Fiscal deficit: Will the gap remain higher for longer?

India has thus far remained a bright spot in the global economy but worries for India include core inflation remaining entrenched at 6 percent, pressure on fiscal deficit, and high current account deficit

In such times of financial tightening and record-high levels of inflation, amid rising geopolitical uncertainty, India is being seen as a bright spot and the fastest growing major economy. It is against this backdrop that Minister of Finance Nirmala Sitharaman will roll out Budget 2023

Photo Illustration: Chaitanya Dinesh Surpur

In such times of financial tightening and record-high levels of inflation, amid rising geopolitical uncertainty, India is being seen as a bright spot and the fastest growing major economy. It is against this backdrop that Minister of Finance Nirmala Sitharaman will roll out Budget 2023

Photo Illustration: Chaitanya Dinesh Surpur

India stands at an interesting juncture of threats and opportunities in a volatile global economy, which is grappling with the challenges of a slowdown in one-third of the world. In such times of financial tightening and record-high levels of inflation, amid rising geopolitical uncertainty, India is being seen as a bright spot and the fastest growing major economy. It is against this backdrop that Minister of Finance Nirmala Sitharaman will roll out Budget 2023.

The past one year has seen the domestic economy perform relatively better in comparison to global peers. So far it has been fairly resilient to global headwinds but, of course, it has not been unaffected by the storm: The rupee declined nearly 10 percent against the US dollar in CY22, the repo rate rose by 2.25 percent to 6.25 percent in the previous calendar year, and retail inflation averaged above the Reserve Bank of India’s (RBI) comfort level at 6.2 percent.

The rising cost of oil (mainly in the first half of CY22) and capital adversely impacted India’s current account deficit, which widened to a nine-year high of 4.4 percent in the September-ended quarter.

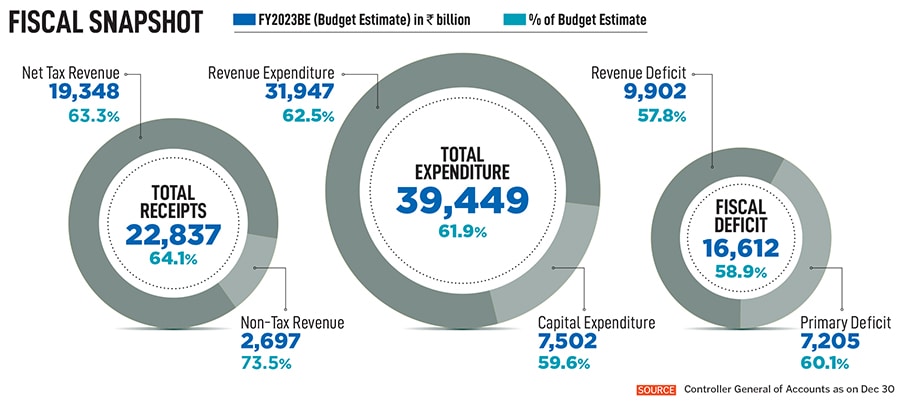

Dhiraj Relli, MD and CEO, HDFC Securities, says, “Worries for India include core inflation remaining entrenched at 6 percent, pressure on fiscal deficit due to MNREGA spend, subsidies, and high current account deficit.”

Relli believes the fiscal deficit is unlikely to return to prudent levels after the Covid breach. In response to the unprecedented coronavirus pandemic, the government had raised its FY22 fiscal deficit target to 6.9 percent from 3 percent. The actual fiscal deficit stood at 6.7 percent for the same period. In focus is the country’s roadmap for fiscal consolidation as it tries to narrow the shortfall and attain its target of 4.5 percent in FY26.