The story behind attractive FD rates

Non-banking financial companies are offering appealing rates to raise deposits, raising concerns about sustainability, pressure on margins

Image: Shutterstock

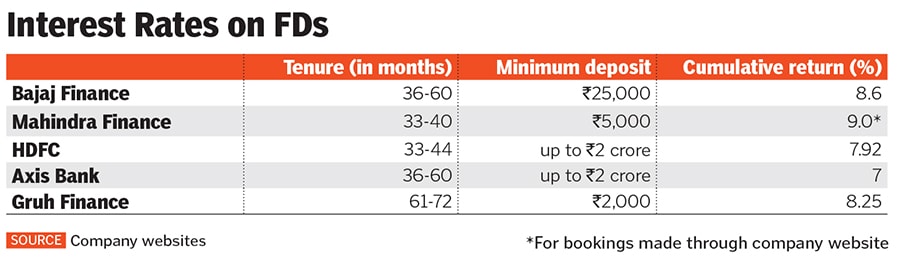

Image: Shutterstock At a time when policy rates are softening, non-banking financial companies (NBFCs) are offering attractive rates to raise deposits. A fixed deposit (FD) from Mahindra Finance for a tenure of 33 to 40 months offers a return of 9 percent while Bajaj Finance gives up to 8.6 percent interest for new customers and 8.95 percent for senior citizens. Weakening stock market returns are forcing investors to eye sizeable returns through debt instruments such as FDs, besides investing in gold. This raises concerns about whether NBFCs will be able to maintain their margins, and the rates at which they will lend in the future.

“Our cost of funds has remained steady at 8.5 percent. As long as our contribution of deposits is within 25 percent of our total borrowings, we do not foresee any material impact on our overall cost of funds in the short and medium term,” says Rajeev Jain, managing director of Bajaj Finance.

“Our ALM management and strong liquidity position has ensured our strong growth momentum. We have a diversified borrowing mix between banks/ money markets/ deposits at 37 percent/ 50 percent/ 13 percent respectively. In the current scenario the liquidity event has clearly differentiated between good and bad credit,” Jain says.

Bajaj Finance’s net interest margins were around 12 percent in Q1FY20 and 9.8 percent for FY19. Bajaj Finance’s overall franchise stands at 36.94 million in Q1FY20, a growth of 31 percent year-on-year. The NBFC added 2.46 million new customers in the three months to June.

“The margins that most NBFCs commanded in previous quarters are unlikely to be met,” says an analyst with a global equity research firm.

For Bajaj Finance or Mahindra Finance too there could be some pressure on their margins in future quarters, though it is possible that these firms will be able to lend at rates of 12-13 percent.

The main rationale that these NBFCs are offering such attractive rates is for balance sheet expansion, which would help them to cover for fixed costs or maintain satisfactory capital adequacy to meet for instances of a possible default or for higher provisioning. There continues to be a very real concern in retail lending at this stage.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)