Pansari: From a humble kirana store to a Rs 1,000-crore brand

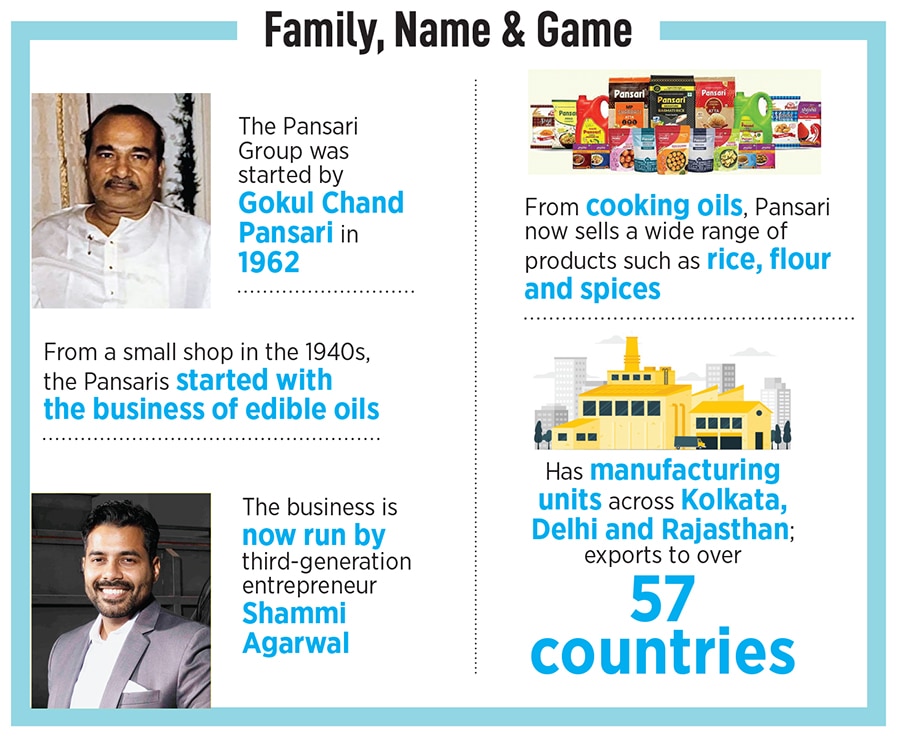

Starting as a grocery shop in Rajasthan, the third generation of the Agarwals is now doing its bit to modernise the brand

(left) Shammi Agarwal, Director, Pansari Group and Kamal Agarwal, Chairman, Pansari Group

Image: Amit Verma

(left) Shammi Agarwal, Director, Pansari Group and Kamal Agarwal, Chairman, Pansari Group

Image: Amit Verma

2011, New Delhi. Shammi Agarwal found himself on slippery ground. The third-generation entrepreneur, who joined the family business of bulk trading and retailing of mustard oil in 2011, was making a serious pitch to push the Pansari Group into branded play. “Tum log tel becho, brand nahin bech paaoge (you guys sell oil, you won’t be able to sell brand),” was the initial pushback from big retailers in Delhi-NCR. The 25-year-old had rolled out the Pansari-branded mustard oil and expected a decent traction if not an outright blockbuster. And why shouldn’t he? He was coming from a family business, which traced its roots to 1940s when his grandfather opened a small grocery store in Poata, Rajasthan. The shop was named ‘Pansari ki dukaan’.

Over the next few years, the Agarwals grew their clout. Shammi’s grandfather shifted to Kolkata in the 1960s, and gradually dabbled into the business of wholesale trading of mustard and sesame seeds. In the early 80s, the family had a huge financial setback when its sesame seed business collapsed. Excessive rains damaged the crop, supply tumbled thereafter and the family realised the risk of trading in seeds. From seeds, they moved onto the business of edible oil. Shammi’s father Kamal relocated to Delhi, took a factory on rent and started manufacturing mustard oil. There was still no brand as the B2B business focussed on wholesale trading and contract manufacturing.

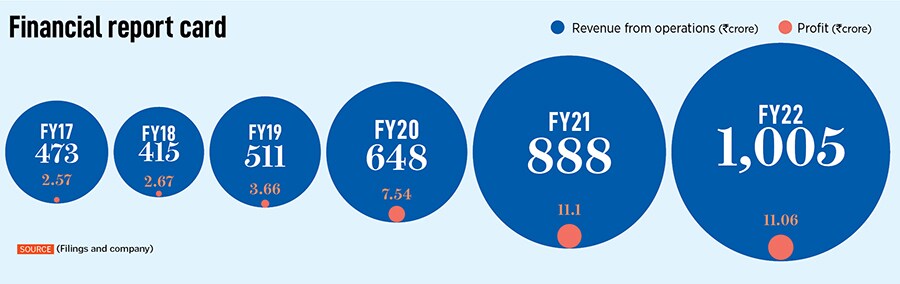

Back in 2011, Shammi was going B2C. The young man ticked all the boxes before taking the plunge. He had the financial muscle, possessed the retail clout, and had grand plans to make a dent in the mustard oil market. The group had clocked ₹180 crore in revenue in FY11, and the family backed the move. The response from traders, though, was negative. “Kaisa brand naam hai (what kind of a brand name is this)?” was the feedback. In a market dominated by biggies such as Fortune, Shammi’s Pansari didn’t stand any chance. However, he persisted with his efforts. The production was ramped up, the brand reached out to small retailers who were not entertained by the big brands and the sales team was beefed up to connect with thousands of kiranas across the state.

There was success. Sales increased, reach widened and the young entrepreneur saw room for a wider play. Soon, however, the business of oil slipped into turmoil. Though sales picked up, Shammi forgot he was playing a credit game. Lots of traders, big and small, took supplies and didn’t pay. Then there was a problem within the sales team. Some of the officials collected money from the market and disappeared. The company had to take a hit of over a crore.

There was success. Sales increased, reach widened and the young entrepreneur saw room for a wider play. Soon, however, the business of oil slipped into turmoil. Though sales picked up, Shammi forgot he was playing a credit game. Lots of traders, big and small, took supplies and didn’t pay. Then there was a problem within the sales team. Some of the officials collected money from the market and disappeared. The company had to take a hit of over a crore.

Swords were out in the family, and outside. Shammi was criticised for his costly blunder, and there was a strong voice favouring sticking to the core business of B2B. The senior management, though, supported the young lad. “Don’t worry about the losses. Stay focussed and keep trying,” was the message from his father. His uncle, too, encouraged him to keep the risk appetite intact. “There are no failures. It’s always learning,” he said.