Health concerns of Indian public sector banks

Once a tag of wilful defaulter is imposed on a borrower, very quick action is warranted

Gross Non-Performing Assets (NPAs), as of March 2016, of 38 listed Indian Banks stood at Rs.5.7 trillion (about USD 85 billion); up 89% from Rs.3.02 trillion (about USD 45 billion) a year back. As 70% of business remains with Public Sector Banks (PSBs), huge burden of NPAs and consequent loss is shared by them. This NPA situation is without taking into account restructured loans, a significant portion of which runs the risk of being irrecoverable. Estimated NPA + Stressed Asset of PSBs is about Rs.8 trillion (about USD 119 billion) which substantially exceeds the market value.

In 2015-16 fiscal, PSBs posted a net loss of Rs.18,000 crores (about USD 2.7 billion). But operationally, they are still strong. Operational profit of PSBs in 2015-16 exceeded Rs. 1.4 trillion (about USD 20.9 Billion ). It is mainly provisions against Problem Loans that contributed heavily to the loss.

The present government has taken the matter head on and is dealing with the issue with seriousness that it deserves. Right from measures suggested in 'Gyan Sangam' (a 2-day retreat held at Pune first on 2-3 Jan 2015 and second at Gurgaon on 4-5 March 2016 - the first one was addressed among others by Prime Minister, Finance Minister, Governor Reserve Bank of India and attended by Heads of Banks and Financial Institutions), several meaningful and important steps have followed the conclaves. On August 14, 2015 a plan was launched for revamping public sector banks by Government of India under the name of 'Indradhanush' (signifying seven colors of rainbow). Seven important measures were taken up including splitting of the post of Chairman and Managing Directors into two, Formation of Bank Board Bureau, Capitalization of Banks, De-Stressing of PSBs, Empowerment, Framework of Accountability and Governance.

Various efforts have been taken and some are in process, namely, enactment of Insolvency & Bankruptcy code, 2015 aiming at expeditious winding up of NPA borrowal units (which has already been passed in both the houses of Parliament and awaiting Presidential Assent), amendments to SARFAESI (Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest) Act, RDDB & FI (Recovery of Debts due to Banks & Financial Institutions) Act, creation of stressed assets fund, provision of additional capital for recapitalization of banks beyond budget commitment of Rs. 25,000 crores, if need so arises and taking stricter action against willful defaulters.

Problem loans in the books of Public Sector Banks have never been a subject of such a serious thinking at various levels of government authorities. Whether it is Ministry of Finance, Reserve Bank of India, Supreme Court, Investigative Agencies, Non-Performing Assets are increasingly attracting attention. And rightly so. Perhaps, this was required a few years earlier when post global crisis regulatory forbearance was allowed to banks to restructure many high value accounts.

Did authorities, whether in the respective banks or at the regulator level, not foresee many large accounts as future NPAs? There were many hidden NPAs in the system.

Way back in 2002, I met a group of bank officers at a training session. I sat with them over a cup of tea past the session and talked to them over the NPA situation at their respective work places. It was a news to me then from what they shared with me, off-the-record that about a third of total problem loans were not being shown as NPAs which was nothing but window-dressing. I could not blame them either as they were under informal instructions from their bosses not to show bad debts beyond a certain level in order to contain provision against bad debts. Over a period of time, with improving digitalization, such window-dressing could be brought under control but many high-value NPAs started taking a toll on the health of the system.

Instruction of present Reserve Bank of India Governor to cleanse Banks' balance sheet by March 2017 is a welcome decision as health of banking system is a function of health of an economy. If we study the past few macro-economic crisis in the global economies, we would find a common feature of weak banking system. We can look at five such crisis:

1. East Asian crisis

2. Japan's economic slump

3. Argentina's economic crisis

4. Mexican Peso crisis

5. Global financial crisis

1997 - East Asian Crisis

Originated in Thailand but impacted Indonesia, South Korea and Malayasia heavily and entire south-east Asia in varying degrees. One of the significant factors contributing to this crisis is lack of supervision and control of the banking system. Prior to the crisis, East Asia was the fastest growing region, with strong export orientation, high rates of savings and investments, favorable demographics and with high growth rate. Four East Asian Economies were popularly known as Asian Tigers.

Post crisis analysis shows many macro-economic deficiencies notably, inappropriate exchange rate policies, large current account deficits, weakness in banking system, highly leveraged corporate balance sheets, large credit growth etc. Banking issues showed glaring lacuna e.g. inadequate supervision and absence of prudential regulation, Assets-Liability mismatch, large credit expansion for unproductive investments, large off-balance sheet liabilities crystallized in adverse situations, improper intermediation including poor credit appraisal, lack of transparency in lending process, acceptance of high concentration risk etc.

Japanese Slump

A major feature of Japanese economy during 19th century was prevalence of large industrial houses called 'Zaibatsu' having close nexus with government officials - a case of crony capitalism. Here also, the prolonged crisis was felt in the non-performing loans of Japanese banks which went up in 1990's and reached a peak in 2001 at above ¥ 40 trillion. There was spate of financial failures since 1994 involving credit cooperatives, housing loan corporation requiring public bail out. In 1998 one of the largest global bank, Long-Term credit Bank collapsed which signaled a wake-up call to Japanese authorities necessitating action on non-performing loans and improved supervision.

An important lesson of financial crisis is that the government/regulator should take expeditious steps to cleanse banks' books from bad loans to enable them to accelerate lending activity to stimulate the economy. Japanese authorities did not act fast and it is only from 2003 that they started serious attempts to tackle bad loans.

Argentina

Argentina was one of the richest countries in the world during 20th century but the period of prosperity could not withstand the Great Depression which resulted in a long period of stagnation. Weak political system, contagion effects of crisis of other Latin American countries and Russian default and loss of confidence of investors led to capital flight and a run on the banking system as panic-stricken Argentines withdrew heavily from their Bank Accounts. By the end of 2001, there was a capital flight of about US$ 20 Billion. The authorities froze bank accounts which led to public outcry and finally culminated in the collapse of the government in December, 2001. Subsequent authorities devalued the currency and peso was floated. The value of peso went down from par to 3.9 pesos a dollar. Recovery from the crisis was also largely due to large scale debt restructuring - as many as 152 types of bonds were issued and with a long maturity, in some cases 42 years.

Mexican Crisis

Mexican crisis was largely caused by macro-economic issues like large current account deficit (7% of GDP) financed primarily by short-term dollar denominated bonds (tesobonos), devaluation of peso, high inflation leading to a sharp recession.

Global Economic Crisis

Broad factors causing the global crisis of 2008-09 included securitization of home loans, deterioration of lending standards, use of Adjustable Rate mortgages with teaser rates, increasing loans to sub-prime borrowers (NINJA loans - loans to No income No job and Asset holders), flawed credit rating, structured securities, liquidity crunch and loss of confidence etc.

A quick overview of these four crisis points out the predominant role of financial sector, especially banking, in the financial stability of an economy. Historically, India has had a reasonably stable banking and financial system which has withstood many economic upheavals.

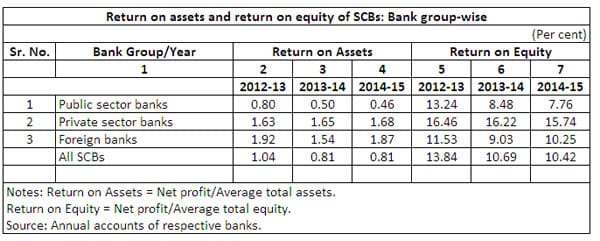

But now, the Indian banking system - Public Sector Banks in particular, are overburdened with Non-Performing Assets (NPAs) and Re-structured Assets. NPAs have a direct bearing on the net profit and consequently on Return on Asset (ROA) and Return on Equity (ROE) (the following table shows the rapid deterioration in case of Public Sector Banks over last 3 years). ROA should be in the range of about 1% whereas, it has come down to 0.46% as against 1.68% over Private Sector counterparts.

(Source: Speech of Deputy Governor, Reserve Bank of India, Shri. S. S. Mundra on 28/4/16)

Three categories of borrowers exist in NPA accounts:

1. Those not having funds but have willingness to pay.

2. Those neither have funds not willingness to pay.

3. Those have funds but no willingness to pay.

Situations become difficult in case of third category - those having funds but no willingness to pay. They are known as 'Willful Defaulters'. They divert borrowed funds for purposes other than the one for which loan was approved - may be to sister concerns or elsewhere. Some of them siphon off borrowed funds to a totally different activity outside the functioning of the unit (e.g. stock market). Some others dispose off collateral security without knowledge of the lender. Once a tag of willful default is imposed on a borrower very quick action is warranted - like action of cease and sale under legal provisions, criminal actions or selling the loan to Asset Management Companies.

What are the factors that cause NPA? They can be grouped under Internal and External Factors.

Internal Factors:

• Diversion/Siphoning off funds

• Business factors

• Inefficient management

• Strained labor relation

• Product obsolescence

• Old technology

• High leverage

External Factors:

• Economic slowdown

• Natural calamities/Accidents

• Poor credit appraisal by Banks

• Suppression of potential NPAs - ever greening

• Lack of adequate supervision by Banks

The situation, today is a cause for concern. Though Reserve Bank of India, Ministry of Finance have all exuded confidence in the system and government owning majority stake, has announced all support to the Banks, the foregoing gives us reason to believe that we should seriously keep economic crisis in mind as during major international crises, banking system and non-performing loans were significant contributors. Our Banking system has always been resilient, regulator well known for prudential policies and Government Authorities are now taking strong steps. On the one hand, NPA situation need to be dealt with on war-footing and on the other hand, banks need to dispense credit for growth.

As the issue of economic stability is involved, we must take decisive action at both micro and macro level.

- Prof Bijoy Bhushan Bhattacharyya is Dean – Banking, WeSchool. Opinions expressed are personal.

[This article has been reproduced with permission from Welingkar Institute of Management Development and Research (WeSchool)]