Polycab India: Switching gears

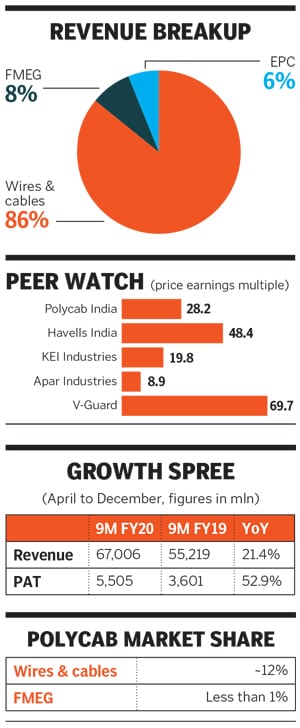

How the company's next-gen is working on making the wires and cables leader an FMEG player to reckon with

The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and Kunal

The Jaisinghanis of Polycab India: (From left) Ramesh, Ajay, Girdhari, Inder, Nikhil, Bharat, Anil and KunalIt all started with a little shop in Mumbai’s Lohar Chawl in 1964. Thakurdas Jaisinghani, who had moved to Mumbai from Pakistan after Partition, founded Sind Electric Stores in the city’s epicentre for electrical goods and sold various products, including fans, lighting, switches and wires. Four years later, Jaisinghani met with an accident and passed away, leaving his wife and five children to pick up the pieces.

His eldest son Girdhari, then 16, had just completed his schooling and instead of pursuing higher studies, he had to take over the mantle of running the shop. Inder, then 15, was also told to drop out of school and join his elder brother. Two other brothers, Ramesh and Ajay, followed suit.

The young guns learnt quickly. By 1975, they set up Thakur Industries and acquired a small piece of land from the Maharashtra Industrial Development Corporation in the Mumbai suburb of Andheri to set up a factory for manufacturing cables and wires. Eight years later, they set up another factory in Halol, Gujarat, to make and process PVC insulated wires and cables, copper and aluminium, and bare copper wire, and Polycab Industries was born.

“It was time for us to think big and differently. We had to take a leap of faith from trading towards manufacturing,” recalls Inder, chairman and managing director of Polycab India. “We had to forward and backward integrate to ensure our margins improved consistently and gave us more cash in hand. We believed in the power of manufacturing and invested in it to grow our business.”

As they continued to grow and set up more manufacturing plants, the second generation stepped in. Ramesh’s son Nikhil and Ajay’s son Bharat, both in their early 20s, joined the family business in 2006. Starting off by shadowing Inder, they underwent training and rotation in various departments from operations and purchase to finance. “It took us a few years to get the hang of everything. We were then only trying to support our chairman as much as we could since it was a family-run business and he had a lot on his shoulders,” recollects Nikhil, 34, who completed his bachelor’s in business from the University of Kent, UK.

In 2008, International Finance Corporation, the private equity arm of the World Bank, invested ₹401.75 crore in Polycab and the second generation took on bigger roles. “After this investment, our roles changed from being the export or procurement manager to change agents, where we started implementing new things in the company,” says Bharat, 35. Changes ranged from introducing Enterprise Resource Planning to hiring a professional in the family-run business.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)