Mutual Funds Attracting Big Money from Retail Investors

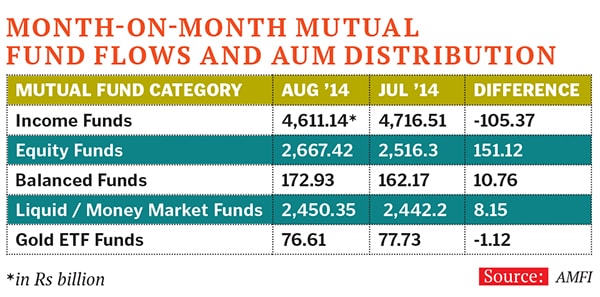

As India’s stock markets soar to record highs, retail investors continue to pump in big money into mutual funds. Within mutual funds, balanced funds—besides equities—have seen strong monthly inflows, rising by 6.64 percent or Rs 10.76 billion to Rs 172.93 billion in August compared to July. This is the highest since January 2008.

A report from ratings agency Crisil shows that assets under management (AUM) of all mutual funds rose to a record high of Rs 10.13 trillion in August. The figure edged past the previous peak of Rs 10.11 trillion in May, according to data from the Association of Mutual Funds in India (AMFI).

Fund managers are confident that the trend will continue despite record stock prices.

“We may not be in a cheap zone anymore, but we are not in a bubble. From a valuation perspective, we are trading at 15x on year forward earnings,” says Yogesh Bhatt, senior fund manager with ICICI Prudential AMC. “Financial savings are at a 15-year-low of 8 percent of GDP compared to 11 percent in 2008. So, flows are coming back into the markets and mutual funds,” he says.

Balanced or hybrid, funds are viewed as “low-risk” products, which first-time or conservative investors are keen to put money into. Also, these funds are attractive because they have outstripped returns from fixed deposits by over 60 percent on an annual basis, Bhatt says.

“Balanced funds are finding takers as they invest into the rapidly accelerating mid-cap stocks,” says a fund manager with a state-run bank. “Also some balanced ‘flexi’ funds have been investing well above an expected 65 percent in equities, going up to 70-80 percent, which investors find attractive.”

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)