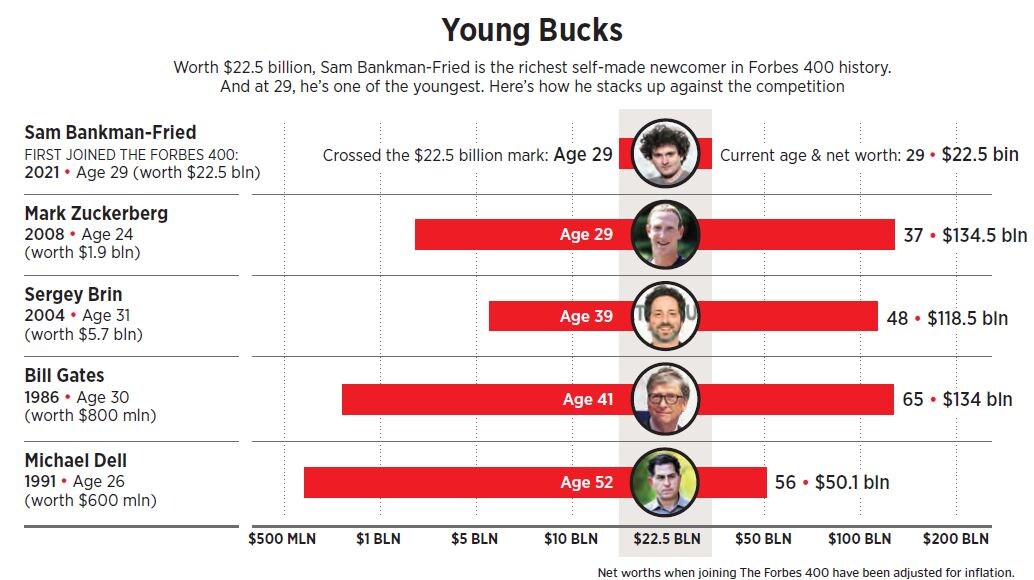

The Croesus of Crypto: How Sam Bankman-Fried built a $22.5 billion fortune without really believing in cryptocurrency

The FTX co-founder built his fortune before his 30th birthday by profiting from the cryptocurrency frenzy. Now, he just wants his wealth to survive long enough to give it all away

FTX co-founder Sam Bankman-Fried

FTX co-founder Sam Bankman-Fried

Image: Guerin Blask for Forbes

It’s a hazy late-summer evening when Sam Bankman-Fried drifts into Electric Lemon, a “clean, conscious” eatery on the 24th floor of the five-star Equinox Hotel in Manhattan’s Hudson Yards complex. The 29-year-old cryptocurrency billionaire has jetted in from Hong Kong in part to co-host this private party but nonetheless tries to slink to the corner of the room unnoticed.

His standard attire—black hoodie, gray khaki shorts, beat-up New Balances—might be camouflage on the streets below, but in this sea of cufflinks and cocktail dresses he stands out even more than 6-foot-9 Obi Toppin, the New York Knicks power forward who’s mingling with the crowd. It doesn’t take long before Bankman-Fried is mobbed: Can I pitch you something? What do you think about the latest crypto crash? How about a photo for

It’s all part of the job for the richest twenty-something in the world. Bankman-Fried’s cryptocurrency exchange, FTX, which enables traders to buy and sell digital assets such as bitcoin and Ethereum, raised $900 million from the likes of Coinbase Ventures and SoftBank in July at an $18 billion valuation. It handles some 10 percent of the $3.4 trillion face value of derivatives (mostly futures and options) traded by crypto investors each month. FTX pockets 0.02 percent of each of those trades on average, good for around $750 million in nearly risk-free revenue—and $350 million in profit—over the last 12 months. Separately, his trading firm, Alameda Research, booked $1 billion in profit last year making well-timed trades of its own. Lately, Bankman-Fried has been hitting the TV circuit to opine on bitcoin prices, regulations and the future of digital assets.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)