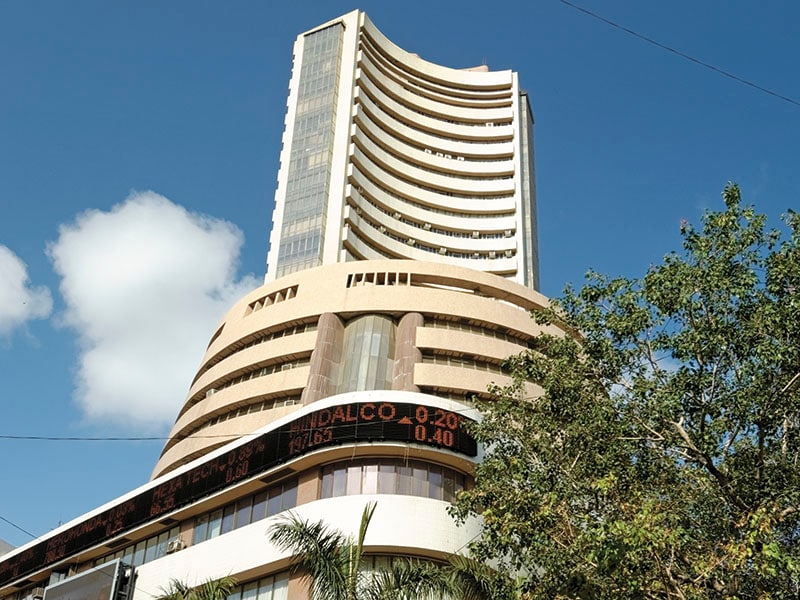

BSE's public offer hits bull's eye

Image: Shutterstock

Change has come to BSE, Asia’s oldest stock exchange. In January, it completed its initial public offering (IPO), opening up an exit route for shareholders. The total issue size was about 1.07 crore shares in a price band of Rs 805 to Rs 806. It was oversubscribed a hefty 51.22 times.

BSE is the world’s largest stock exchange in terms of the number of listings—it has over 5,900 companies registered with it. But, in recent years, it has not only lost its dominance in the cash segment to rival National Stock Exchange (NSE), it has also been late in the adoption of derivatives. But there remain factors that make investing in an exchange an attractive option.

Siddharth Purohit, a senior research analyst at Angel Broking, wrote in a note to clients, “While equity savings in India remain low, with other asset classes becoming less attractive, investor acceptance of equity as an investment is gaining momentum. With India remaining an attractive investment destination, BSE is likely to see decent growth in business.”

The exchange is trying to stay ahead of the NSE with product innovation—currency derivatives, debt markets, mutual funds, an international exchange, and commodity trading—which would add to its revenue mix and boost the brand.

Prior to the IPO, BSE said it had raised Rs 373 crore through anchor investors, including ICICI Prudential Mutual Fund, Kotak Mutual Fund, Goldman Sachs Asset Management, Citigroup Global Markets Mauritius, DSP Blackrock and Kuwait Investment Authority Fund.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)