Valuing China: Chinese Currency

Indian exports benefit if China lets its currency appreciate

It is not always that Stephen Roach, the chairman of Morgan Stanley Asia wants to batter people who don’t agree with him. But Paul Krugman’s remark that China should be forced by the US to appreciate the renminbi is something that has not gone well with Roach. Roach argues that China has a savings surplus but doesn’t feel that all that can be attributed to the depressed renminbi, while Krugman argues that the currency gives China an unfair advantage.

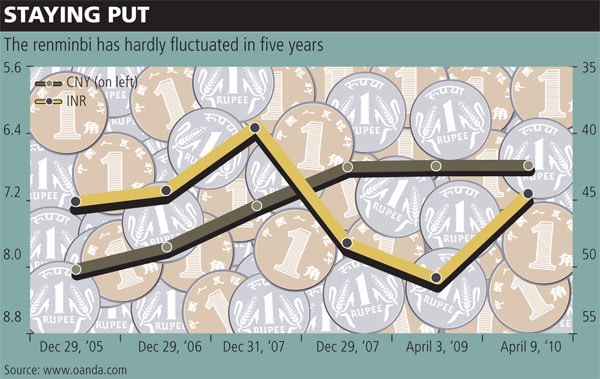

The fact is that the pressure on China to revalue its currency is rising. And experts feel that it is very likely that China will revalue its currency soon. According to the Peterson Institution of International economics, the renminbi is undervalued by 20 to 40 percent. This itself warrants an appreciation of the currency.

Illustration: Hemal Seth

What if China does revalue its currency? What will be the effect on India?

Currency traders feel that even if we assume that the Chinese currency is undervalued by 30 percent, China is surely not going to revalue it to the same extent. The consensus is that Chinese currency will be revalued by not more than 2 percent for the next year. The US will not be happy with that, least of all Paul Krugman.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)