China is Rocking the Indian Steel Boat

China is flooding the world, especially India, with steel. As long as this lasts, the prices of locally produced steel will stay depressed

N.C. Mathur cut short his holiday in Himachal Pradesh because of the heat that the country’s stainless steel industry is facing. The president of the Indian Stainless Steel Development Association spent his vacation getting anxious calls from members worried over the sudden rise in the imports of utensil-grade steel from China. Since the beginning of 2010, the Chinese have been selling as much as 8,000 tonnes of stainless steel in the Indian market per month; a giant leap from last year’s average of 1,000 tonnes per month.

Thicker grade steel used for industrial purposes is largely protected with anti-dumping duties, but there is no such barrier for stainless steel less than 650 mm in thickness. The Chinese have targetted that segment forcing steel makers to try and lobby with the government for protection there too. “Our members from Rajasthan, Delhi, Kanpur and Chennai are alarmed and have been calling me continuously,” says Mathur.

China is being opportunistic, buying when the price is low and selling when the price is high. But the only reason why China can swing it is the sheer size of its steel industry, at over 500 million tonnes a year, it is almost half of the global production.

Distress Flares

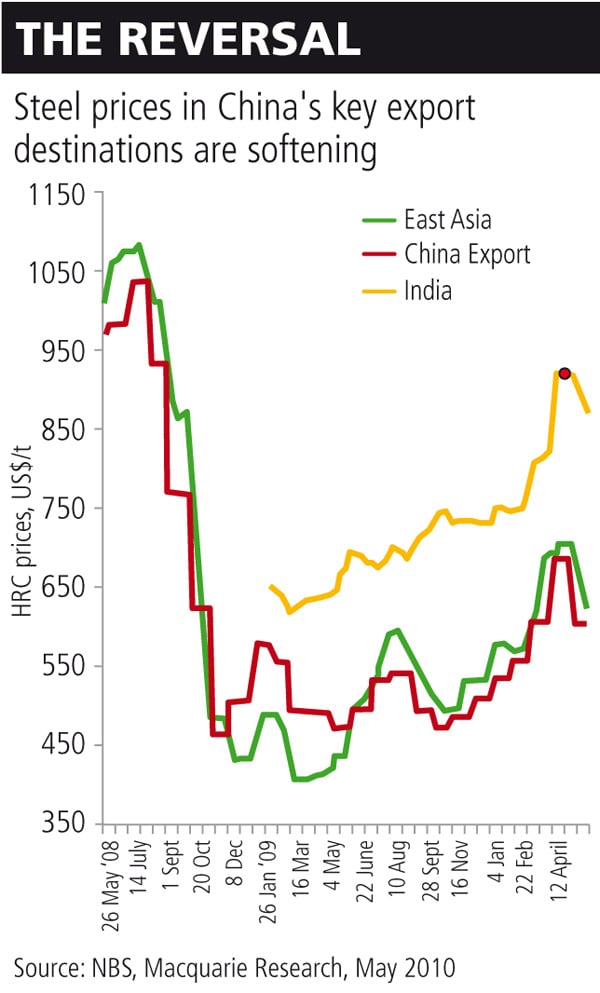

“The most obvious effect of the Chinese exports will be on the prices,” says A.S. Firoz, chief economist at the Economic Research Unit under the ministry of steel. Sure enough, prices in India have seen a definite softening since April, and are hovering at $850 a tonne level from over $900 a tonne level. Indian prices are still higher by $100 to $200 a tonne compared to the international rates, but that is little comfort in the wake of cheap Chinese steel.

Companies that have higher costs like Ispat Industries, Essar Steel and JSW Steel are more likely to be affected. There will be less impact on Tata Steel and SAIL as they have their own raw materials and they can afford to reduce prices.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)