Who are the big sharks of the Indian stock markets?

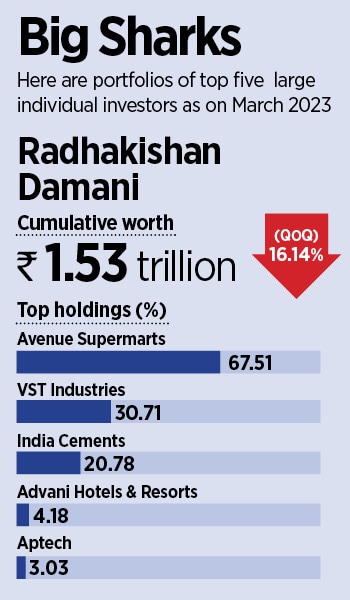

Topping the chart is Radhakishan Damani, promoter of Avenue Supermarts that runs and operates retail format stores D-Mart. At the end of March, Damani's cumulative holding was worth Rs1.53 trillion

Radhakishan Damani, an Indian billionaire investor and the founder of Avenue Supermarts Limited.

Radhakishan Damani, an Indian billionaire investor and the founder of Avenue Supermarts Limited.

Even as the dramatic events of 2022 brought in sudden unprecedented changes and behavioural bias in investment strategies, a few remained persistent. Steep inflation, a long unwinding cycle of interest rates, abrupt geo-political factors wrecking capital markets and global financial crisis with an anticipated recession in history did little to wither the wealth or portfolio of large individual investors of Indian stock markets, often referred to as ultra high networth individuals (UHNI) or the super rich.

A Forbes India analysis of India’s super riches’ portfolio in the three months ending March 2023 based on data provided by Prime Database reveal that these masters-of-the-game held on to their equity in companies even as overall markets tanked in the period. The analysis is based on shareholding patterns filed by 1,838 of the total 1,864 companies listed on NSE (main board) for the quarter ending March 31, 2023. The analysis includes portfolios of individual investors whose combined holding across multiple companies is more than Rs250 crore as on March 2023 and may include promoters as part of public shareholdings in few cases.

Topping the chart is Radhakishan Damani, promoter of Avenue Supermarts that runs and operates retail format stores D-Mart. At the end of March, Damani’s cumulative holding was worth Rs1.53 trillion. However, over the last quarter, it has declined 16.14 percent from Rs1.83 trillion in the October-December period. In percentage terms, his top holdings were Avenue Supermarts—where he cut exposure to 67.51 percent from 67.53 percent—the share price of which fell 16 percent during the three-month period. His other top holdings were VST Industries, India Cements, Trent and Sundaram Finance.

In value terms, Damani has raised his stake in 3M India, Trent and Aptech. The share prices of those stocks climbed 1-5 percent in the period.

In value terms, Damani has raised his stake in 3M India, Trent and Aptech. The share prices of those stocks climbed 1-5 percent in the period.

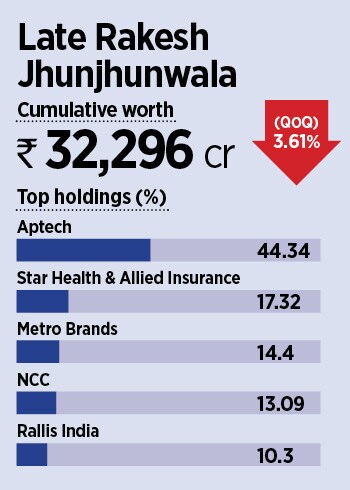

Next, with a wide margin gap, is the late Rakesh Jhunjhunwala, whose cumulative holding was Rs32,296 crore in March, falling by 3.61 percent from Rs3,506 crore in December. Jhunjhunwala invests in stocks through entities like Aryaman Jhunjhunwala Discretionary Trust, Aryavir Jhunjhunwala Discretionary Trust, Nishtha Jhunjhunwala Discretionary Trust, Rare Enterprises, Rare Equity Pvt.Ltd, Rajeshkumar Radheshyam Jhunjhunwala and his wife Rekha Rakesh Jhunjhunwala.

Top five companies in which Jhunjhunwala reduced his stake (by percentage terms) are Dishman Carbon Amcis, Autoline Industries, Edelweiss Financial Services, DB Realty and Nazara Technologies. Except Dishman Carbon Amcis, stock price of which jumped 31 percent, other four fell 10-31 percent in the three months period.

Top five companies in which Jhunjhunwala reduced his stake (by percentage terms) are Dishman Carbon Amcis, Autoline Industries, Edelweiss Financial Services, DB Realty and Nazara Technologies. Except Dishman Carbon Amcis, stock price of which jumped 31 percent, other four fell 10-31 percent in the three months period.

“No doubt, uncertainty is a deal breaker in stock markets, yet a deep assessment of these portfolios will show you consistency and discipline in the investment strategy, even when markets were in rough weather in the March quarter,” says a research analysts on condition of anonymity. The person adds that these portfolios also reveal a deep love for certain stocks that, to some extent, become an obsession and are seldomly sold off completely for years.

“No doubt, uncertainty is a deal breaker in stock markets, yet a deep assessment of these portfolios will show you consistency and discipline in the investment strategy, even when markets were in rough weather in the March quarter,” says a research analysts on condition of anonymity. The person adds that these portfolios also reveal a deep love for certain stocks that, to some extent, become an obsession and are seldomly sold off completely for years.  Anuj Anantrai Sheth, promoter of Anvil Share & Stock Broking Pvt, with cumulative holding of Rs1,139 crore has seen a decrease by 11.04 percent in a quarter. His top stocks are Themis Medicare, Bannari Amman Spinning Mills, Bannari Amman Sugars, Finolex Industries and Asahi India Glass.

Anuj Anantrai Sheth, promoter of Anvil Share & Stock Broking Pvt, with cumulative holding of Rs1,139 crore has seen a decrease by 11.04 percent in a quarter. His top stocks are Themis Medicare, Bannari Amman Spinning Mills, Bannari Amman Sugars, Finolex Industries and Asahi India Glass.

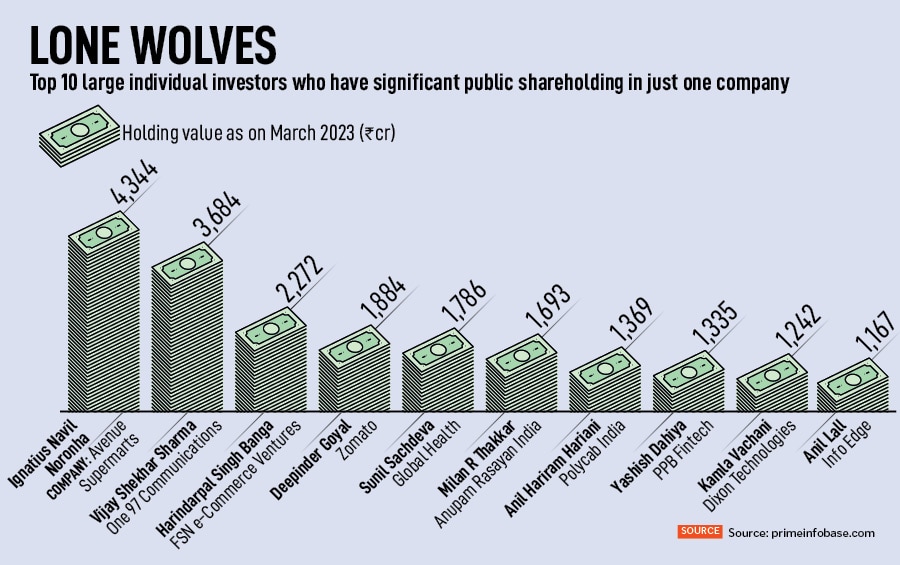

According to stock exchange data, Noronha holds 1.97 percent in Avenue Supermarts, Sharma holds 9.13 percent in One97 Communications, Banga owns 6.41 percent in FSN E-Commerce Ventures, Goyal 4.32 percent in Zomato and Sachdeva holds 12.64 percent in Global Health.

According to stock exchange data, Noronha holds 1.97 percent in Avenue Supermarts, Sharma holds 9.13 percent in One97 Communications, Banga owns 6.41 percent in FSN E-Commerce Ventures, Goyal 4.32 percent in Zomato and Sachdeva holds 12.64 percent in Global Health.