Thoughts on private equity

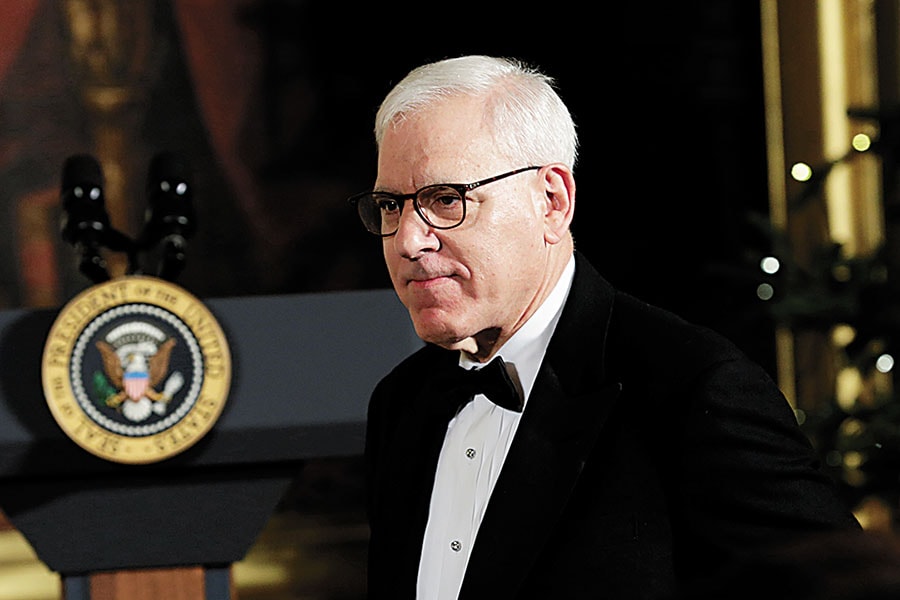

Image: Yuri Gripas / Reuters

Image: Yuri Gripas / Reuters Most of what I learnt about how to do business I learnt from Shakespeare, not Harvard Business School.

—Leon Black

There are old investors, and there are bold investors, but there are no old bold investors.

—Howard Marks

It’s one of the most important things at the end of the day, being able to say no to an investment.

—Henry Kravis

There are no patents in finance.

—Stephen A Schwarzman

What I want to do is see things for what they are, not how other people see them.

—Wesley R Edens

People used to think that private equity was basically just a compensation scheme, but it is much more about making companies more efficient.

—David Rubenstein

Nobody in my generation ever started out in private equity. We got there by accident.

—David Bonderman

The big banks’ pain is private equity’s gain.

—Joshua Harris

The assets you want to buy are the ones people have to sell.

—William E Conway Jr

Their new label became “private equity”, a name that turns the facts upside-down: A purchase of a business by these firms almost invariably results in dramatic reductions in the equity portion of the acquiree’s capital structure compared to that previously existing.

—Warren Buffett

Not all private equity people are evil. Only some.

—Paul Krugman

The role of private equity as fiduciaries is certainly to make money.

—Thomas G Stemberg

Hint: Money flows into most funds after good performance, and goes out when bad performance follows.

—John Bogle

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)