Headmasters of edtech: Why Sequoia Capital bets big on the sector

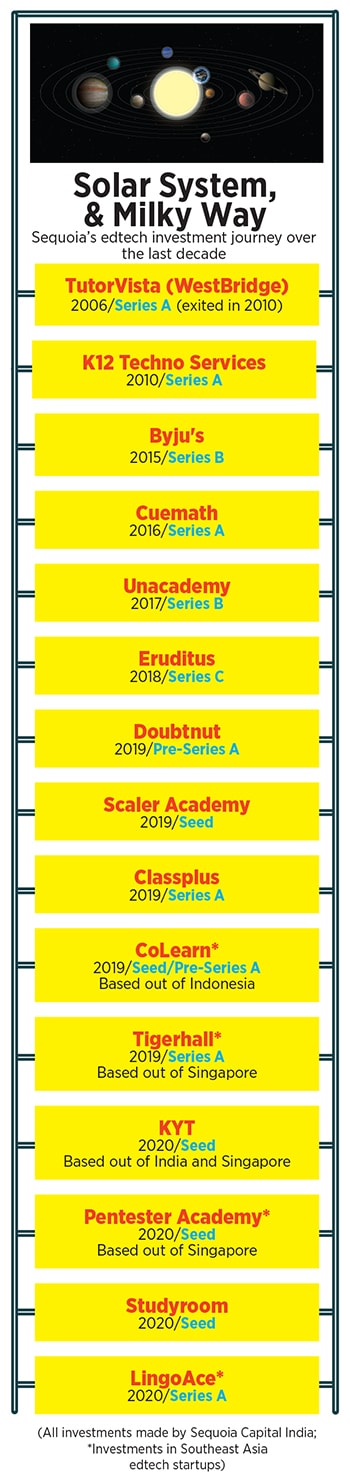

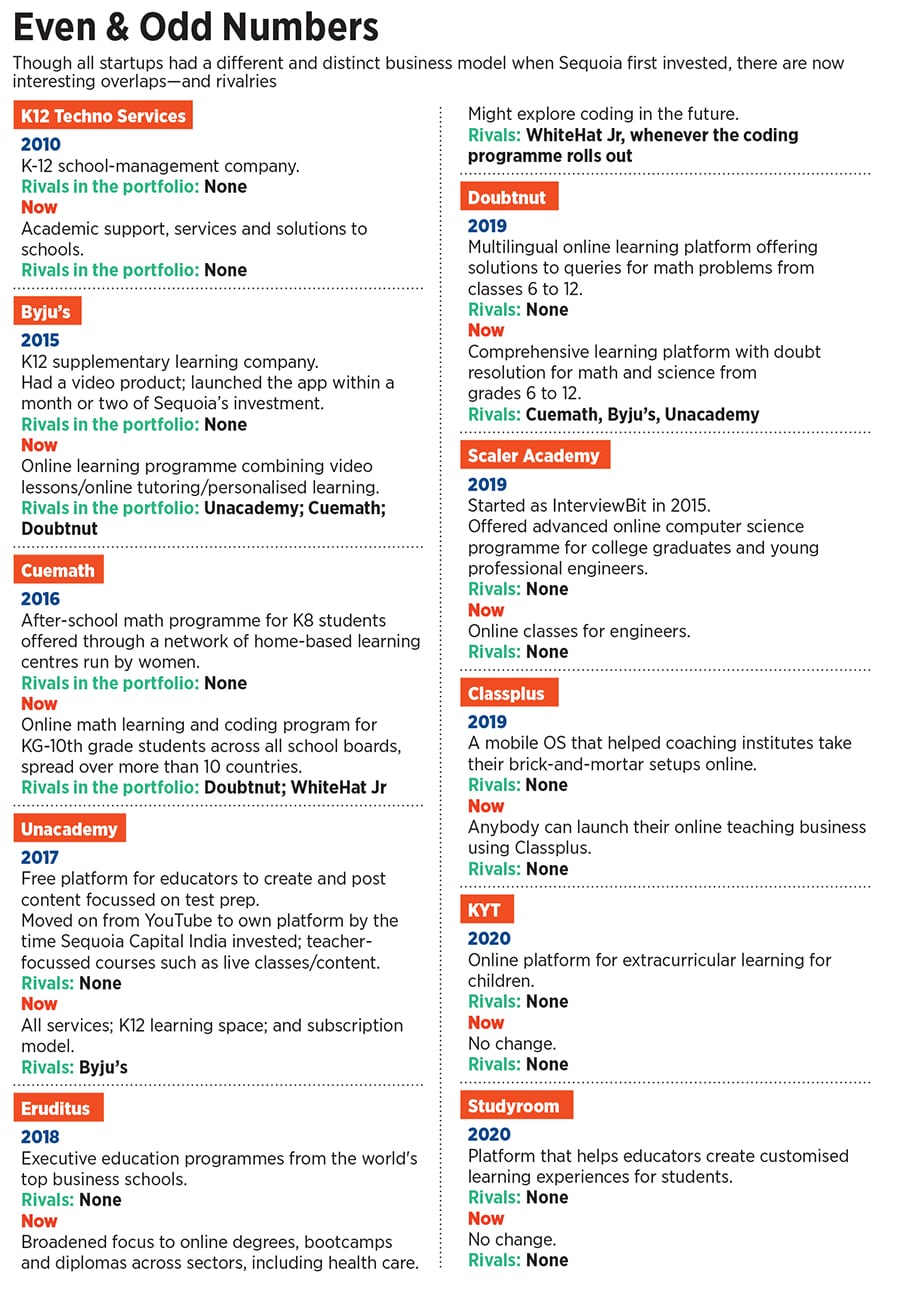

Sequoia Capital's first edtech investment was 15 years ago—from then to now, the sector has evolved significantly—and today it has over a dozen investments in the sector, including heavyweights Byju's and Unacademy

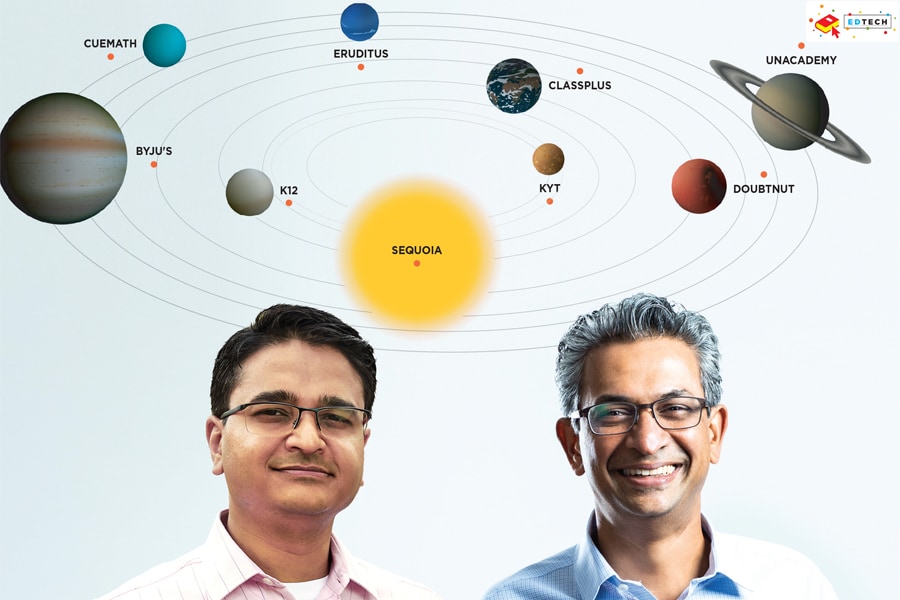

GV Ravishankar (left) and Rajan Anandan, Sequoia India’s managing directors. The firm has been among the early VC companies to make the most of the edtech boom

GV Ravishankar (left) and Rajan Anandan, Sequoia India’s managing directors. The firm has been among the early VC companies to make the most of the edtech boomImage: GV Ravishankar: Mexy Xavier

A section of Christ College wore a festive look over the weekend. It was the last Sunday of July. July 27—GV Ravishankar still has the date saved on his Google calendar. How can the managing director of Sequoia India forget the day? The mood inside the college auditorium was electric. Restive schoolchildren—from classes 5 to 12—and their twitchy parents were jostling for every inch of space; everybody was glued to the big white screen on the empty stage. The class was about to start. The spectators were waiting patiently to see the teacher.

Ravishankar, sitting in one of the last rows, was also eager to hear the pitch. He looked edgy though. Two visuals were playing on his mind. The first was the giant Byju’s hoarding which he unfailingly noticed hanging on a building next to the flyover every time he travelled from the Bengaluru airport towards the city.

The second thought that bugged the seasoned venture capitalist (VC) was the joke doing the rounds at the office of India’s biggest VC firm. “There was a reputation at Sequoia—that we meet and pass every opportunity in education,” he says. The jibe had roots in the fact that the marquee VC fund had managed to invest in just two education-focussed startups since 2006. Reason: The fund didn’t find anything super exciting. “We were in no hurry to pull the trigger,” recounts Ravishankar. This time, though, he was hoping to change the script.

Back in the auditorium, the noise levels suddenly dropped. You could have heard a pin drop as Byju Raveendran took the stage to address the gathering. As the charismatic teacher solved student queries, the parents and their wards were hooked; and the backbencher was onto something. By December 2015, Sequoia had pumped $26 million into Byju’s for a 22 percent stake, which went over 25 percent by early 2016.

Fast forward to four years later in the same city. At a late-night dinner towards the fag end of 2018, Gaurav Munjal, co-founder and chief executive officer of Sequoia-backed Unacademy, was thinking of his next big move. The person giving him company was Shailendra Singh, managing director at Sequoia India. Munjal’s special bonding with Singh started way back in 2017 when he used to chat on Twitter. “When I first met him, I wanted to partner with him,” recalls Munjal. The reason was simple. All the investors to whom the entrepreneur had pitched urged him to think small. Singh, though, was cut from a different cloth. “In the first meeting, Shailendra asked us to go global and think big,” he says.

Back at the dinner table, Singh offered some food for thought. “Why don’t you bundle everything and give access to quality teachers and live classes under one package?” he asked. Munjal was dismissive. “I didn’t understand it. I thought it won’t work,” he recalls. After two weeks, though, Munjal got convinced. “That idea didn’t leave me. It stuck with me,” he says, adding that the ‘Unacademy Plus Subscription’ plan was rolled out in January 2019. Within two months, the edtech startup managed to get a staggering 15,000 paid subscribers. “It became one of the fastest products to strike a $100 million annual revenue run rate,” claims Munjal (see interview).

Cut to January 2020. Sequoia India made a killing by partly exiting Byju’s. In FY19, the VC firm reportedly made 21x of its ₹78.8 crore investment by pocketing a whopping ₹1,665.33 crore from a partial exit. Though Ravishankar declined to comment on the financials of the deal, Sequoia reportedly is still the second biggest investor in Byju’s with an 8 to 9 percent stake, after Naspers.

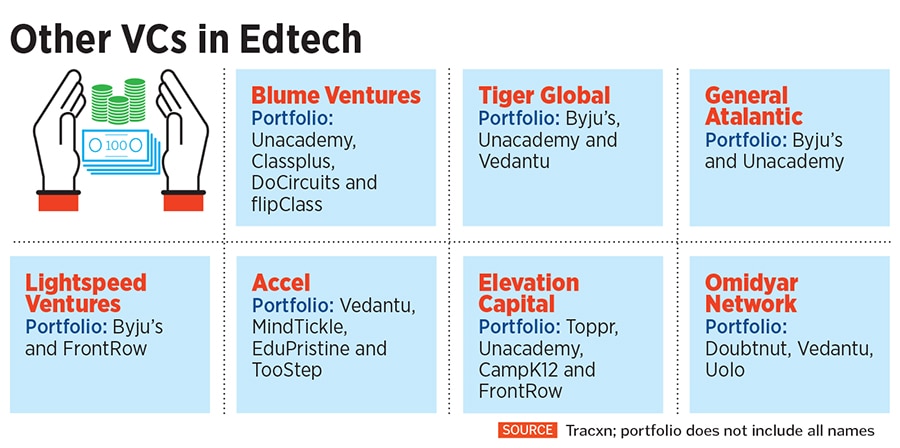

That’s enough to make Sequoia India the largest edtech investor in the country over the last decade. Along the two big boys of edtech, the portfolio also boasts a diverse and promising mix of startups catering to students in India, Southeast Asia and beyond.

Ravishankar makes a modest assessment of the strategy of the VC firm. “At times, many things are all supremely planned,” he says. “But sometimes it’s serendipity,” he smiles. “It’s all about having a prepared mind until you find the right opportunity.”

Right from the first investment

in TutorVista in 2006—it was actually made by WestBridge Capital, which got merged with Sequoia India in June 2006—to the funding of school management firm K12 Techno Services in 2010, the VC firm kept at it. Ravishankar and his team met hundreds of companies across all segments: Pre-school, school, test prep, high education, training post higher education. Nothing triggered the ‘aha’ moment.

The reasons were many. Most of the first wave of companies was far from education firms. None of the entrepreneurs had any education background, the business model was to give technology and content, and then charge a leasing fee over a period of time. “We were not convinced that these were the models of the future,” explains Ravishankar.

Another impediment in finding the right kind of edtech company was the absence of a conducive environment. “Remember 2006 was a time when 256 kbps was called broadband,” laughs Ravishankar. This is not the kind of infrastructure, he lets on, which would support high quality video and other things. “Clearly, the market was not ready for such offerings.”

K Ganesh, founder of TutorVista, chips in. “In 2006, there were no unicorns.” There was a major question mark on whether Indian startups could raise hundreds of millions of dollars, deploy them in India, create value, and provide billion dollar exits to investors. “This was unproven and had never happened,” says the serial entrepreneur and promoter at BigBasket, Portea Medical and HomeLane.

Ravishankar, though, didn’t give up. “We knew somebody would come up with a model that we would be interested in.” Then came Byju’s in 2015, Cuemath the next year, and Unacademy in 2017. Since then there has been no looking back. “We feel fortunate to be in such a place. I’m a big believer in serendipity,” he says.

Though luck or ‘being the right one at the right time’ might have had a role in Sequoia’s success, credit must also be given in large part to the ‘design’ of the VC firm in carving out the edtech empire, reckon industry experts. “Investing is about being able to think ahead and imagine the future,” says Radha Kizhanattam, partner at Unitus Ventures. “It [Sequoia] has carefully chosen bets across the edtech spectrum: K12, test prep, employment and continuous learning,” she points out. It has partnered with some of the best entrepreneurs, learnt and morphed their thesis constantly and built conviction to support companies with capital across stages. “All this has put it in a unique position,” she adds. Whether in education or investment market, success and returns take time. One needs to have loads of patience, risk-taking appetite and stay curious, she adds.

Back in 2014, Ravishankar exuded all the above traits. He was patient. He didn’t jump the gun and invest in Byju’s after his Christ College tryst. The first meeting happened when Tejeshwi Sharma, who was then an analyst and now a principal with Sequoia India, decide to cold call the company. “Then it was more a CAT (common admission test)-focussed company,” recalls Ravishankar. Raveendran, the star teacher, was all over the place. “He was taking flights over weekends, and had people from Infosys, Wipro and all coming for CAT preparation,” he says. Flying from one city to another made it clear to Raveendran that he couldn’t scale the model. “When we met them we thought that the bigger market was K12,” he says. Back then, the market for CAT was small, with roughly half a million people preparing for the exam as against an estimated close to a million now.

The first meeting set the ball rolling. Ravishankar stayed in touch, and met again after a few months, in August, in Mumbai. By then, Raveendran had made a big change in his business, and had launched digital content in recorded form for K12. Raveendran, his head of sales and the CFO were there for the meeting. The team explained how teaching using VSAT (very small aperture terminal) technology was not different from teaching in a classroom; how recorded digital content was effective even in the absence of live classes; and how the experience could be enhanced through multi-media content. “The way they explained to us was fascinating,” he recalls. The analogy used was watching a play in a theatre and watching a movie. “He had a big vision, and had a set of people who formed the core management team,” adds Ravishankar.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)