Super 50: The excellence roll call

The Super 50 list of Indian public firms is significant because it demonstrates that being 'super' has little to do with size

A company’s credentials can be assessed on various parameters—how it conducts its operations, how it innovates in the marketplace and the manner in which it rewards its stakeholders and creates value. Take any one of these parameters and you will get only a partial assessment of how good or bad a company is. It is imperative then to ensure that companies are judged on the basis of not one or two, but multiple criteria when putting together a listing such as the one we bring you in this issue.

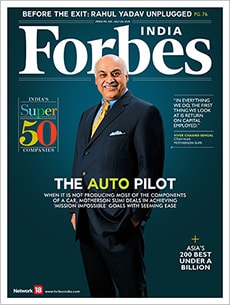

As you will see in the stories on auto components maker Motherson Sumi, motorcycle success story Eicher Motors or even the much smaller Ajanta Pharma, these are companies which took bold risks, innovated aggressively and took adversity on the chin. This list is also significant because it demonstrates that being ‘super’ has little to do with size. It is about drawing up a successful business strategy and being able to execute it seamlessly, keeping an eye on value creation all along. Pharma, financial sector and auto and auto components are the top three sectors in this list of 50.

The Indian list apart, this issue also has the Forbes Asia list of 200 Best Under a Billion Companies, which honours listed companies in the Asia Pacific region with annual revenues of between $5 million and $1 billion. The list is dominated by companies from mainland China, Hong Kong and Taiwan, which account for as much as 60 percent of the 200, reflecting the enormous economic power of this region.

And there’s good news for India too: This year, the list has 11 Indian companies, up from eight last year.

Best,

Sourav Majumdar

Editor, Forbes India

Email:sourav.majumdar@network18publishing.com

Twitter id:@TheSouravM

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

X