The End Is Near: Blackberry’s GRIM Reaper Story

Technology and innovation in the smart phone industry have developed at an extremely fast pace. Shifting consumer preference towards iPhone and Android devices (even in the business user segment) is causing RIM to lose market share at an exponential rate

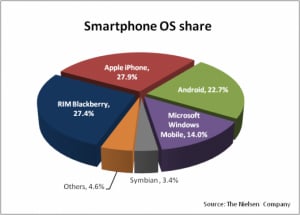

Research in Motion [RIMM: $60.81], known for its private data security and e-mail addicts, may be on the verge of disappearing. Drawing this conclusion may seem strange in light of its recent stock price increases, its 27 percent market share, and the pending release of its iPad competitor, the Playbook. However, RIM’s demise isn’t apparent on the surface. Its misaligned long-term strategy is what will ultimately bring RIM to its knees.

Technology and innovation in the smart phone industry have developed at an extremely fast pace. This has caused consumers to upgrade their devices on an annual basis if not sooner. As these devices increasingly become an extension of the life of today’s consumers, supplying innovative, advanced devices is more important than ever. This shifting consumer preference towards iPhone and Android devices (even in the business user segment) is causing RIM to lose market share at an exponential rate.

Rather than adapt to these changes and protect its smartphone market share, RIM has decided to dedicate its resources towards entering the emerging tablet market currently dominated by the Apple iPad. This new “Playbook” has everything current iPad users are craving, such as Flash capabilities, a USB port, compatibility with Microsoft Office tools, higher speed CPU, and front and rear facing cameras. While the temptation to enter this market with these features is enormous, the near horizon vista shows a bloody competitive battlefield. Well established technology companies with deep pockets such as Cisco, Samsung, Dell, HTC and HP, all have similar devices ready to launch by June 2011. RIM may take advantage of the initial open space, but they will soon be inundated with heavy competition.

This short-sighted strategy is distracting RIM from what they have done best—smartphones. Blackberry devices are being attacked on all fronts. In the regular consumer segment, preferences are quickly shifting towards iPhone and Android interface systems. Overall, the smartphone segment is growing by approximately 30 percent annually, yet RIM’s market share dropped from 35 percent to 27.5 percent in that same segment. This equates to a 23 percent drop in their own customer base. Yet, rather than innovate and fight to maintain market share, they focus their efforts outside their own expertise and extend into the realm of tablets. This is a short-term, unsustainable strategy that has the potential to cause long-term problems for RIM.

In the business user segment, RIM corporate clientele are being courted by both iPhone and Android operating systems. Their hope is to lure corporations into new contracts through their highly sought after devices combined with a third party “Good” data network connection. The trade-off between data security and advanced smartphone devices is one that many RIM clients are seriously considering. A declining market share in this segment would only accelerate the exponential decline that RIM is already experiencing.

Apple CEO Steve Jobs was recently quoted as saying, “We’ve now passed RIM, and I don’t see them catching up to us in the near future. They must move beyond their area of strength and comfort into the unfamiliar territory of trying to become a software platform company.” Retorting this statement, RIM CEO Jim Balsillie stated, “…the implication being that RIM practically invented the smartphone category and is not going anywhere.”

However, having invented the smartphone category does not necessarily correlate with being a leader in the industry. Balsillie is holding onto this lifeline like Phil Knight held onto the claim that Nike did not have to associate themselves with their suppliers’ actions in 1990’s. Even ten years later, Nike has yet to recover their previous market share. Lesson: when consumers speak, listen.

Why is it that the renowned Blackberry is losing its foothold so quickly? A lack of innovation and adaption appear to be the diagnosis to the symptom of market share loss. RIM has constantly been behind the innovation curve in recent years, and in more areas than one. The obvious surface issue is the lack of adaptation to the quickly growing consumer preference into touch interface smartphones and the myriad of applications, or “apps”, that go with them.

Since the introduction of the iPhone in 2007, there has yet to be a Blackberry device that has been able to compete in terms of operating systems or touch screen interface. However, where RIM failed to respond, the market did. The Android operating system (created by Google) opened up the market for any technology producer to create an applicable touch screen phone for the market. Subsequently, players such as HTC, Samsung, and Motorola, and have been able to effectively penetrate the smartphone market and compete against Apple. In the meantime, Blackberry is still on the sidelines…with their playbook in hand.

To add to this, RIM’s operating system is constantly criticized as not user friendly and difficult to integrate into third party technologies. Compared to competitors in the industry, this has been a challenge for gaining market share in the consumer market for RIM. The anticipated release of their new operating system in the Playbook will eventually end up in the blackberry phones, but a date is yet to be released. This puts RIM further behind the industry in innovation. Their hardware has been no more innovative or adaptive to new consumer preferences. With only one fully dedicated touch screen phone on the market (Storm), RIM is not delivering and their declining market share is an explicit demonstration of this.

Other lags in innovation include their almost complete lack of “apps” for their unique operating system. Apps are one of the biggest attractions for consumers to purchase iPhone and Android devices. In comparison to Apple’s 150,000 and Android’s 80,000, RIM only has 12,000 apps. Part of the problem lies with their lack of touch screen interface devices, and the other problem stems from their complex user interface that makes it difficult for third party providers to write apps for the open market.

Other lags in innovation include their almost complete lack of “apps” for their unique operating system. Apps are one of the biggest attractions for consumers to purchase iPhone and Android devices. In comparison to Apple’s 150,000 and Android’s 80,000, RIM only has 12,000 apps. Part of the problem lies with their lack of touch screen interface devices, and the other problem stems from their complex user interface that makes it difficult for third party providers to write apps for the open market.

RIM does still have some definite advantages over many of their competitors. Among these advantages are its privately owned data security network, its low-bandwidth data transfer capabilities, the potential for a strong market share in the tablet market with the release of the Playbook, and the recent acquisition of The Astonishing Tribe (TAT).

RIM’s privately owned data security infrastructure leads the industry in terms of offering completely private data networking capabilities. This has always set them apart as the only phone provider that can offer superior corporate data transfer for sensitive correspondence. They have proven themselves time and again by defending this privacy stance against governments around the world. Despite their current market decline, RIM does excel in this unique competitive advantage and the world’s most important corporations will likely always want to use this superior network.

Another advantage is that their current phone technology uses far less bandwidth than other smartphone providers. This allows for more phones for a given bandwidth than other devices which makes them extremely attractive to carriers in emerging markets. This may allow them to continue growing in emerging markets and may be enough to maintain much of their revenue stream.

RIM is betting much of its future on the evolution of its product line with the recent acquisition of The Astonishing Tribe and release of the “Playbook.” The strategic acquisition of TAT should assist RIM in differentiating their product line in terms of both operating system and hardware design. However, the lag time for integration into the product line is unknown. TAT has the potential to save RIM by bringing out a breakthrough product to market, but only if they capitalize on this technology immediately.

The Playbook is RIM’s bet to maintain their name in the business world. The tablet market is quickly transitioning into a “red ocean” opportunity with new entrants on the verge of flooding the market and duplicating the Apple iPad in technology. This brings into question RIM’s ability to effectively compete with these big players of the industry. To make matters worse, release of the Playbook is scheduled to occur near the time of Apple’s second generation iPad, which will have additional enhancements to the first generation. The tablet market is unfamiliar territory for RIM; however, they have set up the Playbook to be required to use a Blackberry device for connectivity outside of Wi-Fi zones. This will help to maintain some of their customer base, although it will not be enough to stop their declining market share entirely.

Investors wonder if these advantages are enough to save RIM from their currently declining market share. Both of these technology advancements with TAT and the Playbook require a fast move to market and an aggressive stance in both differentiation and branding to secure market share in these consumer segments. The data security and low-bandwidth usage must be made a major selling factor with carriers.

Overall, RIM can end up as one of three similar examples from past companies: (1), Nokia; (2), Nintendo; or (3), Apple. First, Nokia offers a prime example of having an enormous market share in the late 1990’s, getting too comfortable in their position, and then experiencing a fast decline and not regaining market share. If RIM is not careful, they could easily follow in their footsteps. Second, they could be like Nintendo and experience a decade of not bringing any popular products to markets, and then bringing a breakthrough device (the Wii) that re-established their previous position amongst their competitors. Finally, they could be like Apple who made a tremendous comeback and now leads the market in terms of both innovation and consumer preference.

Given these three scenarios, how will RIM fare? With their launch of the Playbook and their acquisition of TAT could they be the next Apple for smartphones? We have concluded that this is not likely. Stepping into the Playbook market has fragmented their competitive strategy by straddling an unknown market, and it has diverted much needed research and development funds away from the smartphone segment. Without these investments, their market share will continue to decline. If RIM is not careful, they may focus too much on international markets and lose touch consumer preferences in their home markets. This international income may even distract RIM long enough for them to be at a complete loss in their high margin home market. If this happens, the next wave of technology flow into emerging markets will likely knock down RIM just as it did Nokia.

RIM may make their segmented strategy work or their downfall may be immediately eminent. However, it is most likely that they will experience a slow, painful death. Whatever the case, RIM has their work cut out for them. If they are to survive and maintain their market share, they must act immediately to leverage their recent technology acquisitions. Overall, we hope that the GRIM Reaper doesn’t visit too soon so RIM can have a chance to pull off a resurrection of their dying market presence.

[This article has been reproduced with permission from Knowledge Network, the online thought leadership platform for Thunderbird School of Global Management https://thunderbird.asu.edu/knowledge-network/]