We need to increase the speed of road construction: Nitin Gadkari

The minister of road transport and highways explains why he cannot rush to launch Series 3 of NHAI InvIT in an exclusive and wide-ranging conversation on Forbes India Pathbreakers Season 2

India's Union Minister of Road Transport and Highways Nitin Gadkari, signs a register while inspecting the under construction Zojila tunnel which will connect Kashmir with Ladakh, on September 28, 2021 in Baltal 100 km east of Srinagar, Indian administered Kashmir, India. Image: Yawar Nazir/Getty Images

India's Union Minister of Road Transport and Highways Nitin Gadkari, signs a register while inspecting the under construction Zojila tunnel which will connect Kashmir with Ladakh, on September 28, 2021 in Baltal 100 km east of Srinagar, Indian administered Kashmir, India. Image: Yawar Nazir/Getty Images

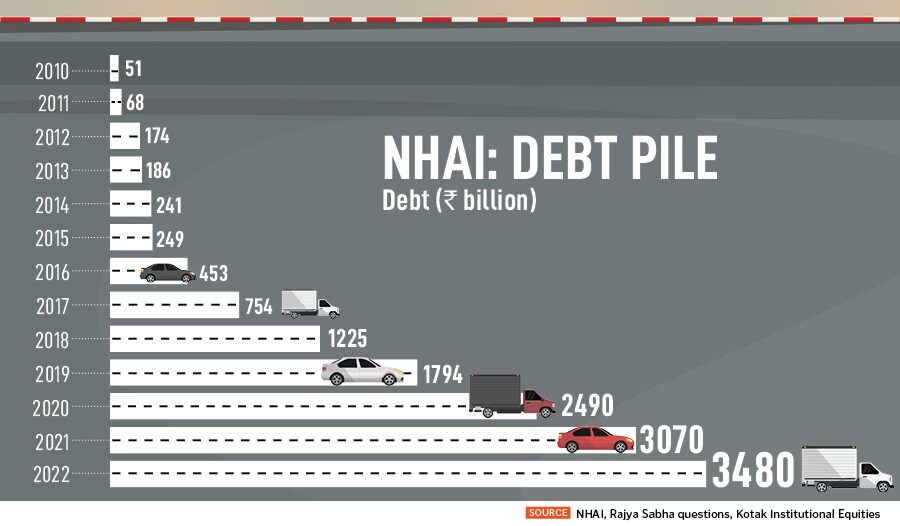

It is easy to see why Nitin Gadkari is popular among different factions of the government and industry. The minister of road transport and highways is respected for his ability to execute and create value for all stakeholders by ensuring that projects are economically viable. This has given a lot more confidence to private sector players to partner with the government after many companies were pushed to the brink of bankruptcy in 2014 due to inefficient allocation of capital and cost escalation because of crippling bottlenecks and policy hurdles.

But Gadkari claims to be a taskmaster who believes in overcoming challenges to unlock opportunities rather than using problems as a crutch for failure. When he took office in 2014, he says, there were 406 stalled projects worth 3.85 lakh crore that would have slipped into NPAs for banks. After months of negotiations and a strategic overhaul his ministry set the ball rolling. He proudly points out that India has the second largest road network in the world now. The total length of national highways in the country increased around 50 percent in the last nine years to over 1.45 lakh kms as per latest estimates.

“Before 2014, the work order was given before land acquisition, environment and forest clearance. After that there was a lot of delay due to courts, environment ministry, NGOs. And because of delays the total contract will collapse, because the interest meter does not stop and that was the reason there were losses to the companies… a big company made a lot of losses and had to go to NCLT. But now majority, about 90 percent of the companies, I have been able to help them with the law and now the majority of companies are out of problem and they are doing an excellent job. Now we are not working only on BOT. We are working on BOT, hybrid annuity, TOT, EPC model,” Gadkari says in an exclusive interview on Forbes India Pathbreakers Season 2.

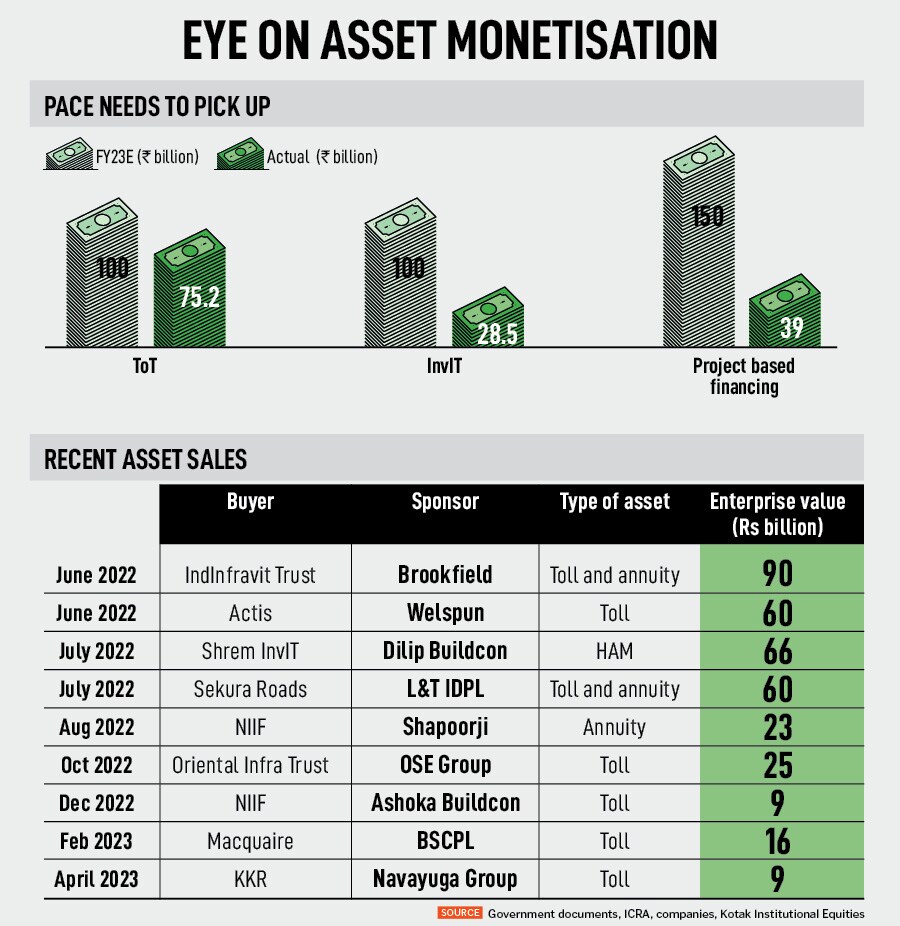

BoT or build-operate-transfer was the main model used by the government for the construction of road infrastructure before 2014. Many companies went belly-up due to legal disputes and policy inertia. The average construction of roads was 3-5 km/day. Analysts say the strategic implementation of the hybrid annuity model (HAM)—along with toll-operate-transfer (ToT), engineering, procurement and construction (EPC) models, and Infrastructure Investment Trusts (InvITs)—energised the sector and attracted private players to participate in road building projects.

“The InvIT model is the best model. Now I don’t have any problem at all as far as investment is concerned. People are coming to me and we have ample money available. Now the idea is we are taking money from the small (investors). Presently when they deposit their money in the banks, they are getting 4.5 percent to 5.5 percent. But now I'm offering them 8.05 percent interest. Now there is a provision that they will get interest monthly. Presently, our toll income is Rs 42,000 crore and at the end of 2024 it will go up to Rs 1,40,000 crore. There is no risk,” he explains.