How Prasad Chalavadi's 'saree with software' business has gone the extra yard

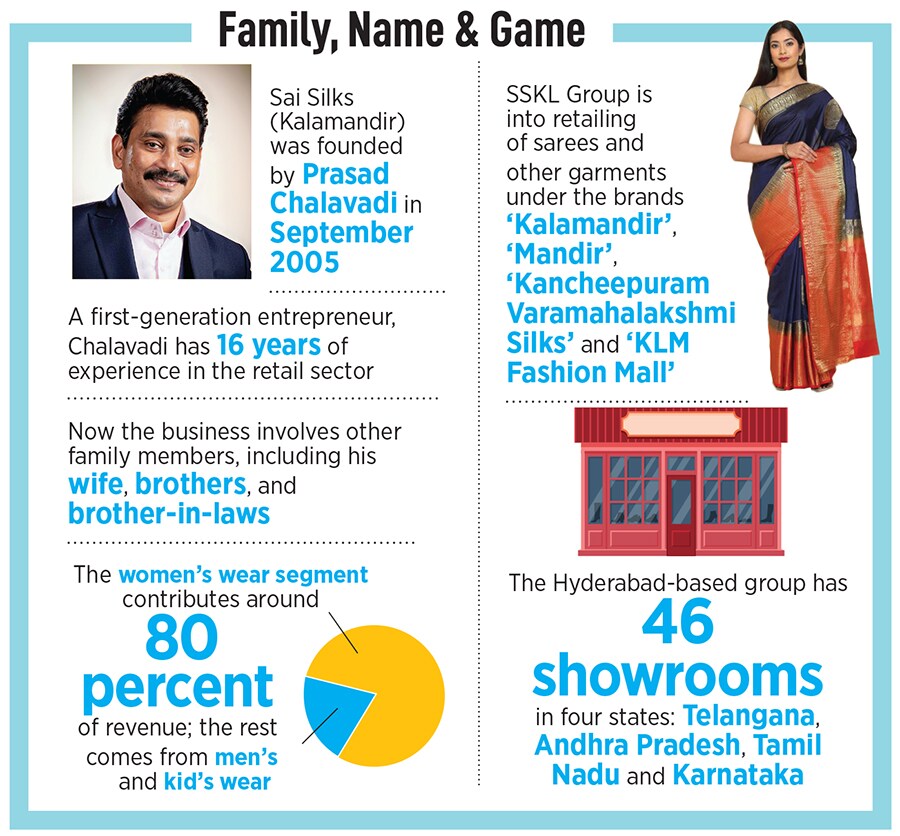

Chalavadi has built Sai Silks (Kalamandir) into a formidable brand across South India, with 46 showrooms in four states: Telangana, Andhra Pradesh, Tamil Nadu and Karnataka. Now his love for the six yards is taking him to the IPO market

Team Sai Silks (Kalamandir), from left: Durgarao Chalavadi, whole-time director, head operations (Karnataka); Kalyan Srinivasa Annam, whole-time director & head of advertisement projects; Venkata Rajesh Annam, senior VP-operations (Andhra Pradesh); RB Bharadwaj, senior VP-IT & ecommerce; Mohan Chalavadi, senior VP-operations (Telangana); Jhansi Rani (seated), head-retail; Annam Subash, head of sourcing; Prasad Chalavadi, founder & managing director Image: Vikas Chandra Pureti for Forbes India

Team Sai Silks (Kalamandir), from left: Durgarao Chalavadi, whole-time director, head operations (Karnataka); Kalyan Srinivasa Annam, whole-time director & head of advertisement projects; Venkata Rajesh Annam, senior VP-operations (Andhra Pradesh); RB Bharadwaj, senior VP-IT & ecommerce; Mohan Chalavadi, senior VP-operations (Telangana); Jhansi Rani (seated), head-retail; Annam Subash, head of sourcing; Prasad Chalavadi, founder & managing director Image: Vikas Chandra Pureti for Forbes India

October 2005, Hyderabad. Prasad Chalavadi starts the show with a request. “If you want to see the magic, then please follow the instructions,” says the man from Vijayawada. An excited bunch of around dozen young women and men—including a few employees in a 3,213 square feet outlet where the show was being organised—stayed glued to the gestures of the 37-year-old, and nodded their head in approval. Chalavadi came from a family business of spices, went to Dubai and the US after finishing his college and MBA, armed himself with software programming courses, and worked with an IT firm for a few years. He then came back to India in 2003 and hosted his maiden show two years later.

The show starts, and spectators get the first direction. The lower button of the blouse, says Chalavadi, must not be too tight or loose. Ditto for the petticoat. “If it’s too tight, it disallows tucking and if too loose, it might prevent pleat spillage,” he instructs. Now the second step. “Start draping the end of the saree,” he says. “It should be tucked in at the right side of the waist covering only three-fourth.”

After a few more steps, Chalavadi pauses and scans the reactions of the onlookers. He then gets into the penultimate act with a few more dos and don’ts. First, ensure that the saree doesn’t entangle with the petticoat. Second, use pins to tie, but don’t use too many as the fabric gets spoilt. Lastly, walk a few steps to get a feel of the saree. “Be confident. Magic happens when confidence seamlessly merges with the saree,” he says. The crowd applauds and disperses, a few consumers walk in to buy sarees from the ‘Kalamandir’ store, and Chalavadi, who founded Sai Silks (Kalamandir) in 2005, calls his store manager after finishing his demonstration. “It’s only when you go through the extra yard, you get six yards of love, beauty and grace,” he says.

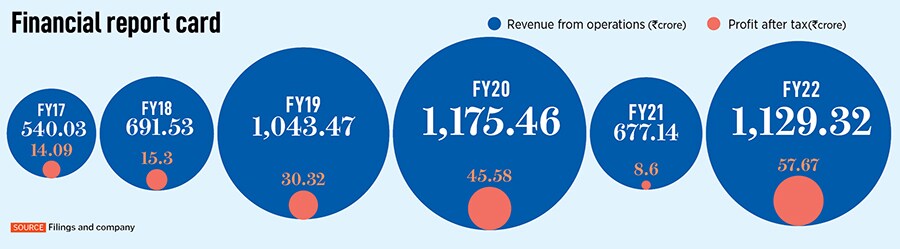

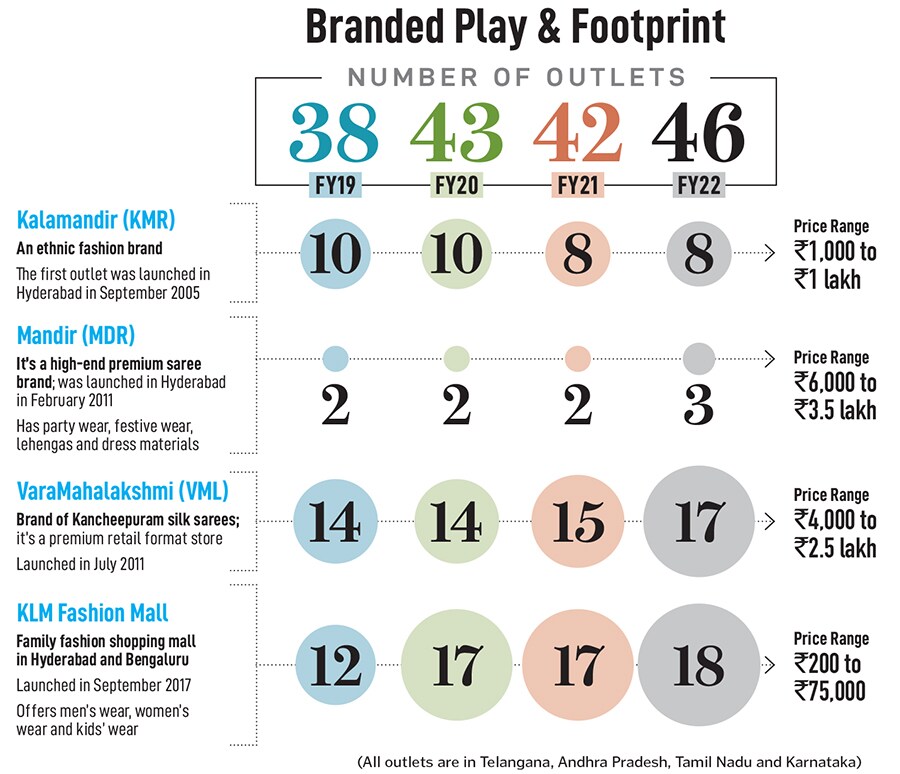

Fast forward to July 2022. Chalavadi is getting ready to see how far his love for the six yards can take him. Sai Silks (Kalamandir), which closed FY22 with an operating revenue and profit after tax of ₹1,129.32 crore and ₹57.67 crore respectively, has filed the draft red herring prospectus (DHRP) for an initial public offering (IPO) of around ₹1,200 crore. The move makes Sai Silks (Kalamandir) the first saree retailer in India to go public. The company, which operates under four brands—Kalamandir, Mandir, VaraMahalakshmi and KLM Fashion Mall—gets over 65 percent of the revenue from sarees. It has 46 outlets across Telangana, Andhra Pradesh, Tamil Nadu and Karnataka, and has played its cards well to cater to every segment of the society.

Then there is the ethnic silk sarees brand VaraMahalakshmi, which is meant for festivals, weddings and occasional wear, and has a price range of ₹4,000 to ₹2.5 lakh. And the fourth and the youngest ‘pleat’ is KLM. Started in 2017, it’s a value-fashion brand for the family. “It is for the masses,” says Chalavadi, founder and managing director of Sai Silks (Kalamandir).

Then there is the ethnic silk sarees brand VaraMahalakshmi, which is meant for festivals, weddings and occasional wear, and has a price range of ₹4,000 to ₹2.5 lakh. And the fourth and the youngest ‘pleat’ is KLM. Started in 2017, it’s a value-fashion brand for the family. “It is for the masses,” says Chalavadi, founder and managing director of Sai Silks (Kalamandir).