How to restart the manufacturing, MSME sectors

Government intervention will be essential to the reboot of India's most heavily impacted industries

Illustrations: Sameer Pawar

Illustrations: Sameer Pawar

As the clock strikes 8 in the morning, the blare of the hooter is a common feature in factories across industrial townships. But with the nationwide lockdown, the hooter has fallen silent as factories across the country have come to a standstill.

As have the cash flows.

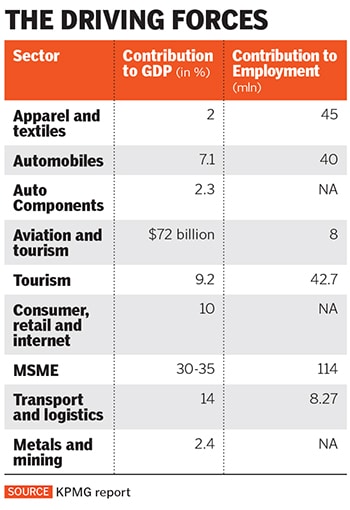

The coronavirus outbreak couldn’t have hit the country at a worse time. India’s GDP decelerated to its lowest in over six years during the third quarter of 2019-20. In January, the International Monetary Fund (IMF) cut its global outlook citing slowing growth and India contributed a lion’s share—80 percent—to the downward revision. Now, the impact of the lockdown is only set to make things worse.

“There is not an iota of doubt that this kind of lockdown will have a profound impact. The ones that are less affected are food, fertiliser, information technology or those in which work can happen from home, but sectors like steel, infrastructure, cement have come to a complete halt,” says Ravi Uppal, chairman and managing director at Steel Infra Solutions Pvt Ltd (SISCOL).

Uppal, who has previously headed companies like ABB India and Larsen & Toubro, now runs five factories around Bhilai, an industrial township in Chattisgarh—known as the Indian steel manufacturing belt. He believes that the cash flow crunch will adversely kickstart a chain reaction.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

.jpg?impolicy=website&width=122&height=70)