'I Have Been a Lifer Here'

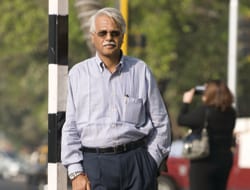

Deepak Satwalekar relishes his association with the HDFC brand

In his role as managing director & CEO of HDFC Standard Life, Deepak Satwalekar built an insurance company that is trusted and seen as an ethical player. Having turned 60, he has retired and now wants to focus on social causes close to his heart.

There are other things I have to do. It is not that I did not want to continue to be in insurance. I want to do something else; give back to society whatever I received. I believe education is important, so I am taking some initiatives on primary education and employment opportunities in rural areas. I want to do it even while I have the energy.

I was able to convince one man (Deepak Parekh, chairman, HDFC) to give me a job and I didn’t want to test myself again. They used to say HDFC is a private sector company with public sector salaries. But there are a whole lot of people out here who have stayed for long. We had a value system given to us by the founder and continued to work on those principles.

There is no shortcut available in life. Don’t do anything that will come back and haunt you. That was the driving principle. If you are giving a 30-year mortgage, you can’t take a view based on the next one year. We used to take asset liability match very seriously. At no point was asset liability mismatch more than a fraction of a year. We used to give 15-20 year loans. It was based on the mentality of the Indian middle class. They would come and prepay the loans. The average loan never used to go beyond seven years. We used to have a mix of deposits and long-term loans. Never a bigger mismatch. You don’t get a big spread when you have a perfect match, but you get to sleep at nights.

Yes, we tried to take the same thing over to insurance, issuing policies for 25-30 years. We were the only one to issue long-term policies. The change in regulations in July 2006 hurt us the most. We had a book where 25-26 percent of our policies were in the 25-30-year maturity range. The regulator was unwilling to change. They said: “You are the only one doing it. None of your competitors are issuing longterm policies. So, if we change the policy it will look like we are favouring you”. If you assess my performance on whether I have the topline growth, whether I have the market share and whether I have the market ranking, then sure, I am a loser. But I don’t think insurance is a two-year, three-year game. It is a 30-year, 40-year game. We have to position ourselves for the long-run. I have been a lifer here and the brand means a lot to me. I cannot take a decision which would adversely impact the brand. We are the custodians of that brand.

It was difficult when the whole business is being done in a particular way.

For instance, rebating of agency commission is not allowed by law. It is rampant in the industry and everyone knows that. It is not that I can say that not a single agent or financial consultant of ours is not doing it. In the second year of business one of our topmost agents was found rebating. He was summarily removed. Churn in employees made it difficult to ensure the value systems. The effort was much more. For me, the value systems are not a deterrent to doing business, it is a guide post. If you are not number one, not two, it does not matter. In the long-run we will be number one. We thought we will break even in the seventh year. We grew faster. The faster you grow the greater the losses in insurance business. The losses were beyond what we estimated. In the last four years compounded annual growth rate has been 100 percent, not something to be ashamed of. Others have grown faster. But we have built a good book.