Can KamaSutra pole vault to the top?

With a new owner, can the brand finally get a much-needed marketing push, enough advertising thrust, a wider reach and a premium positioning to topple condom leader Manforce?

KamaSutra is second biggest with a 9.5 percent volume market share in March 2023, followed closely by Skore with 9 percent, according to a top industry official citing Nielsen data

KamaSutra is second biggest with a 9.5 percent volume market share in March 2023, followed closely by Skore with 9 percent, according to a top industry official citing Nielsen data

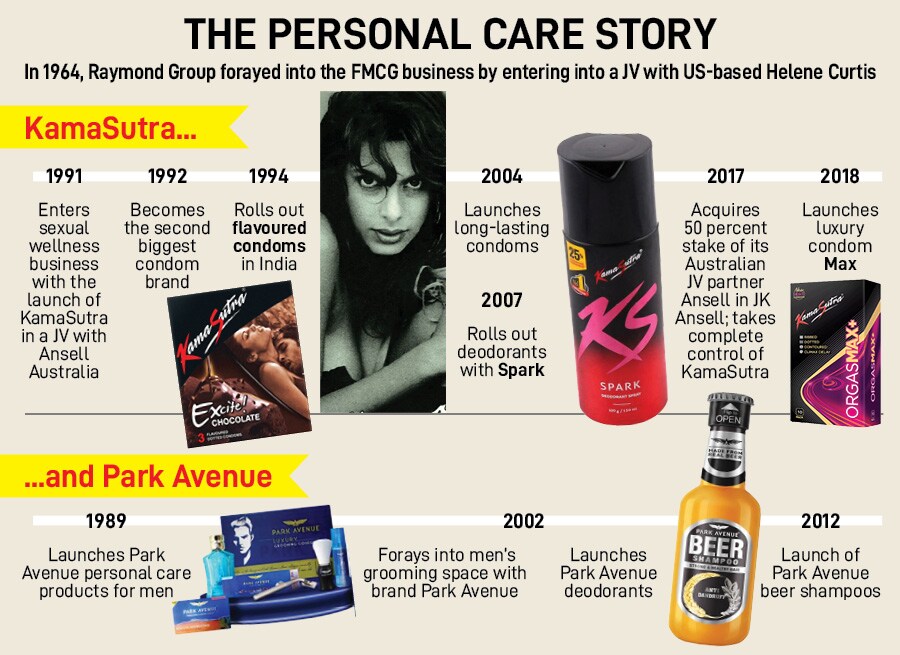

August 2017, Mumbai. The ‘Complete Man’ underlined the value of owning a complete brand. "The acquisition of Ansell's 50 per cent stake gives us the full ownership of brand KamaSutra," Gautam Hari Singhania reportedly remarked in August 2017. The chairman and managing director of Raymond Group was alluding to buying out Ansell’s 50 percent stake in JK Ansell, a joint venture with Ansell Australia, which marked Raymond’s foray into the sexual wellness business with the launch of KamaSutra condoms in 1991. “The acquisition,” Singhania reckoned, “would pave the way for Raymond to further scale up the FMCG business and unlock the immense potential of brand KamaSutra globally.”

A year later, in August 2018, the then CEO of the FMCG business of Raymond reiterated the value of KamaSutra. “Around Independence Day last year, KamaSutra actually got its freedom. This year (2018) KamaSutra will don its most potent avatar,” he told this reporter in an interview in Mumbai. The prophecy turned out to be true.

Look at the numbers. In 2015, KamaSutra had a volume market share of 8.2 percent, which made it the fourth biggest condom player. The top three in the pecking order were Manforce, Moods and Skore. Over the next few years, the brand briskly ramped up business and climbed the charts to become second biggest in volume and third in value—13.8 percent and 13.5 percent, respectively—in the first quarter of 2021. Two years later, KamaSutra is still second biggest with a 9.5 percent volume market share in March 2023, followed closely by Skore with 9 percent, according to a top industry official citing Nielsen data. Manforce, he points out, still has a thumping market share of 34 percent. “Though KS (KamaSutra) had been maintaining its rank, it never got the push to take on Manforce,” he says, requesting anonymity.

The pecking order, though, might change now, reckon marketing and branding experts. “If the brand has been holding on to its ranking without any advertising and marketing push, imagine what it can do if the new owner gives an aggressive nudge,” reckons Harish Bijoor, who runs an eponymous brand consulting firm. With Godrej Consumer Products acquiring three FMCG brands of Raymond’s consumer care—KamaSutra condoms, KS deodorants and the grooming brands of Park Avenue—in an all-cash deal for Rs 2,825 crore, KamaSutra stands a realistic chance of getting back its premium appeal, taking on Manforce in volume play, and overtaking Durex in the value game. “Having a new owner is the best possible thing that could have happened to the brand,” he says, adding that for years the brand has been an orphan in terms of advertising and marketing neglect. For a brand which was started way back in 1991, Bijoor reckons, having less than 10 percent market share in over two decades doesn’t do justice to its potential. “It should have been the biggest in India,” he says. A name like KamaSutra, he lets on, is in itself a key to cracking the global market.

The huge gap between the top two players—Manforce with 34 percent and KamaSutra with 9.5 percent—is also a story of how the second-biggest brand in volume failed to crack the mass and the class act. Ashita Aggarwal explains. Manforce, says the marketing professor at SP Jain Institute of Management and Research, has always stayed true to its core and positioning of being a mass player and price warrior. And it clearly reflects in its volume and value market share as both are almost equal. Durex, on the other hand, is fifth biggest in volume—between 8 and 9 percent—but second-biggest in value with a 13 percent share. KamaSutra, in contrast, is the third biggest value player. “So a 9.5 percent volume share gives it around 10 percent value,” Aggarwal, underlining how the brand could not fan out to become a complete mass player, and how it lacked a premium appeal to take on the likes of Durex. “It never got ample attention,” she says.

The huge gap between the top two players—Manforce with 34 percent and KamaSutra with 9.5 percent—is also a story of how the second-biggest brand in volume failed to crack the mass and the class act. Ashita Aggarwal explains. Manforce, says the marketing professor at SP Jain Institute of Management and Research, has always stayed true to its core and positioning of being a mass player and price warrior. And it clearly reflects in its volume and value market share as both are almost equal. Durex, on the other hand, is fifth biggest in volume—between 8 and 9 percent—but second-biggest in value with a 13 percent share. KamaSutra, in contrast, is the third biggest value player. “So a 9.5 percent volume share gives it around 10 percent value,” Aggarwal, underlining how the brand could not fan out to become a complete mass player, and how it lacked a premium appeal to take on the likes of Durex. “It never got ample attention,” she says.