Games NBFCs play

Inside the art of selling complex loans

Image: Shutterstock

Image: ShutterstockLiquidity-starved non-banking financial companies (NBFCs) are resorting to innovative – perhaps desperate – ruses to keep their head above water. One such gambit is downselling loans to each other. Optically, in most cases, loans are being sold at par value but in reality the deep discounting on the loan is happening in other ways, said two people directly familiar with the development.

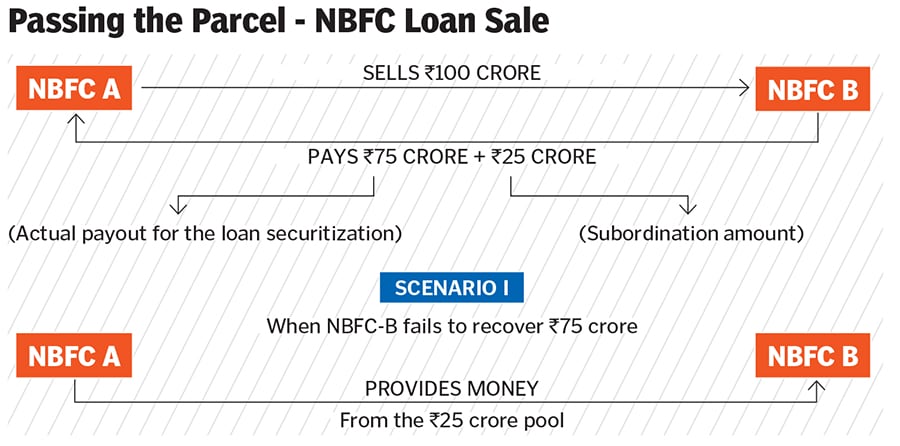

For example, let’s say NBFC-A has a loan of Rs 100 crore which it wants to sell to NBFC-B; it will sell it for the same price. Both parties are aware it is a bad loan and that NBFC-A is trying to offload it but on paper it does not want to take a hair cut. Hence, NBFC-B might be willing to buy it a discount, lets say, it is willing to pay Rs 75 crore. Thus, NBFC –B pays Rs 75 crore as the amount to acquire the loan and the rest is kept with NBFC-A as a subordinate tranche.

So if NBFC-B is unable to recover that Rs75 crore it will go back to NBFC-A to recover the loss from that Rs25 crore which was kept aside.

These transactions are done through profit and loss account and hence NBFC-A does not have to book losses and it is recorded in the balance sheet. If NBFC-B ends up ploughing the Rs 25 crore back it will slowly bring down the net worth of the company but not affect the optics of the book.

Some of the recent large sized real estate loan sales have been done through this route.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)