Bitcoin tumbles below $30,000 for the first time since January

The latest drop leaves Bitcoin little changed from where it began the year, erasing a large run-up in recent months

Bitcoin fell below $30,000 on Tuesday, June 22, 2021, for the first time since January after a torrid week of trading in which the cryptocurrency has lost nearly 30% of its value; Image: Florence Lo / Reuters

Bitcoin fell below $30,000 on Tuesday, June 22, 2021, for the first time since January after a torrid week of trading in which the cryptocurrency has lost nearly 30% of its value; Image: Florence Lo / Reuters

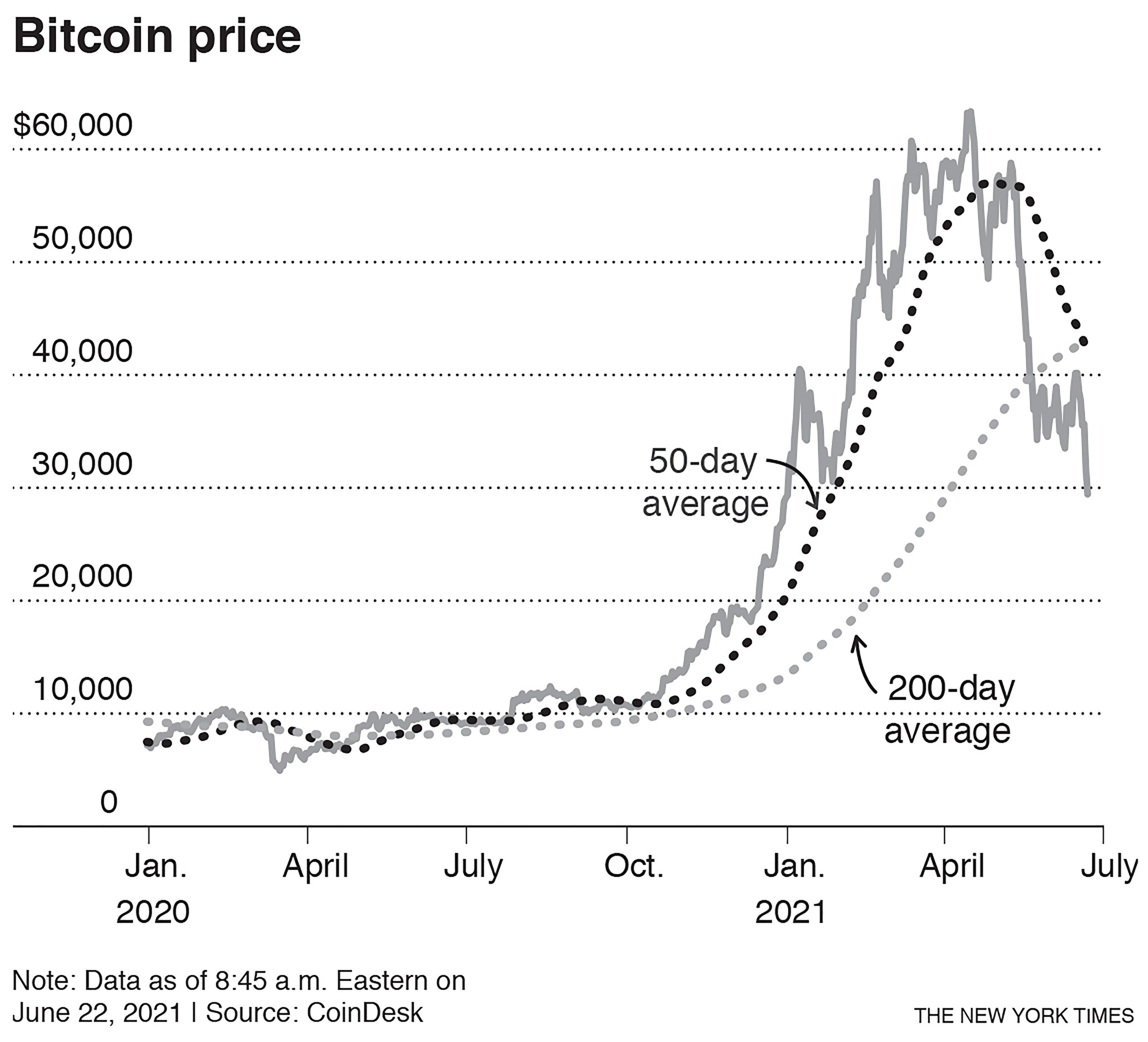

Bitcoin fell below $30,000 on Tuesday for the first time since January after a torrid week of trading in which the cryptocurrency has lost nearly 30% of its value. The latest drop leaves Bitcoin little changed from where it began the year, erasing a large run-up in recent months.

The decline comes as China intensifies its crackdown on Bitcoin. The Chinese government has long viewed cryptocurrencies as a threat to its control over capital flows in the country. Recent statements from top policymakers and articles in the official news media have signaled an increased focus on controlling financial risks, likely to ensure smooth sailing for the economy before a major Communist Party political meeting next year.

China banned domestic cryptocurrency exchanges years ago, but trading has continued on other platforms. And China has remained a major hub for cryptocurrency mining operations, in which vast computer farms compete to solve complex equations in return for Bitcoin. Now, though, all of that is coming under greater official scrutiny.

In May, Chinese financial regulators issued a stark statement barring banks and payment companies from handling crypto-related business and reminding consumers about the dangers of virtual currencies. Since then, local authorities in several parts of China have shut down crypto mining operations.

In recent days, processing activity on the Bitcoin network, known as the hashrate, a measure of the computing power devoted to processing the cryptocurrency, has dropped markedly. And China’s central bank said Monday that it had summoned banks and financial technology firms to remind them that crypto trading in the country was banned.

©2019 New York Times News Service