Green vs Blu: An electrifying cab war in the offing

Uber's 'Green' EV fleet is pitted directly against the biggest homegrown EV cab player BluSmart in India. Can the desi warrior keep the global David at bay?

Uber Green versus BluSmart: The global ride-sharing platform is rolling out ‘Green’, its EV (electric vehicles) car fleet in Mumbai, Delhi and Bengaluru from June.

Illustration: Chaitanya Dinesh Surpur

Uber Green versus BluSmart: The global ride-sharing platform is rolling out ‘Green’, its EV (electric vehicles) car fleet in Mumbai, Delhi and Bengaluru from June.

Illustration: Chaitanya Dinesh Surpur

It’s a battle of unequals. But then, this is how all ‘David versus Goliath’ scripts unfold. Right? It’s a battle between a global giant that can flex its financial muscle and operational clout to gobble smaller rivals versus the tenacity of homegrown warriors who are equally capable of upsetting the calculations of the big boys on the back of their first-mover advantage and nimbleness. But isn’t that how all MNCs versus local wars start to begin with? Remember Flipkart versus Amazon? MakeMyTrip versus Expedia? Naukri versus Monster, and Ola versus Uber?

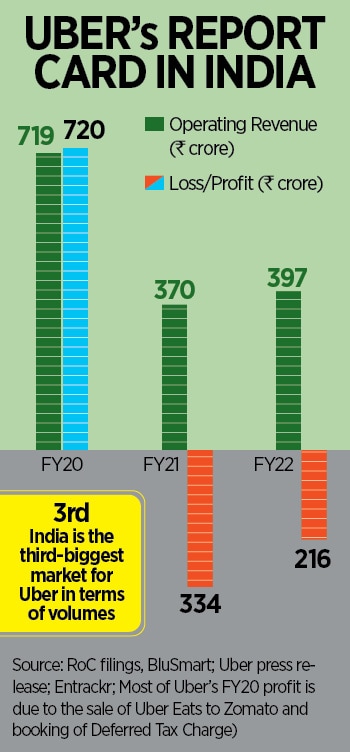

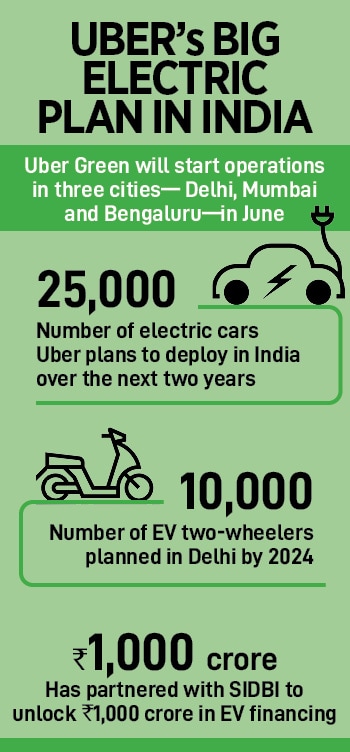

Adding one more ‘versus’ to the long list is the latest ‘Uber Green versus BluSmart’. The global ride-sharing platform is rolling out ‘Green’, its EV (electric vehicles) car fleet in Mumbai, Delhi and Bengaluru from June. “Green will roll out in other cities in a phased manner," says an Uber spokesperson. The long-term plan is to deploy 25,000 cars over the next two years through a wide network of large fleet partners. Uber, the spokesperson underlines, is expanding its fleet network with Lithium Urban Technologies—which happens to be India’s largest B2B fleet service provider—Everest Fleet, and Moove. “Uber does not own or operate fleets,” he says, alluding to continuing with its asset-light business model, and helping the driver partners own the EVs. “When we talk about going electric, we are looking at the entire mobility ecosystem which includes buses,” he adds, claiming that Uber has around 8 lakh drivers in India. He, however, declined to share the total number of cars on its platform.

So, Uber’s EV game plan in India is simple: Start with cars, add two-wheeler (Moto), and then swiftly attach other modes of transportation.

So, Uber’s EV game plan in India is simple: Start with cars, add two-wheeler (Moto), and then swiftly attach other modes of transportation.

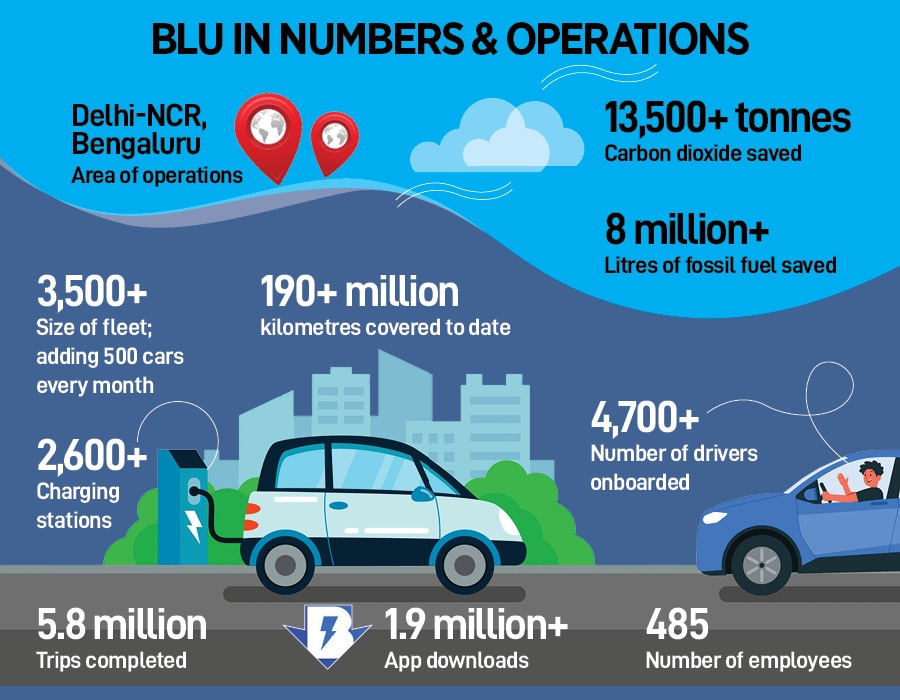

BluSmart, meanwhile, is a blue-blooded EV player, which started operations from Delhi-NCR in 2019. In four years, the startup has briskly scaled up its operations to become the biggest EV cab operator in India. It has over 2,600 charging points, has expanded operations into Bengaluru, has a fleet of over 3,500 cars, claims to add 500 cars every month, and has over 4,700 drivers. The most interesting part, though, is the way it operates. Unlike Uber which doesn’t own any car and has an asset-light model, BluSmart buys EVs and has drivers on its rolls. So, it works on an asset-heavy model.

So, how will the fight pan out? To begin with, BluSmart has the first-mover advantage, and this edge is not because of having a head-start, reckon marketing and branding experts. Harish Bijoor explains why Blu has a bigger ‘green’ attached to its name.

Also read:

Also read:  Also read:

Also read: