India's fintech sector is a heady concoction of potential and peril

If you had to bet on one startup sector from which will emerge a thriving global business model, chances are you'd put your money on fintech. The flipside? If you had to pick one startup sector that urgently requires to get its compliance act together, it would be fintech

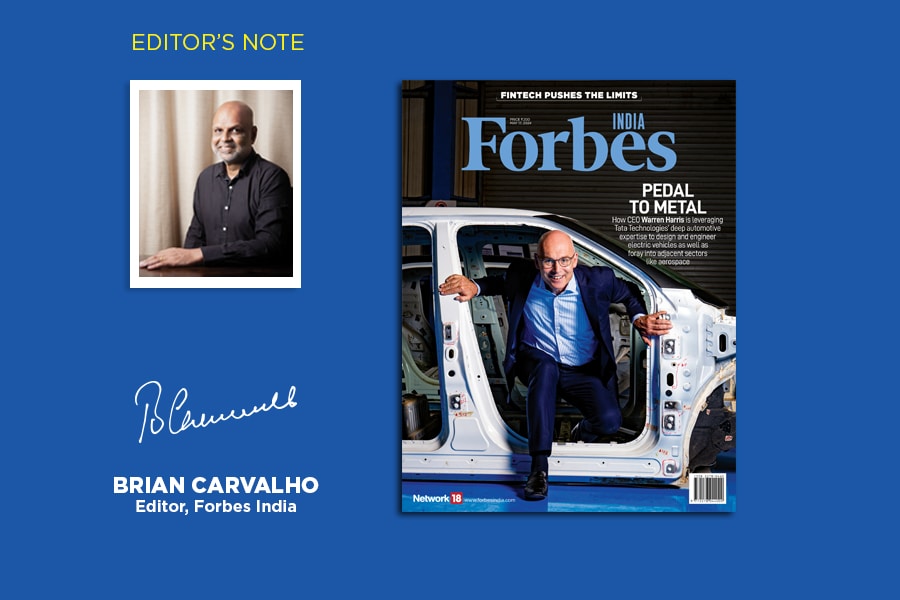

(From right) Warren Harris, CEO & managing director, Tata Technologies; fintechs of the future will continue to assist financial institutions to lend faster and better

(From right) Warren Harris, CEO & managing director, Tata Technologies; fintechs of the future will continue to assist financial institutions to lend faster and better

If you had to bet on one startup sector from which will emerge a thriving global business model, chances are you’d put your money on fintech. The flipside? If you had to pick one startup sector that urgently requires to get its compliance act together, it would be fintech.

Let’s start with the promise. In 2023, global research firm Statista ranked India third among countries with the most fintech unicorns (17), behind the United States (134) and the United Kingdom (27). Companies like Zerodha, Razorpay, and Billdesk, along with their valuations of well over a billion dollars, are growing rapidly and are also profitable.

Such startups, in areas from mobile payments and online gateways to lending and broking, are generously backed by venture capital. Statista data suggests that of the total funding of roughly $10 billion in Indian startups, fintechs received close to a third.

Data from research firm Tracxn shows fintech funding declined in 2023 over the previous couple of years, but the funding winter—across startups—may be showing signs of thawing. Funding was up by almost 60 percent in the January-March quarter of 2024, to $551 million, over the previous year’s Q1. This may well set the stage for a whole new set of fintech unicorns.

If there’s one smear on an otherwise sunny picture, it’s an apparent lack of statutory and regulatory compliance, transparency and consumer protection. At least that’s how the regulator, the Reserve Bank of India (RBI), sees it.