Billionaire fastlane

In 2009, the cut-off to enter the Rich List was $400 million. In 2018, it is $1.48 billion

How do entrepreneurs become superrich? One, and easily the more virtuous way, is via technology and globalisation. Economist Caroline Freund, in her book Rich People Poor Countries (2016), throws light on the “superstar” theory, which argues that new technologies allow people to communicate more easily, “enhancing returns to scale, while globalisation provides a nearly unlimited audience”. Great examples of such superstars in India are Azim Premji (the second-richest Indian) and Shiv Nadar (No 6).

An easier way to wealth is inheritance. French economist Thomas Piketty had argued that because capital earns higher returns than labour, the inheritors continue to get richer. That, however, may not always be the case. The Indian corporate landscape is littered with old-money-fuelled family enterprises that have fallen by the wayside as competition and innovation increased. Conversely, century-old family-run conglomerates continue to thrive (Godrej family, at No 7 on the India Rich List and the Burman family at No 13) by diversifying into sunrise areas and growing inorganically. Yet, increasingly, growth becomes more challenging, and often radical changes in business models are the call of the hour.

To view the full India's 100 Richest 2018 list, click here

A less virtuous path to extreme prosperity is what academics term the “extraction of rent”. Here, government interventions like privatisation and regulation, and rising asset prices allow for a larger share of rents to accrue to a small group of capital owners without a corresponding rise in efficiency of the allocation of that capital. A glance through the Forbes India Rich Lists over the past decade gives a few pointers to those who benefited this way. The infrastructure sector, for instance, was conspicuous in the earlier lists. By now, many of these entrepreneurs have crashed out, snowballed by debt piled up to build power stations, roads and highways.

The good news, though, is that the billionaire list keeps getting longer. This also means the cut-off to enter the top 100 keeps rising; for instance, in 2009, $400 million was adequate to guarantee a place on the Forbes India Rich List. The figure in 2018: $1.48 billion. For more of such fascinating insights, don’t miss the four pages of infographics put together by Forbes India’s Ruchika Shah.

Consistent performers on the Rich List are largely of two types: One, those who’ve built world-class businesses that have a strong consumer connect—almost a third of the 100 on the Rich List are such companies (and that makes sense in an economy in which private consumption accounts for almost 55 percent of GDP); the rich list is also choc-a-bloc with entrepreneurs at the vanguard of innovative tech and pharma enterprises—nearly every fifth billionaire in the top 50 derives wealth from pharmaceuticals.

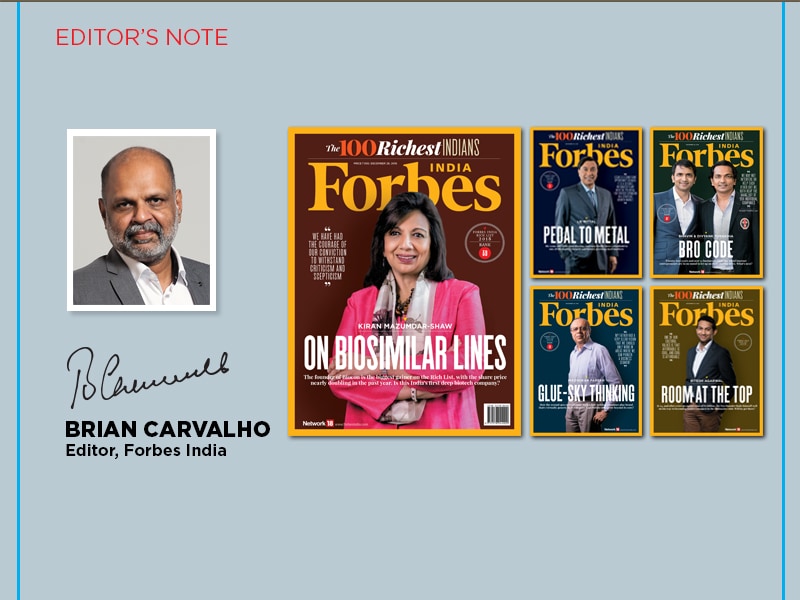

And the biggest gainer of 2018 is first-generation entrepreneur Kiran Mazumdar-Shaw, with the company she founded, Biocon, earning its spurs as a credible developer of differentiated biopharmaceuticals. Forbes India’s Harichandan Arakali has more on the Biocon gambit.

Among the new-age internet companies, the Turakhia brothers, Bhavin and Divyank, are the youngest billionaires (at 38 and 36) on the 2018 list. They’re on it for the second time, after debuting in 2016. Eyeing the billionaire club is Ritesh Agarwal, founder of what’s now morphed into a full-fledged international hotel chain, Oyo. Can he get there? Read Neeraj Gangal’s take for answers.

Best,

Brian Carvalho

Editor, Forbes India

Email:Brian.Carvalho@nw18.com

Twitter id:@Brianc_Ed

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)