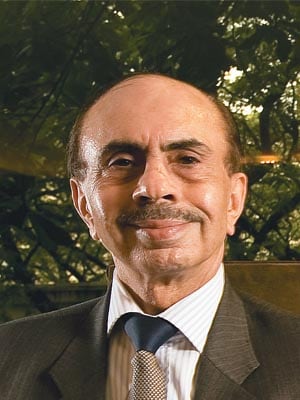

Adi Godrej: Localise Your Business Abroad

Godrej Group Chairman Adi Godrej talks to Forbes India about the company's recent international acquisitions and Africa expansion plans

Adi Godrej

Age: 68

Title: Chairman, Godrej Group

Education: Post graduation in business administration from the Massachusetts Institute of Technology

Career: Joined the family business as soon as he finished his studies, and has been there ever since

Interests: He is an avid cricket follower, and also enjoys sailing

The market has reacted positively to your acquisitions of companies like Megasari (Indonesia) and Tura (Nigeria). As you look for more acquisitions will you look to raise equity?

The market has reacted very well because it is very clear that these two acquisitions besides being highly strategic, will also be highly accretive. I expect our profit after tax will increase by around Rs. 50 - Rs. 70 crore after taking the cost of acquisitions in to account. So clearly it is highly accretive in the first year. We are looking to buy 51 percent stake in Godrej Sara Lee. Then, we may have to raise some equity because otherwise our debt equity ratio might become too high, which we could manage with, but which we are not very comfortable allowing. So we would like to have over a medium-to-long term a debt equity ratio of 1:1. And of course for temporary periods, if we have to take a bridge loan its fine, but not on a long term basis.

You said you wanted to buy Sara Lee’s stake in the Indian joint venture but the business is up for sale globally. Would you have to buy the business globally to get it here?

We are interested in global household insecticides business and that is a competitive process. We are interested — at the right valuation we would do it. We are interested in the developing world. I can’t talk in detail because we are in negotiations but you can work out structures where our objective is fulfilled.

How do you see your international business growing?

We are agnostic to what is the size of our international business. We don’t have a goal that so much must be international. We are looking at long term strategic value and early accretiveness. So it should be very valuable for our shareholders.

Currently it [international business] is between 20 percent – 25 percent of our total revenue. These two acquisitions will increase that percentage, but not by much. The reason is that we are also acquiring the Indian business of Godrej Sara Lee. So that will increase our Indian business also.

Now that you have a growing international operation you need a management pipeline to support this growth. How have you been building this?

Very clearly, we are building management bandwidth. In most of our acquisitions we continue a large part of our existing management. We typically send a few people from India. Not too many.

Is it a very conscious decision to have local people, local brands in you international businesses?

Yes, I think that is very important. Even the global multinational companies that are very successful are the ones that allow the local operations to have a major say. My learning is that when multinationals try to centralise things, it’s not going to go as well. That is what we have seen happening to multinational companies in India and other parts of the world.

Yours is one of the companies that moved in to Africa fairly early on and have been successful there. Are there any lessons on doing business there?

First of all, Africa to our mind is the growth continent of the future. It has a population of roughly a billion people. Most African countries have reformed their economic policies so they are growing well. And I think Africa will sort of perform like China and India have done over the last few decades. So we are very bullish on the Africa story. We can take a lot of our technology to Africa. We specialise in high technology products at low costs for low income families, which suits Africa well.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)