Commercial property braces for lease expiries worth Rs 6,000 cr. What happens next?

Indian commercial real estate has been the darling of global private equity investors. But with the novel coronavirus outbreak bringing the economy to its knees, can it still stand tall?

Image: Satvik Shahapur/Gettyimages

Image: Satvik Shahapur/Gettyimages

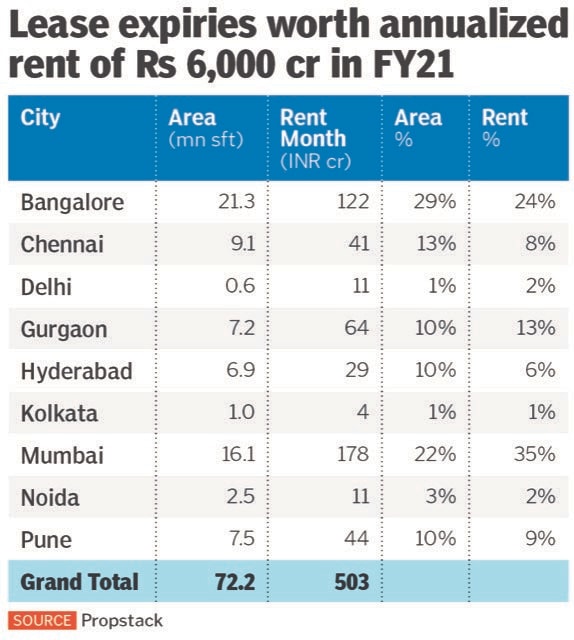

According to real-estate data platform Propstack, commercial office lease expiries worth annualised rent of Rs 6,000 crore (or monthly rent of nearly Rs 500 crore) are coming up in FY21.

“Of the entire amount, nearly 60 percent of the value of the lease expiries are in Bengaluru and Mumbai alone. The industry will be keeping a close watch on how these renewals will pan out as businesses plan to keep a check on costs in the current economic scenario,” says Sandeep Reddy, co-founder of Propstack.

A closer look at the data indicates that this encompasses nearly 72.2 million sq ft, of which Mumbai alone accounts for 16.1 million sq ft with 35 percent of the rent value. Most lease contracts have a tenure of three to five years with an annual rent appreciation clause; some larger information technology and foreign banks lease out for nearly 10 years. Both types of leases are included in this data set. Between 2010 and 2019, nearly 319 million sq ft of office supply has been created in the country.

To put it in context, in a normal year, the Indian office market sees net new absorption of about 33 million sq ft; calendar year 2019 was, in fact, a bumper year for commercial real estate in India, with net absorption at 46.5 million sft, a growth of 40 percent on a year-on-year basis. Traditionally most old leases roll over, but with finances stretched across companies, lease renewals are now expected to see downward revision of rentals.