Realty lending fell to five-year low in 2019

The near future looks challenging for an already struggling industry, freshly hit by the halts caused by Covid-19

Image: Ved Prakash/Pacific Press/LightRocket via Getty Images

Image: Ved Prakash/Pacific Press/LightRocket via Getty Images

Ghost towns across the country narrate a tale of sorrow for residential real estate—of stalled projects, a liquidity crunch, investors running away from residential realty, developers even being taken to bankruptcy court by buyers and lenders.

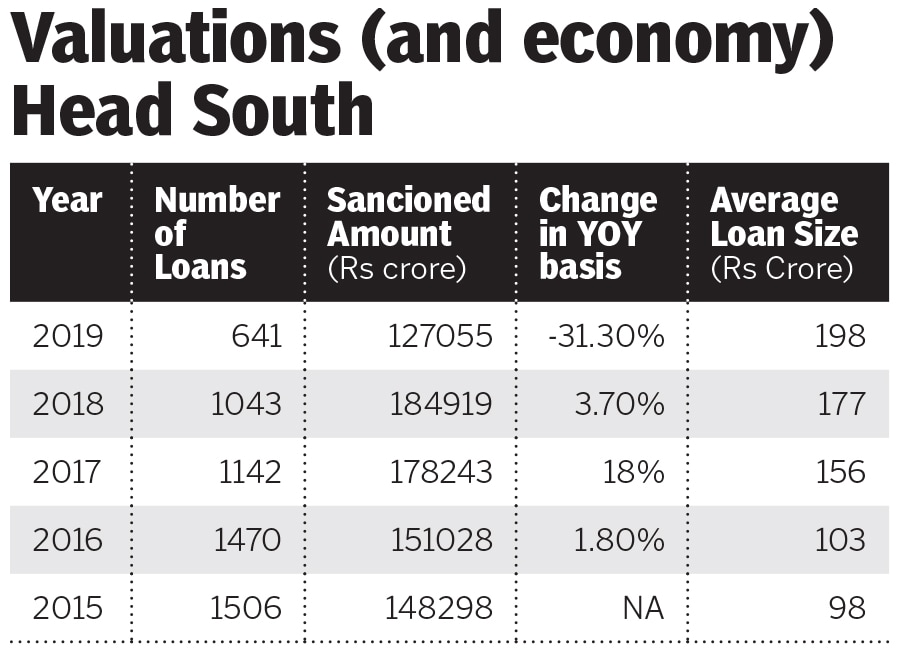

The going has become tougher for developers, as lending shrunk by 31 percent during the 2019 calendar year, shows data compiled by Propstack, a real-estate data platform. With the onslaught of novel coronavirus pandemic, construction has come to a halt, further affecting developers substantially.

In 2019, bank lenders and non-banking financial companies (NBFCs) together lent Rs 1.27 lakh crore to developers, the lowest in five years, whereas lending had been on an upward curve since 2015. (See chart)

A look at the data stack indicates that the number of loans given out to real estate developers have shrunk in size too. In 2015, financial institutions gave out nearly 1,506 loans, with an average ticket size of Rs 98 crore. Since then, with consolidation and a few big players emerging in the ecosystem, the rules of the game have changed. In 2109, financial institutions gave 641 loans with average ticket sizes of nearly Rs 198 crore.