Will elections make interim budget 2024 inflationary

The possibility of some populist schemes can't be ruled out in the interim budget as general elections are due in April-May 2024, but the government has limited fiscal room due to uncertainties amid volatile inflation

In an economic environment of uncertainties due to volatile inflation, the government has very little room for fiscal spends. Illustration: Chaitanya Dinesh Surpur

In an economic environment of uncertainties due to volatile inflation, the government has very little room for fiscal spends. Illustration: Chaitanya Dinesh Surpur

As the interim budget 2024 is merely for a few months, before the general elections decide who gets to form government at the Centre for the next five years, any big reformative announcement is not expected. In an economic environment of uncertainties due to volatile inflation, the government has very little room for fiscal spends. However, there could be some populist measures in the budget with some announcements for farm economy and lower income class but is unlikely to announce any substantial allocations.

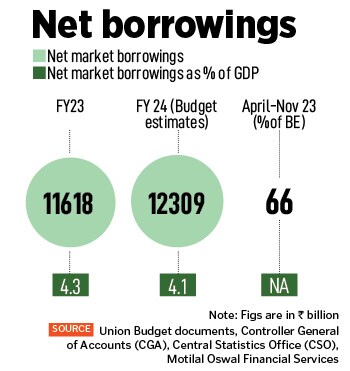

While the consumption demand in the Indian economy has been relatively weak, Indranil Pan, chief economist, Yes Bank, does not anticipate any budget provisions specifically aimed at enhancing it. An inflationary budget implies expectations of expansionary policies, particularly if expenditures are directed towards boosting consumption. “The government has consistently favoured capital expenditure and investments to stimulate domestic growth, expecting a positive spill over effect on private investments and, subsequently, on consumption. This budget is expected to continue on a path of consolidation and align with the aspiration to reach a 4.5 percent fiscal target by FY25-26,” Pan explains.

According to Pan, it is crucial for the government to demonstrate credible efforts towards achieving this target, especially as India will join the JP Morgan Global Bond Index in June 2024. Investors, closely monitoring India’s economic indicators, will be sensitive to any uncertainties. An imbalance could lead to significant capital outflows. It would be disappointing if the government fails to make substantial progress towards a fiscal deficit/GDP target of 5.3- 5.4 percent in FY25, Pan adds.

In an election year, the government usually tables the vote-on-account or the interim budget. A vote-on-account seeks approvals for essential expenditure outlays until the polls, while the interim budget broadly includes an assessment of the current state of the economy, current/capex expenditures, and receipts, as well as revised estimates of the current financial year and estimates for the year ahead.

Rahul Bajoria, MD and head of emerging markets Asia economies (ex-China), Barclays, expects the interim budget to signal continued fiscal consolidation over the medium term but will stop short of any big bang announcements, given its interim nature. Further rationalisation of the direct tax code, in the form of defining the income slabs for tax rebates is likely (which is ongoing since the past couple of budgets).

Rahul Bajoria, MD and head of emerging markets Asia economies (ex-China), Barclays, expects the interim budget to signal continued fiscal consolidation over the medium term but will stop short of any big bang announcements, given its interim nature. Further rationalisation of the direct tax code, in the form of defining the income slabs for tax rebates is likely (which is ongoing since the past couple of budgets).

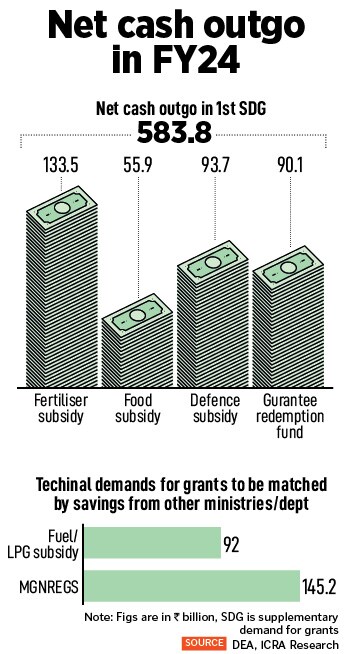

While the vote-on-account will see the government seek permission from the Parliament to cover crucial expenditures until the general elections, Rao expects a few measures to be proposed to support the rural/farming community, as the sector faces near-term challenges like poor weather conditions, the fallout of climate change, and inflationary pressures (food and fertilisers). “Targeted support by way of transfers to make up for output losses due to weather, higher farm insurance outlays, boost to disbursements towards rural employment schemes, irrigation facilities, etc., might be tapped,” she adds.

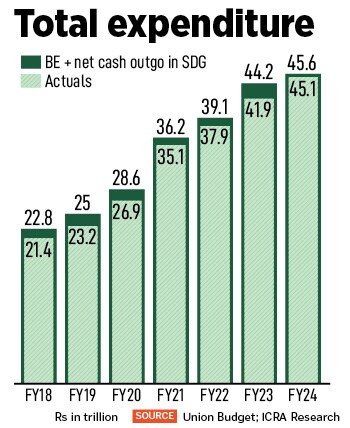

While the vote-on-account will see the government seek permission from the Parliament to cover crucial expenditures until the general elections, Rao expects a few measures to be proposed to support the rural/farming community, as the sector faces near-term challenges like poor weather conditions, the fallout of climate change, and inflationary pressures (food and fertilisers). “Targeted support by way of transfers to make up for output losses due to weather, higher farm insurance outlays, boost to disbursements towards rural employment schemes, irrigation facilities, etc., might be tapped,” she adds. The government’s revenue expenditure grew by 3.6 percent (year-on-year) to Rs 20.7 trillion in April-Nov FY2024, from Rs 20 trillion in April-November FY2023 (57.8 percent of FY2023 provisional), amid a decline in the total outgo for major subsidies (-19.4%), partly offsetting the uptick in interest payments.

The government’s revenue expenditure grew by 3.6 percent (year-on-year) to Rs 20.7 trillion in April-Nov FY2024, from Rs 20 trillion in April-November FY2023 (57.8 percent of FY2023 provisional), amid a decline in the total outgo for major subsidies (-19.4%), partly offsetting the uptick in interest payments.