Forbes India IPO litmus test: Survival of the fittest

The real test for newly-listed companies comes once the listing pop charm fizzles out. A few survive, while most crack under pressure, eroding investor wealth

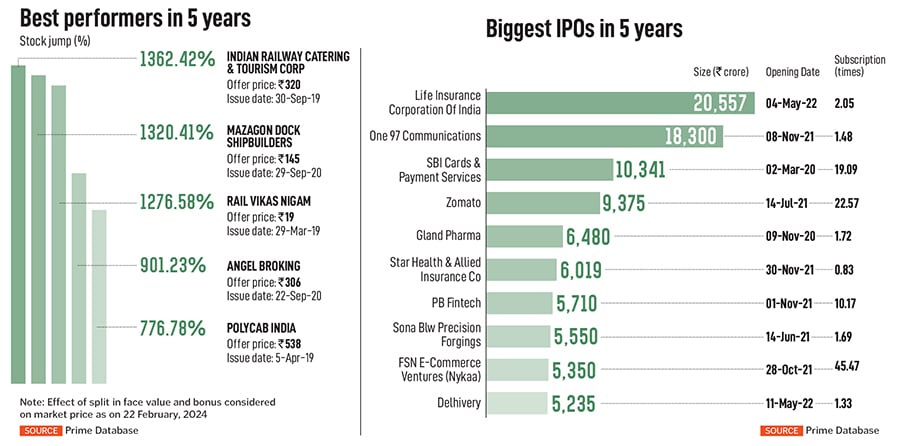

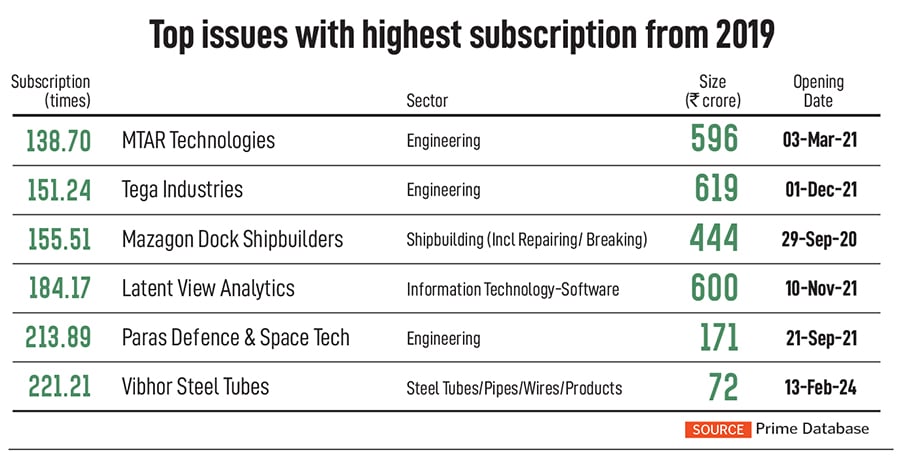

As a flurry of new IPOs hit the stock markets over the last five years, we looked at those that survived the storm and volatility with outstanding performances on the exchanges.

Illustration: Chaitanya Dinesh Surpur

As a flurry of new IPOs hit the stock markets over the last five years, we looked at those that survived the storm and volatility with outstanding performances on the exchanges.

Illustration: Chaitanya Dinesh Surpur

What makes an investor excited about a stock before parking money into it? One may argue about factors like long-term growth prospects, sustainable plans to maintain profits, and to some extent management credibility. But nothing is as delicious and appetising as listing pops that make IPOs attractive for investors, especially the retail segment. To put it simply, listing pops are the first day gains a company makes as its shares debut on stock exchanges.

There is nothing wrong in chasing such mouth-watering fast-paced profits on new listings. This plays immensely well for promoters making the company public, for existing shareholders looking for an exit and for new investors betting for a quick buck, but only at a time the overall equity markets are themselves on an adrenaline rush. That very enthusiasm gets cold once the tide turns. And that’s exactly what happened in 2023.

Overall, primary markets slowed down last year, as macro-economic uncertainties and investor sentiment soured after the two wars—Russia-Ukraine and Palestine-Israel. The challenges got intense and difficult, with concerns of steep valuations as well. Investors are gradually becoming more vigilant of IPO-bound companies with a sharp eye on more compelling, convincing and sustainable strategies beyond profitability.

However, the proof of the pudding is in the eating. As listing pop charm fizzles out, the real survival tests the newly listed companies face is after spending time on the stock exchanges, going through the volatility of markets and the cycle of quarterly earnings sessions. Most such new listings crack under pressure, eroding a chunk of investor wealth. Only a few survive.

As a flurry of new IPOs hit the stock markets over the last five years, we looked at those that survived the storm and volatility with outstanding performances on the exchanges. We sieved through data of over 200 companies that got listed on main board BSE and NSE starting from 2019 till February 15, 2024, based on data provided by Prime Database.