How Ranjan Pai is striving to make Manipal Hospitals India's biggest health care player

Pai is strengthening Manipal Hospitals' presence across the country with a string of acquisitions, with eyes on becoming a market leader and taking his venture public to power the next phase of growth

Dr. Ranjan Pai is the Chairman of the Manipal Education and Medical Group Image: Nishant Ratnakar for Forbes India

Dr. Ranjan Pai is the Chairman of the Manipal Education and Medical Group Image: Nishant Ratnakar for Forbes India

Ranjan Pai is in a hurry, even though he likes to say otherwise. In a year when India’s overburdened health care ecosystem had been stretched thin, Pai, the canny businessman and grandson of the illustrious Tonse Madhava Ananth Pai, founder of Manipal Hospitals, has been busy fortifying plans to take his family’s crown jewel on a rather ambitious journey. And at the centre of it lies a penchant for acquisitions.

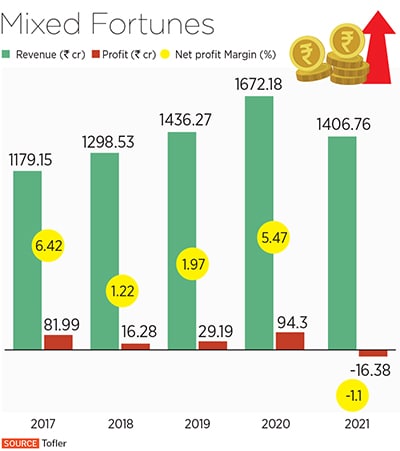

In just one year, Pai’s Manipal Health Enterprises Private Limited (MHEPL) has completed the acquisition of two hospital groups and is in the middle of closing another one, worth a combined ₹4,000 crore, at a time when numerous hospitals across India have shut down due to the financial turmoil caused by Covid-19.

It all started with the acquisition of Bengaluru-based Columbia Asia hospitals last April for ₹2,100 crore which gave the group an additional 1,300 beds across 11 hospitals. That was followed by the acquisition of Bengaluru-based Vikram Hospital for ₹350 crore, adding another 200 beds. Set up in 2009, Vikram Hospital is a high-end tertiary care facility located in the central business district of Bengaluru and focuses on cardiac and neuro sciences.

Now, Manipal is in the midst of advanced talks with Kolkata-based AMRI Hospitals, owned by the Emami Group, to purchase four hospitals in an attempt to build its presence in the eastern region. The deal adds another 1,200 beds to Manipal’s current capacity, taking the total number of beds to nearly 8,700. The deal will also make Manipal the largest hospital group in eastern India and puts it within striking distance of India’s largest hospital chain, Apollo Hospitals, though Pai says he isn’t in it for the numbers game. Apollo Hospitals currently has 71 hospitals across the country with some 12,000 beds.

“No, no, I don’t think there is a hurry,” laughs Pai. “I think it’s years of hard work that’s finally culminating with these deals. But it’s been a good four to five years. While you can acquire assets, the more difficult part is integrating them with the cultural fit, and I think our acquisitions have been integrated very well.”

“This is a big country, and I don’t think anybody can technically be a pan-India player,” Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider.”

“This is a big country, and I don’t think anybody can technically be a pan-India player,” Pai says. “We are in 15 cities today and we’ll go deeper into those cities. We may add another five or six cities and go into cities that are underserved. From our perspective, it’s not about saying that ‘I want to be the largest player or the biggest player’. And we may get there. But the bigger challenge for us will be, can we do a good job in the markets that we operate in and be the preferred health care provider.”