, 51 gazelles and 96 cheetahs in India. However, an economic slowdown has made almost 20 percent of last year's gazelles and cheetahs either drop off the list or be downgraded

Currently, there are 83 unicorns in India, 51 gazelles and 96 cheetahs, according to the ASK Private Wealth Hurun India Future Unicorn Index 2023, released on June 27

Image: Shutterstock

Currently, there are 83 unicorns in India, 51 gazelles and 96 cheetahs, according to the ASK Private Wealth Hurun India Future Unicorn Index 2023, released on June 27

Image: Shutterstock

As companies scout for money to capitalise on their business at a time when rising interest rates and global uncertainties have reduced the appetite of investors, there are 147 startups in India that are most likely to become unicorns in the next five years, according to Hurun Research.

Currently, there are 83 unicorns in India, 51 gazelles and 96 cheetahs, according to the ASK Private Wealth Hurun India Future Unicorn Index 2023, released on June 27. However, this is a slight decline from last year, when there were 84 unicorns, 51 gazelles and 71 cheetahs.

Hurun Research Institute defines unicorns as startups that are founded after 2000, with a valuation of $1 billion, gazelles as startups that are most likely to become unicorns in the next three years, and cheetahs as startups that could become unicorns in the next five years. The evaluation is based on regulatory filings, feedback from other entrepreneurs and some of the India-focussed venture capital funds and angel investors.

Hurun Research found 147 future unicorns from 25 cities in India. On an average, they were set up in 2015, with the vast majority selling software and services, and only 20 percent selling physical products; 37 percent are selling to businesses, while 63 percent are consumer-facing. Future unicorns were seen disrupting sectors such as financial services, health care, business management solutions and education.