Zomato Gold, food tech and the deep discount dilemma

Restaurants are calling for a detox, after food tech platforms have created a 'generation of discount addicts'. What does the future of the industry look like, now that businesses have taken a stand?

For cyber security consultant Chintan Joshi, who orders in food five times a week, convenience matters more than the discount

For cyber security consultant Chintan Joshi, who orders in food five times a week, convenience matters more than the discountPrerna Chandak, 22, a medical student who lives with her parents in Nagpur, orders in food about three times a week. She studies until late, and usually has dessert delivered to keep her fuelled through the night. About two weeks ago, she switched loyalties from Swiggy to Uber Eats, “because Swiggy doesn’t let you apply discounts after you place the order. It makes a huge difference,” she says. Roughly, each order she places is discounted by about 30 percent.

Chandak is also on Zomato Gold (ZG), a dine-in programme now mired in controversy. ZG gives its members ‘1+1’ offers on food at certain restaurants, ‘2+2’ on drinks at others.

Twenty-one-year-old engineering student Abdul Rehman, also a member, says he’s saved ₹20,000 in 10 months with ZG. He uses it three to four times a week, and orders food on delivery multiple times a week. “For a restaurant junkie like me, saving about ₹2,000 a month is a big deal,” he says. “If Gold is discontinued, I would think twice before going out every few days.”

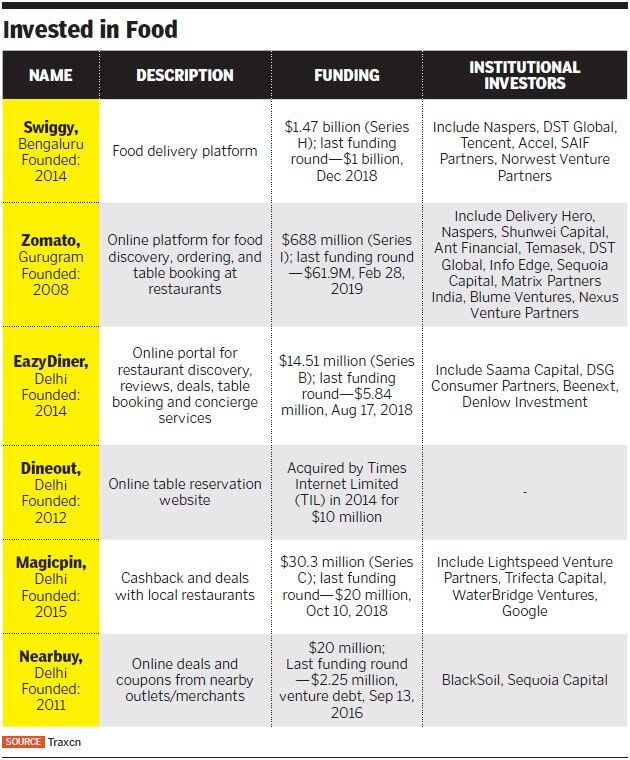

As competition between food tech players gets stiffer by the day, the customer acquisition playbook is bringing out a quick fix: Let them eat cake, for free. With pockets that are deepened with investor money (see box), food tech aggregators are burning cash to cut themselves a slice of the booming market, luring customers with the biggest discounts they can offer. The customer is slowly becoming more agnostic and, like Chandak, switching over to the aggregator that leaves them with the most money in their virtual piggy bank. Discounts can run as high as 60 percent.

This is part of a seeding phase, to get more and more people into the habit of using food tech every day. However, a likely casualty in this equation is the restaurant, which often ends up footing the deep discount from its own pocket, which doesn’t run quite as deep as that of the aggregator. So on August 14, the National Restaurant Association of India (NRAI) launched a nationwide protest against deep discounting. A #Logout campaign urged restaurants to opt out of dine-in discount programmes and aggregators such as Zomato Gold, EazyDiner, Dineout, Magicpin and Nearbuy, claiming they were hurting businesses with ‘unjust practices’. Overnight, 300 restaurants had joined the protest; at the time of going to press, more than 2,000 had ‘logged out’ across the country, including some of the country’s leading F&B brands—the Olive Group, Indigo Deli, Social, and others.

Nearbuy offered discount coupons for various restaurants, while Noida-based table reservation platform Dineout’s membership programme called Gourmet Passport gave subscribers a ‘buy-one-get-one’ on buffet, food and drinks at more than 1,500 restaurants across the country. The #Logout campaign was also supported by the Federation of Hotel & Restaurant Associations of India (FHRAI), who, in a letter to the aggregators, called for a review of their schemes and requested them to engage in a fruitful dialogue.

“Dineout has never imposed any discount conditions on our partner restaurants,” Dineout co-founder and CEO Ankit Mehrotra tells Forbes India via email. “Even right now, restaurants have switched off the discounts on our platform, but are accepting reservations from us. Our only request to NRAI is to clarify the stand on discounts and to make it uniform for all aggregators. The main challenge is with deep discounts, which we already do not partake in.”

At its peak, ZG had 12,000 partner restaurants on board across the world, of which 6,500 are in India. As of March 31, 2019, it had more than 1.4 million active subscribers globally—compared to just 170,000 in March 2018, as per a blog post on its website. This is part of the problem. When it began, ZG was meant to be an exclusive, ‘invite-only’ programme, and sold to partner restaurants as such. ZG discounts would be available to the chosen few, numbering about 10,000. However, that number soon touched 20,000; after a point, ZG was available for anyone to purchase (for a slightly higher price, at about ₹1,800, up from about ₹1,200).

For instance, Singh explains, if Zomato charges members about ₹1,000 for a Gold subscription, and claims to have a million subscribers, that is about ₹100 crore. Moreover, they charge restaurants a fee upwards of ₹40,000 to sign up as a Gold partner, claiming to bring them more traffic and more transactions. “That’s a lot of money,” he adds. “So naturally, the customer assumes that Zomato is subsidising costs, but that’s not the case. A restaurant is burning a large amount of money for Zomato to offer this programme. So if people say we are fools to have signed up for this, they are right. Yes, we are fools who got into this trap. But it is time to set this right.”

For users such as Chintan Joshi, 30, a cyber security consultant who orders in food five times a week and uses ZG only once a month, the convenience matters more than the discount. “My choice of restaurant does not depend on Gold. That’s just an added benefit. Honestly, I use these platforms for the convenience of getting food more easily. Prices and discounts do not really matter that much.”

ZG announced an addition to its business in July, the Zomato Infinity Dining programme, which allowed Gold members all-you-can-eat access, along with an open bar at partner restaurants, at a fixed per-person price. More than 350 restaurants had apparently signed up to be on it. Rumours were rife that ZG would be extended to food delivery, and restaurants were worried they would be losing more and more money.

(This story appears in the 30 November, -0001 issue of Forbes India. To visit our Archives, click here.)

For example, he says, if a Mumbai-based customer wants a burger from Salt Water Café, he is unlikely to care if there isn’t a discount on it. “In fact, in the past few months, only 30 percent of our orders are from people who have applied the discount coupon—either because relevant discounts are not available, or because they just want a specific kind of food. There is a genuine need that is not artificially created.”

For example, he says, if a Mumbai-based customer wants a burger from Salt Water Café, he is unlikely to care if there isn’t a discount on it. “In fact, in the past few months, only 30 percent of our orders are from people who have applied the discount coupon—either because relevant discounts are not available, or because they just want a specific kind of food. There is a genuine need that is not artificially created.” Uber Eats has started to pilot drone delivery in San Diego

Uber Eats has started to pilot drone delivery in San Diego