Cover story: Salil Parekh's biggest challenge, up ahead

On CEO Salil Parekh's watch, Infosys is looking to cash in on the post-pandemic push for digital transformation. Can he ensure that the company stays the course?

Salil Parekh

Salil ParekhImage: Courtesy Infosys

In July, Infosys announced it had won a large contract with Vanguard, a Pennsylvania-based financial services company. As part of the contract, about 1,300 Vanguard staff would be moving to Infosys in the US to become the Bengaluru-headquartered IT services company’s employees. A senior Vanguard executive would also move to head Infosys’s Mid-Atlantic Retirement Services Center of Excellence and serve as the company’s chief client officer.

While Infosys didn’t disclose financial details, the deal was reported by The Times of India to be worth $1.5 billion, citing sources close to the development. “It’s the biggest contract in the history of Infosys,” COO Pravin Rao tells Forbes India, while declining to comment on the value.

Six years after the founders of the company relinquished control of Infosys to professional management, the IT company, which helped put India on the global map, seems to have everything going for it. Even the global Covid-19 pandemic could eventually provide a tailwind to the company as its biggest customers get back to spending more on technology, reshaping their own businesses for the post-pandemic world.

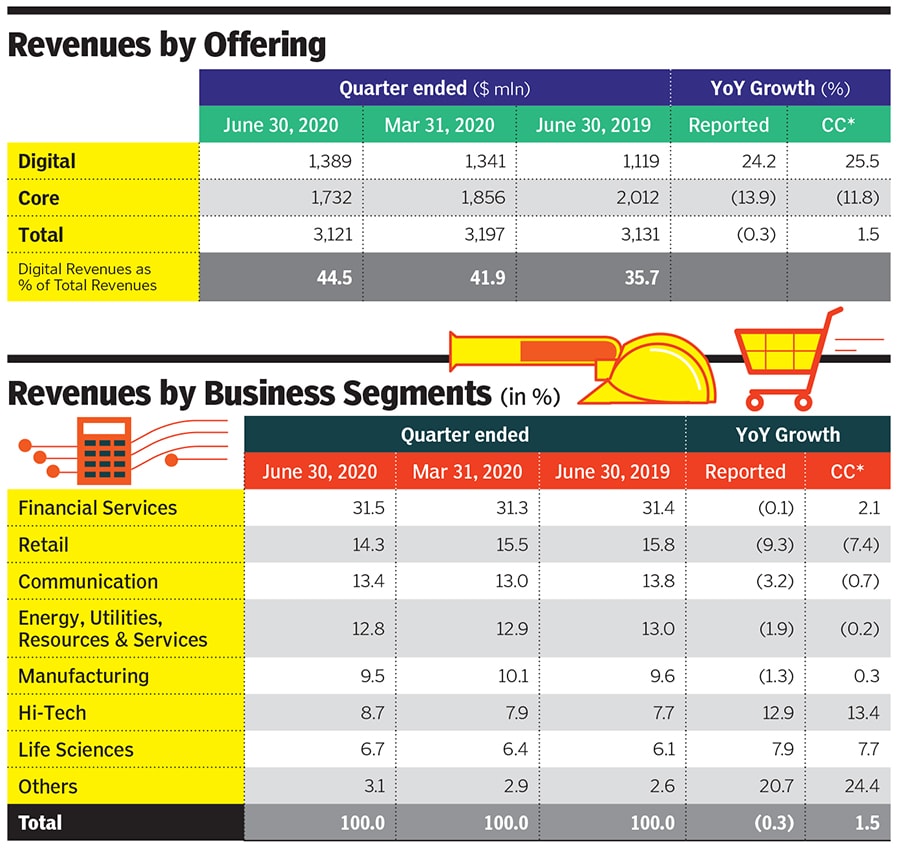

By building new capabilities in digital technologies, cloud computing, automation and AI, Infosys has sought to stay relevant as a technology provider to some of the biggest companies in the world in retail, pharma, manufacturing, telco, hi-tech, utilities, and of course financial services, its biggest vertical. Its efforts—on CEO Salil Parekh’s watch—seem to be paying off as it has won ever larger contracts. And the share of revenues from digital technology services as a proportion of the total has almost doubled in the last two years to 45 percent. Ensuring the company can stay the course is Parekh’s biggest challenge.

“I think, where we are today and among the things that we have focussed most on, the first is client relevance. That really is all about building out capabilities and looking at where our clients are going,” says Parekh. “And today, and over the last couple of years, it has been essentially digital capabilities, cloud capabilities, then focus on automation and AI.”

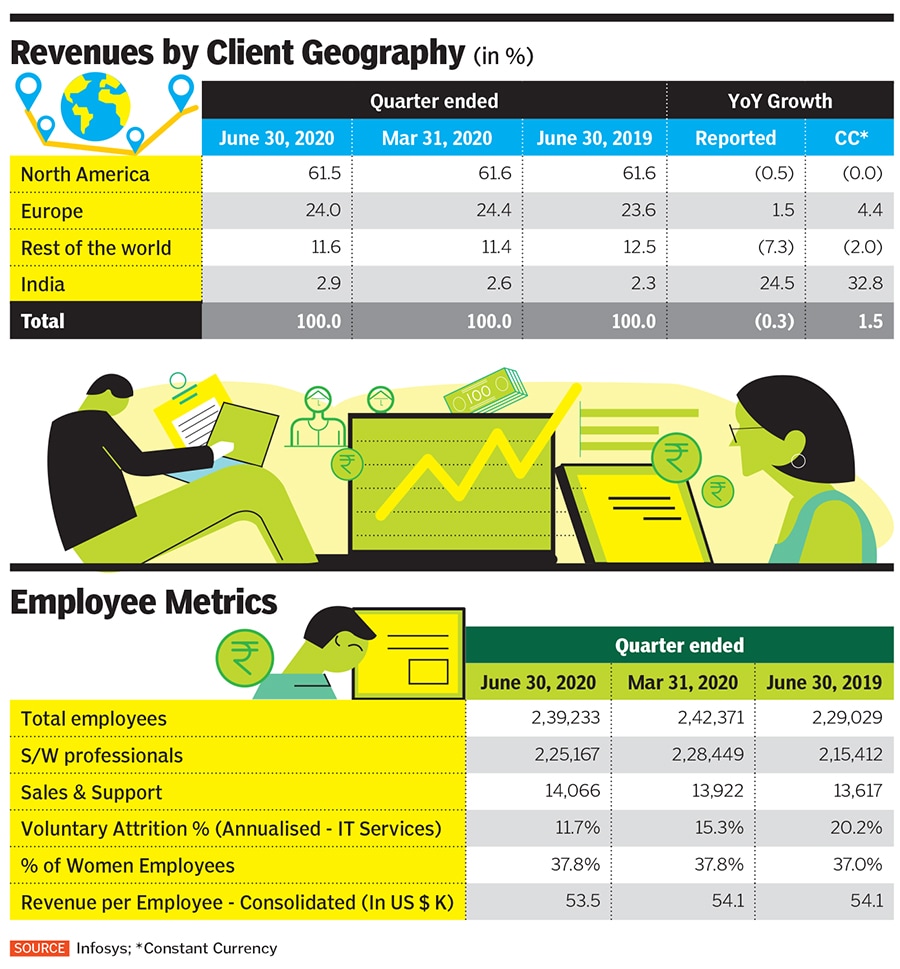

The second has been people-centricity, and the company historically has been one of the most focussed on employees, with its world-class training centre in Mysuru, for example, a couple of hours’ drive south of Bengaluru. Over the last couple of years, reskilling programmes were stepped up, and when the pandemic hit, Infosys was able to get 99 percent of its workforce to work from home and still deliver the services needed by its clients.

“We created skill tags,” says Krish Shankar, the group head for HR. Employees could undergo training in specific in-demand skills and acquire these tags. And after a further six-month period, working on those skills and related projects, they got to switch to positions open where those skills were needed, often with salary increases.

Infosys also created a “power programme” to hire fresh graduates from premier institutes and such recruits were offered twice the entry-level salary of regular recruits, who came from second-tier institutions. These ‘power’ recruits were often targeted to rise along tracks that required both tech and management skills.

A third area of focus is teamwork, which is about bringing every one of the company’s 240,000 staff together and having the leadership aligned and united towards a common purpose. Finally, “the real strength” that’s been with Infosys for years has been its delivery excellence, which held the company in good stead as it reacted swiftly to the pandemic, Parekh says. These four areas have remained constant and if anything, the mandate has been to sharpen the focus on them from the time he took over, the CEO says.

And that is just as well, because the opportunity the IT industry faces is massive in digital services alone. “It’s the biggest play”, according to Parekh, and worth some $250 billion as a market, growing at about 15 percent. The Vanguard deal, for example, is all about the digital transformation of the US company’s IT systems.

Parekh declined to provide any additional details about the Vanguard contract, but offered some examples of opportunities in other verticals. “I think the fundamental issues that most clients, large enterprises have is how do you take their spend which is concentrated on their core IT infrastructure, and make that more available for digital transformation.” For a consumer products company, it would be about what distribution mechanism they can use exploiting ecommerce.

At a utilities company, how do they have their customers more connected through the fluctuations they see within their business? Infosys’s role will be to use automation and AI, apply those to the core IT systems of its clients, and boost efficiency. The savings generated thus can then be ploughed into new digital applications to connect with end users—offering convenience and helping consumers solve their own problems, using their own smartphones.

A pharmaceuticals company discussed an IT overhaul with Infosys some weeks ago. In a video chat with Parekh, one of the executives said: “We have a programme to drive change in digital over the next 24 months. Can we accelerate it, can we go faster?” These sorts of discussions are taking place across many sectors—retail, utilities, pharma, banking, and literally in every industry vertical.

In the April-June quarter, Infosys was selected by GlobalFoundries (GF), the world’s leading specialty foundry, as its partner for its digital transformation programme. Infosys will provide analytical solutions to optimise the overall efficiency and agility of GF’s manufacturing and business operations.

FE Credit, a subsidiary of VP Bank, the market leader in consumer lending in Vietnam, upgraded its Finacle Digital Banking solution suite to the latest version and migrated it from an on-premises deployment to a Software-as-a-Service (SaaS) model. Finacle’s cloud-native, micro-services-based digital banking solution suite will run on the AWS cloud. A large consumer packaged goods company selected Infosys to provide end-to-end support for enabling integrated operations across applications, infrastructure and cybersecurity.

“As an essential supplier to many of the world’s largest corporations, Infosys demonstrates its relevance on a daily basis,” says Peter Bendor-Samuel, founder of Everest Group, which advises large US corporations on their business tech strategies. This could be clearly seen during the Covid-19 crisis, where despite having to move all its employees to work from home, Infosys kept their critical systems up and running while assisting their customers to function as seamlessly from home.

Over the last three years, Infosys has doubled down on providing transformational services to its clients and has emerged as the go-to partner for many of its clients for their digital transformation initiatives, Bendor-Samuel adds.

“Parekh has brought stability to Infosys and more disciplined approaches to selling. He’s also been able to tap into his extensive experience to create new types of innovative deals and models with clients,” says Ray Wang, principal analyst and founder of Constellation Research in the US. “He’s been mostly understated in public, focussed on delivery and execution of the team. There’s been good progress and a focus on the fundamentals.”

The biggest opportunity for Infosys is the emerging market for modernisation that carries large transaction sizes. Clients have been moving slowly to upgrade their IT and business process functions, and now find they have the confidence to dramatically improve them through the use of digital technologies. If Infosys is going to maintain its leading position it must do well in this market, he says.

“Our pipeline is pretty strong,” says COO Rao. The company has usually made public its large-contract pipeline by quantifying the total contract value of these deals won in each quarter. Infosys defines large deals as those with TCV (total contract value) of $50 million or more and these are typically over two to three years. “In Q1, the large deal win was a healthy $1.74 billion. And in FY20, the total TCV of large deals was 3x the TCV of large deals in FY18,” Rao says.

“The pipeline continues to be very healthy and it’s across geographies and industry segments. In fact, early this quarter, we announced the largest deal in Infosys’s history, with Vanguard,” he says. By their very nature, large deals involve not only taking over client operations—day-to-day running of their tech operations—but also transforming them into cloud and digital platforms.

There is always a proportion of digital in these contracts because there is an element of transformation, so from that perspective “we expect the share of digital to continue to accelerate,” Rao says.

Infosys has to become a company that can bring a large variety of disciplines and approaches to solve its clients’ problems. For example, it has made “several acquisitions” and investments to build ‘digital studios’ in Europe and the US, Parekh says. These studios bring together design, user experience and human-centred experiences. Clients are now looking for those capabilities to be combined with deep engineering and technology capabilities. In the latest of such acquisitions, in early September, Infosys said in a press release that it will acquire Kaleidoscope Innovation, a Cincinnati-based product design and development firm that specialises in the areas of medical devices, consumer products and industrial gear.

Infosys’s own experience in getting 99 percent of its staff to work from home in a matter of weeks has also earned it a vote of confidence from its clients. “They’re starting to see us as someone who can work with them more closely in these different environments. And that’s a benefit as we go ahead,” says Parekh.

In addition to the focus on digital technologies, Infosys has now launched its cloud computing initiative called Cobalt. That’s going to expand even faster, Parekh says. There will be more programmes centred around platforms. There will be more changes in technology and Infosys will start to look to how that is affecting its client discussions. The most critical element for the future is to continue to stay relevant.

While Parekh focuses on getting 240,000 people to move as one towards the common purpose of helping clients, there are multiple factors that could also become potential headwinds. The first is that the company’s biggest market, the US, has become less welcoming to engineers with visas such as the H-1B, until recently the mainstay of the outsourcing industry.

Infosys, and other large Indian IT services companies, anticipated some of this. And the shift in their work towards digital also needed more local hiring. Infosys has hired 13,000 locals in the US since it said in May 2017 that it would build multiple centres of excellence and recruit more locals. On September 1, Infosys said in a press release that it plans to hire another 12,000 American workers over the next two years.

The second is that the top Indian IT companies have seen more lawsuits that accused the companies of being racially biased in their recruitment policies and how they treated staff.

“On this front, I think Infosys and the rest of the Indian service providers are in a tough place,” says Everest Group’s Bendor-Samuel. There is no doubt they have come a long way in addressing the types of issues raised in these lawsuits, however, as Indian firms with little diversity, particularly in their senior management, they are vulnerable in the increasingly difficult climate in the US and EU. “I expect more of these lawsuits to emerge over the next few years. I do not expect they will damage the large service providers though. They may have to spend time defending themselves and may have to reach settlements in some cases, but life will go on.”

Wang says the lawsuits “should not be an issue”. Great companies focus on meritocracy and hard work, they create inclusive environments based on the best talent. While it’s also important to have diverse pools of talent, he says, “you wouldn’t want quota-based hiring for airline pilots or surgeons and not have the talent. This is why these suits based on identity politics are dangerous.”

The third potential headwind is Infosys’s own policies aimed at building transparency and model corporate governance. The whistleblower policy, in particular, has been used to bring accusations of wrongdoing at the very top. It even cost the company its first professional CEO, Vishal Sikka, after a fractious year-long fight with Infosys founder NR Narayana Murthy. The founder had accused Sikka and his board of sweeping under the rug allegations brought by an anonymous whistleblower over payments to the then CFO.

“Infosys’s biggest weakness is its internal conflicts which blow up and distract it from its clients,” Bendor-Samuel says. For it to prosper, it must stay focussed on its customers and avoid the internal warfare which seems to be simmering. To Parekh’s credit, he has kept these to a minimum but they still persist.

Sikka’s departure brought back co-founder Nandan Nilekani as non-executive chairman, who eventually named Parekh, a former Capgemeni executive, as the new CEO. Parekh, who took over in January 2018, wasn’t spared either. A so-called whistleblower group alleged last year he had fudged numbers related to large contracts. An internal audit committee investigation found no wrongdoing, as did an investigation by the US SEC.

In the meantime, Parekh’s focus is clearly on winning more Vanguard-style contracts, and to ensure Infosys’s employees have the skills and the tools to deliver on them. “Now the challenge in my mind is to make sure we keep our attention on the execution, focussed on our clients, and on our people that are making sure all of this is possible,” he says.